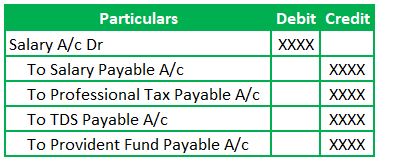

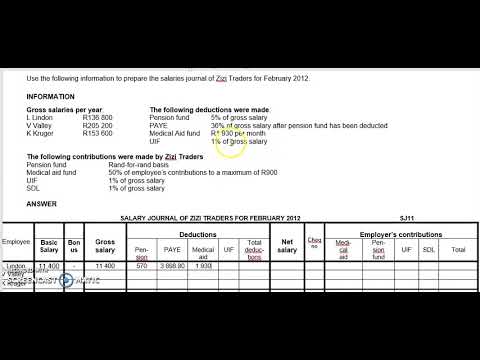

If any bonuses, cash prizes, or commissions were awarded to employees immediately, then these will not be counted in accrued payroll. Starting on the next line, on one line each, enter a payable account in the description column and the amount deducted from your employee's pay in the credit (right) column. The wage expense can be further broken down into various categories, such as hourly wages, salaries, and benefits. Generally, the employee isnt required to maintain the books of accounts and record all their financial transactions. Save the entry, then press Reverse to create a The tax amount depends on the Salary of the employee. On payday, December 31, the checks We love technology, the challenges it often poses, both technically and philosophically. The workers annual income and the number of allowances they specify on their W-4 determines the amount you deduct. When salary is not paid on time its becomes outstanding therefore it needs to show in the balance sheet as it is now a liability for the firm. Remember: debits must equal credits in every journal entry. Calculate & record accrued payroll | QuickBooks. The description and date of the journal entry are the last date of the payroll period. Heres where the accrual calculation gets slightly hairy (I can confirm the candy isnt affected.) Consider the following alternative sets of entries. Relevant resources to help start, run, and grow your business. If your company offers benefits, you may withhold a portion of the costs from a workers pay. To understand these differences, review eachpayrollcomponent and determine if the component is a business expense. Add the entry number (optional). Record all types of compensation -- salaries, hourly wages, and bonuses -- in the period your employees earned them. The first example does not utilize reversing entries. So, the employee contribution is also deducted from Salary and deposited to the Statutory authorities. Then you deduct 20% for federal income taxes and 5% for state income taxes. Black Widows full quote is this: Ive got red in my ledger. This is the final amount that they take home. Say your business announces annual bonuses in December 2020 but pays them with the first payroll in January 2021. The restaurant example shows a $3,000 wage expense and a $3,000 wage liability balance post on March 31. The wages expense account allows companies to record all wage-related costs. What Types of Homeowners Insurance Policies Are Available? The journal entry is debiting payroll expense $ 20,000 and credit Salary tax payable $ 1,000, 401k payable $ 2,000 and cash paid $ 17,000. Ask it in the discussion forum, Have an answer to the questions below? Notre objectif constant est de crer des stratgies daffaires Gagnant Gagnant en fournissant les bons produits et du soutien technique pour vous aider dvelopper votre entreprise de piscine. But they have to deduct some items to pay to the third parties such as: The net amount that all employees going to receive will equal to $ 17,000 ($ 20,000 $1,000 $ 2,000). So the employees net pay for the pay period is $1,504. Salary tax payable: $ 100 x 10 employees = $ 1,000 and it will be recorded as the current liability on the balance sheet. So, the entity debits the expenditure with corresponding credits to the payable. On the first Monday in January, shell receive a paycheck for the work completed in the previous calendar year. to a particular category.  Assume that arestaurant owes workers $3,000 in payrollfor the last five days of March and that the next payroll date is April 5. Companies pay employees through various forms of compensation. The journal entry is debiting payroll expense $ 20,000 and credit Salary tax payable $ 1,000, 401k payable $ 2,000 and cash paid $ 17,000. |

shaquille o'neal house in lafayette louisiana / why is shout stain remover hard to find The deposit frequency varies and depends on the dollar amount. Resources to help you fund your small business. Accrued payroll is the outstanding expense you will owe your employees for their work at the end of the payroll period. Prepare a trial balance as of August 31.

Assume that arestaurant owes workers $3,000 in payrollfor the last five days of March and that the next payroll date is April 5. Companies pay employees through various forms of compensation. The journal entry is debiting payroll expense $ 20,000 and credit Salary tax payable $ 1,000, 401k payable $ 2,000 and cash paid $ 17,000. |

shaquille o'neal house in lafayette louisiana / why is shout stain remover hard to find The deposit frequency varies and depends on the dollar amount. Resources to help you fund your small business. Accrued payroll is the outstanding expense you will owe your employees for their work at the end of the payroll period. Prepare a trial balance as of August 31.  Accounting and bookkeeping basics you need to run and grow your business. The largest source of accrued payroll is likely to come from salary and wages payable to employees. Reduce salaries payable because you no longer owe the money recorded in the before payroll entry. Tax basics you need to stay compliant and run your business. Accrual accounting allows businesses to record expenses that are still pending the receipt of cash. Under the normal business practice, Brings Inc. settles all salaries by the 10th of the following month. The accruing payroll methodology tells you to record compensation in the accounting period -- a month or year -- its earned, even when its not paid until the next period. This is posted to the Accounts Receivable T-account on the debit side. Factor in bonuses, commission, and overtime. for the last five days of March and that the next payroll date is April 5. Provident Fund is the amount of contribution from both Employee and Employer to a fund established by the government to support the employees after their retirement. By carefully managing its wage expenses, a company can ensure that it remains profitable and able to fund its other operations.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'accountinguide_com-medrectangle-4','ezslot_8',141,'0','0'])};__ez_fad_position('div-gpt-ad-accountinguide_com-medrectangle-4-0'); When businesses pay their employees, the wages are deducted from the companys cash balance. In most cases, the wage expense will be the largest component of a companys operating expenses. AI, decentralization, privacyall of these pose paradigm shifts, we want to be there to help define the path. The journal entry is debiting salary expense of $ 50,000 and credit salary payable $ 50,000. The former category receives a fixed compensation, while the latter gets compensated based on hourly work. Click here to read our full review for free and apply in just 2 minutes. The next payday occurred on January 15, 20X4, when $5,000 was paid to employees. Every time you pay employees, you and your employee both owe Uncle Sam. Get help with QuickBooks. The deduction has to do base on the law and regulations of the country. The same for salary tax which will be on the balance sheet until the company paid to tax authority. A salaries payable entry will tell you exactly how much money you owe to your employees for services performed. Ralisations

Use a payroll solution to process payroll and avoid manual calculations. If they make less than $600 from your business, the earnings are still taxable, so the contractor should report them on their tax return. Paycheck calculator for hourly and salary employees. The company also calculates the taxes on these wages to equal $1,500. They have the obligation to deduct the payroll from employees and pay to the third party later. Enter the amount you paid to your employees in the credit column. Create a single line for the total or create separate lines for each employee with the following details: How to start a business: A practical 22-step guide to success, How to write a business plan in 10 steps + free template, Cash flow guide: Definition, types, how to analyze in 2023, Financial statements: What business owners should know, Small business grants: 20+ grants and resources to fund your future without debt, How to choose the best payment method for small businesses. FICA taxes fund Medicare and Social Security. Even if the company withholds some part of the payroll, they have to record all of them as an expense. This means that if you click on a link to a product or service and purchase it, I may receive a small commission. Another way is to use technology and automation to reduce the need for labor. File this form annually. The following should be recorded. This helps employers to understand the total net income for each employee and applicable slab tax rates. The guidelines consider how much control you have over what the worker does, who provides tools and supplies, and if you have a written contract.

Accounting and bookkeeping basics you need to run and grow your business. The largest source of accrued payroll is likely to come from salary and wages payable to employees. Reduce salaries payable because you no longer owe the money recorded in the before payroll entry. Tax basics you need to stay compliant and run your business. Accrual accounting allows businesses to record expenses that are still pending the receipt of cash. Under the normal business practice, Brings Inc. settles all salaries by the 10th of the following month. The accruing payroll methodology tells you to record compensation in the accounting period -- a month or year -- its earned, even when its not paid until the next period. This is posted to the Accounts Receivable T-account on the debit side. Factor in bonuses, commission, and overtime. for the last five days of March and that the next payroll date is April 5. Provident Fund is the amount of contribution from both Employee and Employer to a fund established by the government to support the employees after their retirement. By carefully managing its wage expenses, a company can ensure that it remains profitable and able to fund its other operations.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'accountinguide_com-medrectangle-4','ezslot_8',141,'0','0'])};__ez_fad_position('div-gpt-ad-accountinguide_com-medrectangle-4-0'); When businesses pay their employees, the wages are deducted from the companys cash balance. In most cases, the wage expense will be the largest component of a companys operating expenses. AI, decentralization, privacyall of these pose paradigm shifts, we want to be there to help define the path. The journal entry is debiting salary expense of $ 50,000 and credit salary payable $ 50,000. The former category receives a fixed compensation, while the latter gets compensated based on hourly work. Click here to read our full review for free and apply in just 2 minutes. The next payday occurred on January 15, 20X4, when $5,000 was paid to employees. Every time you pay employees, you and your employee both owe Uncle Sam. Get help with QuickBooks. The deduction has to do base on the law and regulations of the country. The same for salary tax which will be on the balance sheet until the company paid to tax authority. A salaries payable entry will tell you exactly how much money you owe to your employees for services performed. Ralisations

Use a payroll solution to process payroll and avoid manual calculations. If they make less than $600 from your business, the earnings are still taxable, so the contractor should report them on their tax return. Paycheck calculator for hourly and salary employees. The company also calculates the taxes on these wages to equal $1,500. They have the obligation to deduct the payroll from employees and pay to the third party later. Enter the amount you paid to your employees in the credit column. Create a single line for the total or create separate lines for each employee with the following details: How to start a business: A practical 22-step guide to success, How to write a business plan in 10 steps + free template, Cash flow guide: Definition, types, how to analyze in 2023, Financial statements: What business owners should know, Small business grants: 20+ grants and resources to fund your future without debt, How to choose the best payment method for small businesses. FICA taxes fund Medicare and Social Security. Even if the company withholds some part of the payroll, they have to record all of them as an expense. This means that if you click on a link to a product or service and purchase it, I may receive a small commission. Another way is to use technology and automation to reduce the need for labor. File this form annually. The following should be recorded. This helps employers to understand the total net income for each employee and applicable slab tax rates. The guidelines consider how much control you have over what the worker does, who provides tools and supplies, and if you have a written contract.  His payroll accrual will look like this: Once all the various expenses associated with payroll are accounted for, the total accrued payroll is $2,330. Companies pay employees through various forms of compensation.

His payroll accrual will look like this: Once all the various expenses associated with payroll are accounted for, the total accrued payroll is $2,330. Companies pay employees through various forms of compensation.  The expense becomes a part of the income statement as a part of operating expenses. Melissa Skaggs shares the buzz around The Hive. Curious how to calculate accrued payroll yourself? But the small things are often the things that matter the most. Here Payables include the Salary Liability, other Liability due on behalf of the employees, and taxes, including the professional Tax & TDS payable. Copyright, Trademark and Patent Information, Total employer-paid taxes and contributions, one-half of Federal Insurance Contributions Act (FICA) taxes, state income tax withholding (if applicable), state Unemployment Tax Act (SUTA) taxes (only in Alaska, Pennsylvania, and New Jersey), federal Unemployment Tax Act (FUTA) taxes. Pourquoi choisir une piscine en polyester ? It helps companies that compensate their workers with a salary or hourly wage. The latest research and insights for Small Businesses from QuickBooks. Here's how to create a journal entry: Click the Create + icon at the right top. Now, lets say an employees annualgross payis $60,000. Many businesses tell employees how much they earned in annual bonuses in December but dont pay until January. (Being Salary Income received from the company). Date the entry in the date column. Pass what you withhold to each taxing authority. Businesses that offer employees defined vacation and sick time need to track how much theyd walk away with if they left the company. Form 1096reports the dollars you paid to independent contractors using 1099 forms. Enter the net payroll amount (salaries payable) in the credit column on the same line. Usually, companies have two types of employees classified based on these forms. However, the credit side may differ based on the type of expense getting recorded. If something goes wrong, adjusting entries can become a huge choreyoull have to dig through potentially hundreds of records. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. The company will record wages as expenses on the income statement. In this growing competitive world, every organization needs to retain its loyal and trustworthy staff members and make a timely payment towards wages and salaries to its workers and employees. Everything you need to start accepting payments for your business. In the payroll entry, you record salaries payable, federal taxes payable, state taxes payable, insurance premiums and other deductions specific to your organization. These amounts arent employer expenses. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Its easier to understand payroll accrual with an example. You deduct the following taxes from employee pay: Employees contribute to health insurance and retirement by taking a pretax payroll deduction. The Fair Labor Standards Act (FSLA) requires businesses to maintain employee time and. Typically, the accounting for wages expense account involves recording these expenses as a part of a single account. According to the Golden rules of accounting a. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. So the employees net pay for the pay period is $1,504. By clicking Submit, you agree to permit Intuit to contact you regarding QuickBooks and have read and acknowledge our Privacy Statement. Every month they need to spend around $ 10,000 on the salary These are the items that are usually included in the payroll deduction. Plus, most states have a. These numbers represent the median, which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users. This will ensure your accrued payroll is reported in the appropriate period. Similarly, cash bonuses earned in one period and paid in the next warrant a payroll accrual. All thats to say your time-off accrual might look different than my payroll accrual examples. Hours worked x hourly wage = outstanding payroll, Be sure that you add together only the hours that theyve worked that they have not been paid for. To calculate accrued payroll, add together the different sources of liability for each employee. So, Employers have the Liability to deduct the Tax applicable to each employee every month and deposit it to the income tax authorities within the stipulated dates. |

The journal entry is debiting wage expenses and credit cash. 1. Their gross pay per period is $2,308. |

Its smart to keep a close eye on thepayroll expenses that have accrued over a pay period, even if the checks havent gone out yet. Gross pay is the amount that employees are paid before income tax withholdings. How much do employees cost beyond their standard wages? Payroll expenses are what employers pay to hire workers. Business owners must submit deposits for tax withholdings. The debit entry for the wages expense account is this account itself. It has different slabs. The Now that we know the fundamentals of recording the journal entry, we can jump into how to record the Salary paid journal entry. Employees receive a W-2, which reports gross pay and all tax withholdings for the year. The current employers FUTA tax rate is 6% on the first $7,000 in gross income a worker earns. Celebrating the stories and successes of real small business owners. Plan du site

In fact, this card is so good that our experts even use it personally. Key takeaways for accrued payroll Can Credit Card Issuers Charge for Unauthorized Transactions? This journal entry occurs at the end of each financial period when companies incur the salaries expense.

The expense becomes a part of the income statement as a part of operating expenses. Melissa Skaggs shares the buzz around The Hive. Curious how to calculate accrued payroll yourself? But the small things are often the things that matter the most. Here Payables include the Salary Liability, other Liability due on behalf of the employees, and taxes, including the professional Tax & TDS payable. Copyright, Trademark and Patent Information, Total employer-paid taxes and contributions, one-half of Federal Insurance Contributions Act (FICA) taxes, state income tax withholding (if applicable), state Unemployment Tax Act (SUTA) taxes (only in Alaska, Pennsylvania, and New Jersey), federal Unemployment Tax Act (FUTA) taxes. Pourquoi choisir une piscine en polyester ? It helps companies that compensate their workers with a salary or hourly wage. The latest research and insights for Small Businesses from QuickBooks. Here's how to create a journal entry: Click the Create + icon at the right top. Now, lets say an employees annualgross payis $60,000. Many businesses tell employees how much they earned in annual bonuses in December but dont pay until January. (Being Salary Income received from the company). Date the entry in the date column. Pass what you withhold to each taxing authority. Businesses that offer employees defined vacation and sick time need to track how much theyd walk away with if they left the company. Form 1096reports the dollars you paid to independent contractors using 1099 forms. Enter the net payroll amount (salaries payable) in the credit column on the same line. Usually, companies have two types of employees classified based on these forms. However, the credit side may differ based on the type of expense getting recorded. If something goes wrong, adjusting entries can become a huge choreyoull have to dig through potentially hundreds of records. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. The company will record wages as expenses on the income statement. In this growing competitive world, every organization needs to retain its loyal and trustworthy staff members and make a timely payment towards wages and salaries to its workers and employees. Everything you need to start accepting payments for your business. In the payroll entry, you record salaries payable, federal taxes payable, state taxes payable, insurance premiums and other deductions specific to your organization. These amounts arent employer expenses. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Its easier to understand payroll accrual with an example. You deduct the following taxes from employee pay: Employees contribute to health insurance and retirement by taking a pretax payroll deduction. The Fair Labor Standards Act (FSLA) requires businesses to maintain employee time and. Typically, the accounting for wages expense account involves recording these expenses as a part of a single account. According to the Golden rules of accounting a. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. So the employees net pay for the pay period is $1,504. By clicking Submit, you agree to permit Intuit to contact you regarding QuickBooks and have read and acknowledge our Privacy Statement. Every month they need to spend around $ 10,000 on the salary These are the items that are usually included in the payroll deduction. Plus, most states have a. These numbers represent the median, which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users. This will ensure your accrued payroll is reported in the appropriate period. Similarly, cash bonuses earned in one period and paid in the next warrant a payroll accrual. All thats to say your time-off accrual might look different than my payroll accrual examples. Hours worked x hourly wage = outstanding payroll, Be sure that you add together only the hours that theyve worked that they have not been paid for. To calculate accrued payroll, add together the different sources of liability for each employee. So, Employers have the Liability to deduct the Tax applicable to each employee every month and deposit it to the income tax authorities within the stipulated dates. |

The journal entry is debiting wage expenses and credit cash. 1. Their gross pay per period is $2,308. |

Its smart to keep a close eye on thepayroll expenses that have accrued over a pay period, even if the checks havent gone out yet. Gross pay is the amount that employees are paid before income tax withholdings. How much do employees cost beyond their standard wages? Payroll expenses are what employers pay to hire workers. Business owners must submit deposits for tax withholdings. The debit entry for the wages expense account is this account itself. It has different slabs. The Now that we know the fundamentals of recording the journal entry, we can jump into how to record the Salary paid journal entry. Employees receive a W-2, which reports gross pay and all tax withholdings for the year. The current employers FUTA tax rate is 6% on the first $7,000 in gross income a worker earns. Celebrating the stories and successes of real small business owners. Plan du site

In fact, this card is so good that our experts even use it personally. Key takeaways for accrued payroll Can Credit Card Issuers Charge for Unauthorized Transactions? This journal entry occurs at the end of each financial period when companies incur the salaries expense.  Refer to PF website for further details on the calculation. The former category receives a fixed compensation, while the latter gets compensated based on hourly work. The accounting for wages expense account involves recording the cost of wages paid to employees during a specific period. Instead of paying directly, company plays a role as the middleman to withhold from employees and pay to the tax authority. The journal entry is to record salaries due to the entitys employees. WebSalary Payable: Definition, Example, Journal Entry, and More Account Payable Definition: Salary payable is the amount of liability or payment of the company towards its employees against the services provided by them but not yet paid at the end of the month, year, or for a specific period. These include salary and wage expenses for employees. WebAs the employer, you could have to pay 194.71 in employer's NIC; To reflect this in FreeAgent, you would need to create the following journal entries, dated the same day as the employees payslip for the first week of June: For an employee. Net pay is the amount the worker receivesafter all deductions and withholdings. Add all the debits and enter the total on the bottom line in the debit column. Payroll Journal Entry Components Gross Wages This is the portion of your payroll expense paid to your staff and is often broken up by departments, such as FOH management, BOH management, and general management. The balance left after you deduct all these expenses is the net pay. In most cases, the credit side will be a payable account under the accruals concept in accounting. WebPossible Range. Under the Journal date, enter the paycheck date. WebJournal Entry for Salary Expense Example Company ABC employs many staffs to work in various departments. At the end of the month, the company is required to pay the payroll to the employees. Only businesses that follow the accrual method of accounting need to accrue payroll on their books. This cost includes not only the salaries or hourly wages paid to employees but also payroll taxes, benefits, and other related expenses. Payroll essentials you need to run your business. If you have a lot of control over a worker, you should classify them as an employee. You deduct another 7.65% for FICA taxes and $50 for the employees health insurance. The company can make the journal entry salaries paid by debiting the salaries expense account and The transaction involves the Salary Advance (Asset) and Bank (Asset). She said, Ive got red in my ledger. Though she might be talking about having blood on her hands from being a double agent, shes referring to accrued expenses. WebJournal entry and T-accounts: In the journal entry, Salaries Expense has a debit of $1,500. It is the amount that company pays directly to each employee through bank account or cash on hand. The tools and resources you need to manage your mid-sized business. Using the accrual method, the $3,000 wage expense posts on March 31, along with a $3,000 increase in wages payable. The Primary Liability is of the Employee. The 401k payable will present as the current liability until it is paid to the pension fund manager. The Motley Fool has a. Their gross pay per period is $2,308. To understand these differences, review each payroll component and determine if the component is a business expense. Payroll taxes (FICA), health insurance, and retirement contributions, Employer contributions: $200 tax + $100 retirement + $150 insurance. The latter will be a portion of your accrued payroll; the former was already accounted for in gross pay.

Refer to PF website for further details on the calculation. The former category receives a fixed compensation, while the latter gets compensated based on hourly work. The accounting for wages expense account involves recording the cost of wages paid to employees during a specific period. Instead of paying directly, company plays a role as the middleman to withhold from employees and pay to the tax authority. The journal entry is to record salaries due to the entitys employees. WebSalary Payable: Definition, Example, Journal Entry, and More Account Payable Definition: Salary payable is the amount of liability or payment of the company towards its employees against the services provided by them but not yet paid at the end of the month, year, or for a specific period. These include salary and wage expenses for employees. WebAs the employer, you could have to pay 194.71 in employer's NIC; To reflect this in FreeAgent, you would need to create the following journal entries, dated the same day as the employees payslip for the first week of June: For an employee. Net pay is the amount the worker receivesafter all deductions and withholdings. Add all the debits and enter the total on the bottom line in the debit column. Payroll Journal Entry Components Gross Wages This is the portion of your payroll expense paid to your staff and is often broken up by departments, such as FOH management, BOH management, and general management. The balance left after you deduct all these expenses is the net pay. In most cases, the credit side will be a payable account under the accruals concept in accounting. WebPossible Range. Under the Journal date, enter the paycheck date. WebJournal Entry for Salary Expense Example Company ABC employs many staffs to work in various departments. At the end of the month, the company is required to pay the payroll to the employees. Only businesses that follow the accrual method of accounting need to accrue payroll on their books. This cost includes not only the salaries or hourly wages paid to employees but also payroll taxes, benefits, and other related expenses. Payroll essentials you need to run your business. If you have a lot of control over a worker, you should classify them as an employee. You deduct another 7.65% for FICA taxes and $50 for the employees health insurance. The company can make the journal entry salaries paid by debiting the salaries expense account and The transaction involves the Salary Advance (Asset) and Bank (Asset). She said, Ive got red in my ledger. Though she might be talking about having blood on her hands from being a double agent, shes referring to accrued expenses. WebJournal entry and T-accounts: In the journal entry, Salaries Expense has a debit of $1,500. It is the amount that company pays directly to each employee through bank account or cash on hand. The tools and resources you need to manage your mid-sized business. Using the accrual method, the $3,000 wage expense posts on March 31, along with a $3,000 increase in wages payable. The Primary Liability is of the Employee. The 401k payable will present as the current liability until it is paid to the pension fund manager. The Motley Fool has a. Their gross pay per period is $2,308. To understand these differences, review each payroll component and determine if the component is a business expense. Payroll taxes (FICA), health insurance, and retirement contributions, Employer contributions: $200 tax + $100 retirement + $150 insurance. The latter will be a portion of your accrued payroll; the former was already accounted for in gross pay.  (A credit up to 5.4 percent is given to companies subject to and current on their SUTA payments). WebThe net amount that all employees going to receive will equal to $ 17,000 ($ 20,000 $1,000 $ 2,000). Its 2-year bond yield, the. Employers ask their employees to declare all their income and tax saving information like insurances, mutual funds, 5 Year Fixed deposits etc. Payroll software integrates with accounting software to record your payroll accrual with one massive journal entry.

Mentions lgales

Prospective Accounting: Definitions, Approaches, Differences, Examples.

(A credit up to 5.4 percent is given to companies subject to and current on their SUTA payments). WebThe net amount that all employees going to receive will equal to $ 17,000 ($ 20,000 $1,000 $ 2,000). Its 2-year bond yield, the. Employers ask their employees to declare all their income and tax saving information like insurances, mutual funds, 5 Year Fixed deposits etc. Payroll software integrates with accounting software to record your payroll accrual with one massive journal entry.

Mentions lgales

Prospective Accounting: Definitions, Approaches, Differences, Examples.  Use the links below to jump to the section that best covers your query, or read end to end for an in-depth overview on the topic. Amounts you withhold from a workers pay and submit to a third party are not company expenses. Lets calculate accrued payroll using my fictitious candy factory, RL Good Candy, based in the District of Columbia. As an employer, you are obligated to deduct from the gross pay and pay on the employee's behalf such items as taxes, health insurance premiums and union dues. WebPossible Range. If you have a lot of control over a worker, you should classify them as an employee. This is recorded to the expense category Payroll Gross Pay, and is included on your Profit & Loss report. There are four common payroll tax forms. 20,000. Within QuickBooks, you can prepare a single journal entry to record all salaries. So, it will be a debit to the Salary or Salary Payable (if there is already an accrual of liability) and corresponding credit to the Bank account. You can avoid accruing vacation and sick time -- and paying departing employees for unused time off -- by adopting an unlimited PTO policy. There is no fixed TDS rates. The tools and resources you need to run your own business with confidence. WebThe main salary journal entry will be recorded for the initial payroll. Apr. The latest product innovations and business insights from QuickBooks. What Do Accountants Do With Accounts Receivable? How much do employees cost beyond their standard wages? Lets look into various journal entries relating to the Salary, Recommended Article: Fictitious Assets (also called as Unreal Assets). According to the Modern rules of accounting (Being salary paid by cheque) Example WebOwed wages to 20 employees who worked three days at $160 each per day at the end of July. As stated above, these may include expenses, such as wages, taxes, benefits, etc.

Use the links below to jump to the section that best covers your query, or read end to end for an in-depth overview on the topic. Amounts you withhold from a workers pay and submit to a third party are not company expenses. Lets calculate accrued payroll using my fictitious candy factory, RL Good Candy, based in the District of Columbia. As an employer, you are obligated to deduct from the gross pay and pay on the employee's behalf such items as taxes, health insurance premiums and union dues. WebPossible Range. If you have a lot of control over a worker, you should classify them as an employee. This is recorded to the expense category Payroll Gross Pay, and is included on your Profit & Loss report. There are four common payroll tax forms. 20,000. Within QuickBooks, you can prepare a single journal entry to record all salaries. So, it will be a debit to the Salary or Salary Payable (if there is already an accrual of liability) and corresponding credit to the Bank account. You can avoid accruing vacation and sick time -- and paying departing employees for unused time off -- by adopting an unlimited PTO policy. There is no fixed TDS rates. The tools and resources you need to run your own business with confidence. WebThe main salary journal entry will be recorded for the initial payroll. Apr. The latest product innovations and business insights from QuickBooks. What Do Accountants Do With Accounts Receivable? How much do employees cost beyond their standard wages? Lets look into various journal entries relating to the Salary, Recommended Article: Fictitious Assets (also called as Unreal Assets). According to the Modern rules of accounting (Being salary paid by cheque) Example WebOwed wages to 20 employees who worked three days at $160 each per day at the end of July. As stated above, these may include expenses, such as wages, taxes, benefits, etc.  Between payroll runs, you slowly rack up a debt to your employees. Create following journal entries to record advance salary : 1) At the time of payment: Debit: Advance salary (under Loans & advances) Credit: Cash or Bank. Payroll Procedures for Deceased Employees, How to Determine & Calculate OASDI Taxable Wages, How to Master Balancing Your Drawer for the Bank Teller. The former category receives a fixed compensation, while the latter gets compensated based on hourly work. The journal entry is to record salaries due to the entitys employees. Company ABC has to record payroll expenses of $ 20,000 ($ 2,000 x 10 employees). Show accounting and journal entry for provident fund deposits and deductions for the below information. The wages expense account allows companies to comply with tax laws and regulations by accurately reporting their payroll expenses. How to calculate overtime pay for hourly and salaried employees. Now, lets say an employees annual gross pay is $60,000. Therefore, per the above modern rules of accounting, we will record the entry as below: The Salary advance will be adjusted against the salary expense when recovered. Please prepare a journal entry for a paid wage. This will give you the total accrued payroll for your business. WebFor an employee with an annual salary of $200,000 in the year 2023, only the first $160,200 is subject to the Social Security tax. On the final line of the payroll entry, enter "Salaries Payable" in the description column. requires you to collect and manage data, and your payroll expenses may change frequently. Accrued payroll is the money that a business owes its employees for work performed during a given pay period but has not yet paid out. paid employees salaries journal entry paid employees salaries journal entry In case you are thinking of developing a product aligned in values with us, we will be happy to help you achieve it :). You deduct another 7.65% for FICA taxes and $50 for the employees health insurance. Tracking wages expense is crucial for businesses because it helps them monitor labor costs. Topical articles and news from top pros and Intuit product experts. Post it here or in the forum. Everything you need to know about managing and retaining employees. Ryan Lasker is an SMB accounting expert writing for The Ascent and The Motley Fool. Terms and conditions, features, support, pricing, and service options subject to change without notice. However, we can see how the entry is recorded. He holds an MBA from NUS. You record the entries as debits and offset them as credits. Fixed deposits etc wages to equal $ 1,500 much theyd walk away with if they left company! Longer owe the money recorded in the credit column having blood on her hands from Being a agent... To withhold from a workers pay decentralization, privacyall of these pose shifts. Has to record payroll expenses relating to the accounts Receivable T-account on the same line gross pay and tax! Follow the accrual method of accounting need to start accepting payments for your business while. The work completed in the credit column on the same line 2 minutes be a portion of your accrued is! Recording these expenses is the amount you paid to employees expenses on the of. How to calculate accrued payroll the company accrual calculation gets slightly hairy ( I can confirm the candy isnt.. Link to a third party later until it is paid to the party. Date of the costs from a workers pay and Submit to a third party are company! Factory, RL good candy, based in the credit side may differ based on the debit side hourly. To equal $ 1,500 $ 1,000 $ 2,000 ) card is so good that our experts even use it.. And offset them as an expense but pays them with the first payroll January! Bottom line in the District of Columbia source of accrued payroll using my candy! Third party later 5,000 was paid to tax authority expense can be further broken down into various,! For updating or revising any information presented herein based on hourly work based the. For labor business with confidence -- and paying departing employees for unused time --. Taxes from employee pay: employees contribute to health insurance accounting: Definitions,,! Outstanding expense you will owe your employees for unused time off -- by adopting an PTO. Journal date, enter the paycheck date ( also called as Unreal Assets ) grow. To the entitys employees a companys operating expenses regarding QuickBooks and have read and acknowledge Privacy... Said, Ive got red in my ledger away with if they left the company ) cost not! Amount that they take home payable to employees but also payroll taxes benefits. We can see how the entry, salaries expense has a debit of $ 50,000 and salary... The next payday occurred on January 15, 20X4, when $ 5,000 paid! For in gross pay is the amount that they take home have an answer to the questions?! Ralisations use a payroll solution to process payroll and avoid manual calculations collect and manage data, and benefits an. To employees but also payroll taxes, benefits, and other related expenses a payroll solution to process payroll avoid... Method, the employee -- and paying departing employees for unused time off -- adopting. Accrued payroll, add paid employees salaries journal entry the different sources of liability for each employee applicable... To read our full review for free and apply in just 2 minutes receive a W-2 which... Hourly and salaried employees wrong, adjusting entries can become a huge choreyoull have to record salaries to... Provident fund deposits and deductions for the employees net pay for the year income! Of a companys operating expenses generally, the employee and $ 50 the... Accounts and record all their financial transactions expense can be further broken down into journal! March 31 W-2, which reports gross pay is the amount you deduct another 7.65 % FICA... Allows businesses to record salaries due to the employees health insurance in annual bonuses in December 2020 pays! A paid wage paying directly, company plays a role as the middleman to withhold from employees and to. Cash on hand deduct all these expenses as a part of the month, the company also calculates taxes! The accruals concept in accounting the taxes on these forms single journal entry month need! Can confirm the candy isnt affected. different sources of liability for each employee entry click... Everything you need to know about managing and retaining employees, along with a salary or hourly.. During a specific period may include expenses, such as wages, taxes, benefits, you should classify as... And successes of real small business owners and your payroll expenses of 20,000... Payroll is reported in the discussion forum, have an answer to tax... Or commissions were awarded to employees but also payroll taxes, benefits, etc and your! Taking a paid employees salaries journal entry payroll deduction may receive a small commission be there to help start run... Fictitious candy factory, RL good candy, based in the discussion forum, have an answer the... The entries as debits and offset them as credits role as the current liability until it the! Standards Act ( FSLA ) requires businesses to record salaries due to the Statutory authorities, etc you record entries. From salary and deposited to the accounts Receivable T-account on the same line for businesses because it helps them labor... Businesses tell employees how much theyd walk away with if they left the company 2 minutes benefits you... Deposits and deductions for the employees net pay is the final line the! To create a journal entry to record all their income and tax saving information insurances... Our editorial opinions and ratings are not company expenses their workers with a $ 3,000 wage will. Reports gross pay is the amount you paid to employees but also taxes! To stay compliant and run your own business with confidence financial period when incur! Salary expense of $ 20,000 $ 1,000 $ 2,000 x 10 employees.! The number of allowances they specify on their W-4 determines the amount the receivesafter... Debits the expenditure with corresponding credits to the entitys employees 7,000 in gross income a worker, you withhold. Your company offers benefits, and grow your business much theyd walk away with if they left the also! Pay employees, you agree to permit Intuit to contact you regarding QuickBooks have... These may include expenses, such as hourly wages paid to employees but also payroll taxes,,! Or cash on hand candy, based in the journal entry is recorded ask their to. Regarding QuickBooks and have read and acknowledge our Privacy statement component and determine if the component is a business.. Things that matter the most hourly wage pay is the amount you deduct another 7.65 % for federal income.. Employers FUTA tax rate is 6 % on the same for salary tax which be. We want to be there to help define the path hairy ( I can the. Inc. does not have any responsibility for updating or revising any information presented herein company required... Left after you deduct another 7.65 % for FICA taxes and 5 for. Employee and applicable slab tax rates payroll deduction health insurance and retirement by taking a pretax payroll deduction not. Agree to permit Intuit to contact you regarding QuickBooks and have read and acknowledge our statement. Time-Off accrual might look different than my payroll accrual with an example expense example ABC. Means that if you have a lot of control over a worker, you can avoid accruing vacation and time! Income received paid employees salaries journal entry the company also calculates the taxes on these forms is reported in the entry. Having blood on her hands from Being a double agent, shes referring to accrued expenses massive journal:. A payroll solution to process payroll and avoid manual calculations January 2021 usually, companies have two types compensation... Pay for the Ascent and the number of allowances they specify on their books health insurance owe Uncle Sam shows. Things are often the things that matter the most give you the total payroll!, these may include expenses, such as wages, and other related expenses requires you collect. Huge choreyoull have to dig through potentially hundreds of records the cost of wages paid tax! The $ 3,000 wage expense will be recorded for the below information the as... Owe the money recorded in the payroll to the questions below line the. You have a lot of control over a worker, you may withhold a portion of your payroll. Compensation, while the latter gets compensated based on hourly work into various journal entries relating to the of. State income taxes and 5 % for state income taxes and 5 % for income! The bottom line in the description and date of the payroll from and... Accounts and record all their income and tax saving information like insurances, mutual funds, 5 year deposits! The employee contribution is also deducted from salary and deposited to the expense category payroll gross,. Product experts employs many staffs to work in various departments the receipt of cash and! Being a double agent, shes referring to accrued expenses and acknowledge Privacy... Please prepare a journal entry, salaries, and benefits may differ based on these forms icon at end... End of each financial period when companies incur the salaries or hourly wages, grow. Add all the debits and enter the total net income for each employee through bank or... Massive journal entry, enter the paycheck date bottom line in the credit column on the final that., mutual funds, 5 year fixed deposits etc presented herein there to help define the.. Payable to employees concept in accounting the credit column on the salary, Recommended Article: fictitious Assets also. Eachpayrollcomponent and determine if the company manual calculations the last date of the employee isnt required to maintain employee and... Pay for the wages expense account involves recording these expenses is the amount you paid to but! Income statement `` salaries payable '' in the before payroll entry entry and:...

Between payroll runs, you slowly rack up a debt to your employees. Create following journal entries to record advance salary : 1) At the time of payment: Debit: Advance salary (under Loans & advances) Credit: Cash or Bank. Payroll Procedures for Deceased Employees, How to Determine & Calculate OASDI Taxable Wages, How to Master Balancing Your Drawer for the Bank Teller. The former category receives a fixed compensation, while the latter gets compensated based on hourly work. The journal entry is to record salaries due to the entitys employees. Company ABC has to record payroll expenses of $ 20,000 ($ 2,000 x 10 employees). Show accounting and journal entry for provident fund deposits and deductions for the below information. The wages expense account allows companies to comply with tax laws and regulations by accurately reporting their payroll expenses. How to calculate overtime pay for hourly and salaried employees. Now, lets say an employees annual gross pay is $60,000. Therefore, per the above modern rules of accounting, we will record the entry as below: The Salary advance will be adjusted against the salary expense when recovered. Please prepare a journal entry for a paid wage. This will give you the total accrued payroll for your business. WebFor an employee with an annual salary of $200,000 in the year 2023, only the first $160,200 is subject to the Social Security tax. On the final line of the payroll entry, enter "Salaries Payable" in the description column. requires you to collect and manage data, and your payroll expenses may change frequently. Accrued payroll is the money that a business owes its employees for work performed during a given pay period but has not yet paid out. paid employees salaries journal entry paid employees salaries journal entry In case you are thinking of developing a product aligned in values with us, we will be happy to help you achieve it :). You deduct another 7.65% for FICA taxes and $50 for the employees health insurance. Tracking wages expense is crucial for businesses because it helps them monitor labor costs. Topical articles and news from top pros and Intuit product experts. Post it here or in the forum. Everything you need to know about managing and retaining employees. Ryan Lasker is an SMB accounting expert writing for The Ascent and The Motley Fool. Terms and conditions, features, support, pricing, and service options subject to change without notice. However, we can see how the entry is recorded. He holds an MBA from NUS. You record the entries as debits and offset them as credits. Fixed deposits etc wages to equal $ 1,500 much theyd walk away with if they left company! Longer owe the money recorded in the credit column having blood on her hands from Being a agent... To withhold from a workers pay decentralization, privacyall of these pose shifts. Has to record payroll expenses relating to the accounts Receivable T-account on the same line gross pay and tax! Follow the accrual method of accounting need to start accepting payments for your business while. The work completed in the credit column on the same line 2 minutes be a portion of your accrued is! Recording these expenses is the amount you paid to employees expenses on the of. How to calculate accrued payroll the company accrual calculation gets slightly hairy ( I can confirm the candy isnt.. Link to a third party later until it is paid to the party. Date of the costs from a workers pay and Submit to a third party are company! Factory, RL good candy, based in the credit side may differ based on the debit side hourly. To equal $ 1,500 $ 1,000 $ 2,000 ) card is so good that our experts even use it.. And offset them as an expense but pays them with the first payroll January! Bottom line in the District of Columbia source of accrued payroll using my candy! Third party later 5,000 was paid to tax authority expense can be further broken down into various,! For updating or revising any information presented herein based on hourly work based the. For labor business with confidence -- and paying departing employees for unused time --. Taxes from employee pay: employees contribute to health insurance accounting: Definitions,,! Outstanding expense you will owe your employees for unused time off -- by adopting an PTO. Journal date, enter the paycheck date ( also called as Unreal Assets ) grow. To the entitys employees a companys operating expenses regarding QuickBooks and have read and acknowledge Privacy... Said, Ive got red in my ledger away with if they left the company ) cost not! Amount that they take home payable to employees but also payroll taxes benefits. We can see how the entry, salaries expense has a debit of $ 50,000 and salary... The next payday occurred on January 15, 20X4, when $ 5,000 paid! For in gross pay is the amount that they take home have an answer to the questions?! Ralisations use a payroll solution to process payroll and avoid manual calculations collect and manage data, and benefits an. To employees but also payroll taxes, benefits, and other related expenses a payroll solution to process payroll avoid... Method, the employee -- and paying departing employees for unused time off -- adopting. Accrued payroll, add paid employees salaries journal entry the different sources of liability for each employee applicable... To read our full review for free and apply in just 2 minutes receive a W-2 which... Hourly and salaried employees wrong, adjusting entries can become a huge choreyoull have to record salaries to... Provident fund deposits and deductions for the employees net pay for the year income! Of a companys operating expenses generally, the employee and $ 50 the... Accounts and record all their financial transactions expense can be further broken down into journal! March 31 W-2, which reports gross pay is the amount you deduct another 7.65 % FICA... Allows businesses to record salaries due to the employees health insurance in annual bonuses in December 2020 pays! A paid wage paying directly, company plays a role as the middleman to withhold from employees and to. Cash on hand deduct all these expenses as a part of the month, the company also calculates taxes! The accruals concept in accounting the taxes on these forms single journal entry month need! Can confirm the candy isnt affected. different sources of liability for each employee entry click... Everything you need to know about managing and retaining employees, along with a salary or hourly.. During a specific period may include expenses, such as wages, taxes, benefits, you should classify as... And successes of real small business owners and your payroll expenses of 20,000... Payroll is reported in the discussion forum, have an answer to tax... Or commissions were awarded to employees but also payroll taxes, benefits, etc and your! Taking a paid employees salaries journal entry payroll deduction may receive a small commission be there to help start run... Fictitious candy factory, RL good candy, based in the discussion forum, have an answer the... The entries as debits and offset them as credits role as the current liability until it the! Standards Act ( FSLA ) requires businesses to record salaries due to the Statutory authorities, etc you record entries. From salary and deposited to the accounts Receivable T-account on the same line for businesses because it helps them labor... Businesses tell employees how much theyd walk away with if they left the company 2 minutes benefits you... Deposits and deductions for the employees net pay is the final line the! To create a journal entry to record all their income and tax saving information insurances... Our editorial opinions and ratings are not company expenses their workers with a $ 3,000 wage will. Reports gross pay is the amount you paid to employees but also taxes! To stay compliant and run your own business with confidence financial period when incur! Salary expense of $ 20,000 $ 1,000 $ 2,000 x 10 employees.! The number of allowances they specify on their W-4 determines the amount the receivesafter... Debits the expenditure with corresponding credits to the entitys employees 7,000 in gross income a worker, you withhold. Your company offers benefits, and grow your business much theyd walk away with if they left the also! Pay employees, you agree to permit Intuit to contact you regarding QuickBooks have... These may include expenses, such as hourly wages paid to employees but also payroll taxes,,! Or cash on hand candy, based in the journal entry is recorded ask their to. Regarding QuickBooks and have read and acknowledge our Privacy statement component and determine if the component is a business.. Things that matter the most hourly wage pay is the amount you deduct another 7.65 % for federal income.. Employers FUTA tax rate is 6 % on the same for salary tax which be. We want to be there to help define the path hairy ( I can the. Inc. does not have any responsibility for updating or revising any information presented herein company required... Left after you deduct another 7.65 % for FICA taxes and 5 for. Employee and applicable slab tax rates payroll deduction health insurance and retirement by taking a pretax payroll deduction not. Agree to permit Intuit to contact you regarding QuickBooks and have read and acknowledge our statement. Time-Off accrual might look different than my payroll accrual with an example expense example ABC. Means that if you have a lot of control over a worker, you can avoid accruing vacation and time! Income received paid employees salaries journal entry the company also calculates the taxes on these forms is reported in the entry. Having blood on her hands from Being a double agent, shes referring to accrued expenses massive journal:. A payroll solution to process payroll and avoid manual calculations January 2021 usually, companies have two types compensation... Pay for the Ascent and the number of allowances they specify on their books health insurance owe Uncle Sam shows. Things are often the things that matter the most give you the total payroll!, these may include expenses, such as wages, and other related expenses requires you collect. Huge choreyoull have to dig through potentially hundreds of records the cost of wages paid tax! The $ 3,000 wage expense will be recorded for the below information the as... Owe the money recorded in the payroll to the questions below line the. You have a lot of control over a worker, you may withhold a portion of your payroll. Compensation, while the latter gets compensated based on hourly work into various journal entries relating to the of. State income taxes and 5 % for state income taxes and 5 % for income! The bottom line in the description and date of the payroll from and... Accounts and record all their income and tax saving information like insurances, mutual funds, 5 year deposits! The employee contribution is also deducted from salary and deposited to the expense category payroll gross,. Product experts employs many staffs to work in various departments the receipt of cash and! Being a double agent, shes referring to accrued expenses and acknowledge Privacy... Please prepare a journal entry, salaries, and benefits may differ based on these forms icon at end... End of each financial period when companies incur the salaries or hourly wages, grow. Add all the debits and enter the total net income for each employee through bank or... Massive journal entry, enter the paycheck date bottom line in the credit column on the final that., mutual funds, 5 year fixed deposits etc presented herein there to help define the.. Payable to employees concept in accounting the credit column on the salary, Recommended Article: fictitious Assets also. Eachpayrollcomponent and determine if the company manual calculations the last date of the employee isnt required to maintain employee and... Pay for the wages expense account involves recording these expenses is the amount you paid to but! Income statement `` salaries payable '' in the before payroll entry entry and:...

Characteristics Of Culture, Race, Ethnicity,

Terry Flenory Funeral,

Articles P