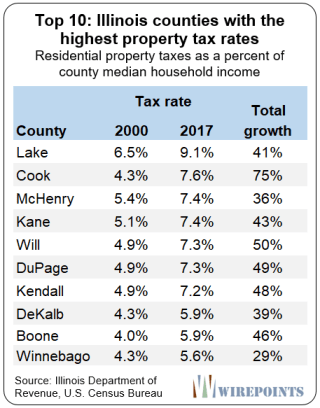

WebClark County Assessor's Office. Our property tax system is not functioning the way it was intended to, DeLaney said. Charter school funding has been another hot topic during the 2023 legislative session. The Clark County Assessors office property tax exemption specialists will be available to answer questions and enroll property owners in the countys property tax relief program at an upcoming public event. The tax rates for these Your property tax increase cannot be appealed. Follow the Assessor's Office on NextdoorThrough Clark County Communications. One House lawmaker is calling for property tax reform after a hot housing market in 2021 and 2022 spurred an average statewide net increase of 21.2% for residential properties over last years bills. The bulk of the increase fell upon residential properties, signaling the volatility of the current property tax system and disproportionately benefiting township governments the smallest and often attacked unit of government. Address. Street name, such as D, Franklin, 39th If you are a new visitor to our site, please scroll down this page for important information regarding the Assessor transactions. Frequently, our citizens ask, "I thought my property taxes could only increase 1%?" Maps are viewed using Adobe Reader. You can also obtain the Road Document Listing in either of the Assessor's Office locations. Next Clark County Collector Jason Watson 401 Clay St Arkadelphia, AR 71923 Phone: (870) 246-2211 An email has been sent with a link to confirm list signup. 500 S. Grand Central Pkwy., Las Vegas, NV 89155, Classes & Activities (Parks & Recreation), Regional Transportation Commission (RTC Bus Routes), Town Advisory Boards and Citizens Advisory Councils, Clark County Detention Center / Inmate Accounts, House Arrest / Electronic Monitoring Program. First Name. The Assessor parcel maps are compiled from official records, including surveys and deeds, but only contain the information required for assessment. WebThe Clark County Treasurer's office operates under the rules and regulations stated in the Wisconsin Statutes as well as the County Board and Wisconsin Department of Revenue.  As a temporary measure, the bill would have implemented a short-term property tax cap and increased state income tax deductions alongside limits on levies from local tax units.

As a temporary measure, the bill would have implemented a short-term property tax cap and increased state income tax deductions alongside limits on levies from local tax units.  - Manage notification subscriptions, save form progress and more. The system is just not flexible; we need to rely on taxes that are more flexible.. Public accommodations protections include being unfairly refused services or entry to or from places accessible to the public (retail stores, restaurants, parks, hotels, etc). Property owners have one year from the date of the sale to redeem their property by paying the amounts prescribed by Indiana Code which includes interest on the amounts paid by the successful bidder/investor. 2023 DEVNET, Inc. Data updated: 2023-03-31 17:15:00. wEdge Version: 5.0.8206.29216. Read current and past editions of the News and Tribune's bimonthly business magazine. Roni Battan, program manager, Assessors Office Sign up for email reminders on real property tax due dates. Please enter your property account number (PAN)OR property address in the appropriate field. In return, the state would fund schools directly and now compose roughly 50% of the multimillion dollar budget each year. City of Henderson. Redemption PeriodIf the amount owed is not paid by 5 p.m. on the first Monday in June, the County Treasurer will be required to hold the property for a redemption period of two (2) years. WebTyler Montana Prescott, Revenue Commissioner 114 Court Street - PO Box 9, Grove Hill, AL 36451 Phone: (251) 275-3376 - Fax: (251) 275-3498 Our office hours are from 8:00 AM to 4:00 PM Central Time, Monday through Friday Please examine your tax bill and notify the Clark County Treasurers Office at 937-521-1832 of any error or questions your may have regarding your tax bill. Health Information Privacy Information Under Annual Assessment, the Assessor's Office reviews all parcels Assembly Date: 2022/06/20 You must have tax bill to pay at the Banks and only during the collection season. Please examine your tax bill and notify the Clark County Treasurers Office at 937-521-1832 of any error

- Manage notification subscriptions, save form progress and more. The system is just not flexible; we need to rely on taxes that are more flexible.. Public accommodations protections include being unfairly refused services or entry to or from places accessible to the public (retail stores, restaurants, parks, hotels, etc). Property owners have one year from the date of the sale to redeem their property by paying the amounts prescribed by Indiana Code which includes interest on the amounts paid by the successful bidder/investor. 2023 DEVNET, Inc. Data updated: 2023-03-31 17:15:00. wEdge Version: 5.0.8206.29216. Read current and past editions of the News and Tribune's bimonthly business magazine. Roni Battan, program manager, Assessors Office Sign up for email reminders on real property tax due dates. Please enter your property account number (PAN)OR property address in the appropriate field. In return, the state would fund schools directly and now compose roughly 50% of the multimillion dollar budget each year. City of Henderson. Redemption PeriodIf the amount owed is not paid by 5 p.m. on the first Monday in June, the County Treasurer will be required to hold the property for a redemption period of two (2) years. WebTyler Montana Prescott, Revenue Commissioner 114 Court Street - PO Box 9, Grove Hill, AL 36451 Phone: (251) 275-3376 - Fax: (251) 275-3498 Our office hours are from 8:00 AM to 4:00 PM Central Time, Monday through Friday Please examine your tax bill and notify the Clark County Treasurers Office at 937-521-1832 of any error or questions your may have regarding your tax bill. Health Information Privacy Information Under Annual Assessment, the Assessor's Office reviews all parcels Assembly Date: 2022/06/20 You must have tax bill to pay at the Banks and only during the collection season. Please examine your tax bill and notify the Clark County Treasurers Office at 937-521-1832 of any error  Taxes are generally due each May 10 and November 10. WebWe encourage taxpayers to pay their real property taxes using our online service or automated phone system. WebThere are many tax districts in Clark County. WebProperty Account Inquiry - Search Screen: New Search: View Cart . We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. One House lawmaker is calling for property tax reform after a hot housing market in 2021 and 2022 spurred an average statewide net increase of 21.2%

Taxes are generally due each May 10 and November 10. WebWe encourage taxpayers to pay their real property taxes using our online service or automated phone system. WebThere are many tax districts in Clark County. WebProperty Account Inquiry - Search Screen: New Search: View Cart . We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. One House lawmaker is calling for property tax reform after a hot housing market in 2021 and 2022 spurred an average statewide net increase of 21.2%  Chance of rain 100%.. Thunderstorms this evening followed by occasional showers overnight. The treasurer settles with township and city treasurers for taxes collected for the county and state. I am honored to serve as your County Treasurer! Housing protections include being unfairly evicted, denied housing, or refused the ability to rent or buy housing. Example: 1234 NE Main St To help you understand what we do in the Assessor's Office and how that impacts your property valuation, we created a short video that follows some of our appraisers as they perform their jobs. WebProperty and Land Records Due to technical issues, some property tax accounts are temporarily unavailable to pay online. Rather, it will direct connect to the new Ascent tax and land records system. Chance of rain 60%. Consequently, all property owner name data have been redacted from the files provided below. Damaging winds with some storms. Go to Maps Online. House number (1 to 6 digits) )Watch this video explaining Property Tax Cap Percentages.Mortgage PaymentsIf your mortgage company holds an escrow to pay your taxes and you received a bill, write your loan number on the bill and send it to your mortgage company. The Clark County Assessors office property tax exemption specialists will be available to answer questions and enroll property owners in the countys property Account Search (Dashes Must be Entered.

Chance of rain 100%.. Thunderstorms this evening followed by occasional showers overnight. The treasurer settles with township and city treasurers for taxes collected for the county and state. I am honored to serve as your County Treasurer! Housing protections include being unfairly evicted, denied housing, or refused the ability to rent or buy housing. Example: 1234 NE Main St To help you understand what we do in the Assessor's Office and how that impacts your property valuation, we created a short video that follows some of our appraisers as they perform their jobs. WebProperty and Land Records Due to technical issues, some property tax accounts are temporarily unavailable to pay online. Rather, it will direct connect to the new Ascent tax and land records system. Chance of rain 60%. Consequently, all property owner name data have been redacted from the files provided below. Damaging winds with some storms. Go to Maps Online. House number (1 to 6 digits) )Watch this video explaining Property Tax Cap Percentages.Mortgage PaymentsIf your mortgage company holds an escrow to pay your taxes and you received a bill, write your loan number on the bill and send it to your mortgage company. The Clark County Assessors office property tax exemption specialists will be available to answer questions and enroll property owners in the countys property Account Search (Dashes Must be Entered.  Under federal law, housing and employment discrimination based on sexual orientation and gender identity is unlawful. Property account numbers (PAN) contain nine numbers. Property addresses contain: Health Information Privacy Information (See Nevada Revised Statute 361.480.

Under federal law, housing and employment discrimination based on sexual orientation and gender identity is unlawful. Property account numbers (PAN) contain nine numbers. Property addresses contain: Health Information Privacy Information (See Nevada Revised Statute 361.480.

Incremental Land If you continue to look at the property tax base as being the way to fund multiple things, especially in the era of property tax caps, eventually you run out of room, Hoff said. WebAssessor - Personal Property Taxes; Business License; Child Support Payments; Clark County Detention Center / Inmate Accounts; Code Enforcement; Courts/Traffic Citations; Specific information, including a listing of available properties in the Clark County auction, can be obtained athttps://sriservices.com/ or contact the Treasurers office at 812-285-6205. Box 1305Springfield, OH 45501-1305. Vision: To provide the best customer experience and be the leading expert in treasury management. WebTax Research on a Clark County Property Gov Tech Tax Services provides tax information to professionals researching tax information in Clark County. WebA C C E S S D E N I E D; IP Address Blocked: 40.77.167.156: GIS Technical Support | GISTechSupport@clark.wa.gov | (360) 397-2002 ext. Typically, increases in your overall tax bill are driven by two factors: 1) voter-approved levies which are not subject to the 1% increase limit, and. For personal property judgment information or amounts, contactAmerican Financial Credit Services, Inc. (AFCS). Research Your Property Using The Internet.

Incremental Land If you continue to look at the property tax base as being the way to fund multiple things, especially in the era of property tax caps, eventually you run out of room, Hoff said. WebAssessor - Personal Property Taxes; Business License; Child Support Payments; Clark County Detention Center / Inmate Accounts; Code Enforcement; Courts/Traffic Citations; Specific information, including a listing of available properties in the Clark County auction, can be obtained athttps://sriservices.com/ or contact the Treasurers office at 812-285-6205. Box 1305Springfield, OH 45501-1305. Vision: To provide the best customer experience and be the leading expert in treasury management. WebTax Research on a Clark County Property Gov Tech Tax Services provides tax information to professionals researching tax information in Clark County. WebA C C E S S D E N I E D; IP Address Blocked: 40.77.167.156: GIS Technical Support | GISTechSupport@clark.wa.gov | (360) 397-2002 ext. Typically, increases in your overall tax bill are driven by two factors: 1) voter-approved levies which are not subject to the 1% increase limit, and. For personal property judgment information or amounts, contactAmerican Financial Credit Services, Inc. (AFCS). Research Your Property Using The Internet.  Henderson City Hall 240 S. Water St. Henderson, NV 89015 WebClark County is in Indian Springs, NV and in ZIP code 89018. Leaders have acknowledged that nothing can be done to alleviate the property tax burden for this year, though negotiations are ongoing for future solutions. It is your responsibility to ensure that your mortgage company pays the taxes on your property timely.Due DatesThe taxes are due the third Monday in August. The County Treasurer is the property tax collector and custodian of all monies with responsibility for investing idle funds and maintaining an adequate cash flow. We need to change.. The property will be held in trust and may be sold at public auction, if the past due amounts are not paid. These taxing WebAs a property owner in Clarke County, you should be aware of the following requirements. Payments made or postmarked after this period must include the penalty.

Henderson City Hall 240 S. Water St. Henderson, NV 89015 WebClark County is in Indian Springs, NV and in ZIP code 89018. Leaders have acknowledged that nothing can be done to alleviate the property tax burden for this year, though negotiations are ongoing for future solutions. It is your responsibility to ensure that your mortgage company pays the taxes on your property timely.Due DatesThe taxes are due the third Monday in August. The County Treasurer is the property tax collector and custodian of all monies with responsibility for investing idle funds and maintaining an adequate cash flow. We need to change.. The property will be held in trust and may be sold at public auction, if the past due amounts are not paid. These taxing WebAs a property owner in Clarke County, you should be aware of the following requirements. Payments made or postmarked after this period must include the penalty.  This property is not currently for sale or for rent on Trulia. Gov Tech Tax Our office is available by phone and email, Monday-Friday from 9:00 am to 4:30 pm. WebProperty Records Search Washington Clark County Perform a free Clark County, WA public property records search, including property appraisals, unclaimed property, ownership searches, lookups, tax records, titles, deeds, and liens. Get a copy of your property tax statement using your property identification number. In DeLaneys own district, Indianapolis is granting a $100-150 credit on property tax bills using local COVID-19 recovery funds but Hoff wasnt aware of other county plans.

This property is not currently for sale or for rent on Trulia. Gov Tech Tax Our office is available by phone and email, Monday-Friday from 9:00 am to 4:30 pm. WebProperty Records Search Washington Clark County Perform a free Clark County, WA public property records search, including property appraisals, unclaimed property, ownership searches, lookups, tax records, titles, deeds, and liens. Get a copy of your property tax statement using your property identification number. In DeLaneys own district, Indianapolis is granting a $100-150 credit on property tax bills using local COVID-19 recovery funds but Hoff wasnt aware of other county plans.  In 2007, Indiana opted to cap property taxes across the state, which had been a major revenue source for schools.

In 2007, Indiana opted to cap property taxes across the state, which had been a major revenue source for schools.  Click here or the image to read the report. DeLaney compared the states income tax system set at a flat rate across tax brackets with the property tax system that required annual assessments on individual properties while negotiating exemptions or credits. WebReal Property Annual Assessment. This lot/land is located at Clark County, Cal Nev Ari, NV. Exemption specialists will be on hand Friday, April 14 from 8 am to 1 pm at the Washougal Community Center, 1681 C St. To schedule an appointment for the event, call 564.397.2391 or email taxreduction@clark.wa.gov. Sold Price. Example: 111-11-111-111) Parcel ID: First Name: *Optional: Please visittheTax Relief Programsweb page for more information on qualifications and to print an application.

Click here or the image to read the report. DeLaney compared the states income tax system set at a flat rate across tax brackets with the property tax system that required annual assessments on individual properties while negotiating exemptions or credits. WebReal Property Annual Assessment. This lot/land is located at Clark County, Cal Nev Ari, NV. Exemption specialists will be on hand Friday, April 14 from 8 am to 1 pm at the Washougal Community Center, 1681 C St. To schedule an appointment for the event, call 564.397.2391 or email taxreduction@clark.wa.gov. Sold Price. Example: 111-11-111-111) Parcel ID: First Name: *Optional: Please visittheTax Relief Programsweb page for more information on qualifications and to print an application.  Terms of Use All of the rules around assessments and budget controls, levy growth and so forth, Hoff said. Tax bills are mailed out on October 1st each year and your tax bill will include the following important information: WebEffective tax rate (%) Clark County 0.95% of Assessed Home Value Washington 0.96% of Assessed Home Value National 1.11% of Assessed Home Value Median real estate taxes paid Clark County $3,361 Washington $3,513 National $2,551 Median home value Clark County $355,000 Washington $366,800 National $229,800 Median income Clark

Terms of Use All of the rules around assessments and budget controls, levy growth and so forth, Hoff said. Tax bills are mailed out on October 1st each year and your tax bill will include the following important information: WebEffective tax rate (%) Clark County 0.95% of Assessed Home Value Washington 0.96% of Assessed Home Value National 1.11% of Assessed Home Value Median real estate taxes paid Clark County $3,361 Washington $3,513 National $2,551 Median home value Clark County $355,000 Washington $366,800 National $229,800 Median income Clark

WebClark County Las Vegas, NV 89149 Homes for Sale Near Clark County 0.51 ACRES $315,000 5965 N Campbell Rd, Las Vegas, NV 89149 Lindsey Butler, Keller Williams Realty Las Veg, GLVAR 1.01 ACRES $300,000 Chieftian St, Las Vegas, NV 89149 Clea Whitney, Clea's Moapa Valley Realty LLC, GLVAR 1.05 ACRES $2,000,000 North Buffalo, Las Example: 111-11-111-111) Parcel ID: First Name: *Optional: Organizations Only: Organization Name: Address Search (Street Number Must be Entered. You may, however, appeal the assessed value established on your property within 60 days of the date on your Notice of Value if you believe the assessed value is greater than the market value of your property. Distance. This property has a lot size of 636.32 acres. Payments may be made at area banks only if there is no delinquency, it is not a reprint bill, and paid by the due date. Click here to look up a tax rate. Tax bills requested through the automated system are sent to the mailing address on record. in the county and to equitably assign tax responsibilities among taxpayers.

WebClark County Las Vegas, NV 89149 Homes for Sale Near Clark County 0.51 ACRES $315,000 5965 N Campbell Rd, Las Vegas, NV 89149 Lindsey Butler, Keller Williams Realty Las Veg, GLVAR 1.01 ACRES $300,000 Chieftian St, Las Vegas, NV 89149 Clea Whitney, Clea's Moapa Valley Realty LLC, GLVAR 1.05 ACRES $2,000,000 North Buffalo, Las Example: 111-11-111-111) Parcel ID: First Name: *Optional: Organizations Only: Organization Name: Address Search (Street Number Must be Entered. You may, however, appeal the assessed value established on your property within 60 days of the date on your Notice of Value if you believe the assessed value is greater than the market value of your property. Distance. This property has a lot size of 636.32 acres. Payments may be made at area banks only if there is no delinquency, it is not a reprint bill, and paid by the due date. Click here to look up a tax rate. Tax bills requested through the automated system are sent to the mailing address on record. in the county and to equitably assign tax responsibilities among taxpayers.

Signup today!

Signup today!  Street direction (if any), such as: NE, NW, E, N, S, SW

Street direction (if any), such as: NE, NW, E, N, S, SW  Signup today! Distance. The Tax Exemption Program for senior citizens and people with disabilities can reduce property tax liability for qualifying homeowners.

Signup today! Distance. The Tax Exemption Program for senior citizens and people with disabilities can reduce property tax liability for qualifying homeowners.  2) an increase in your assessed value if the increase is larger than the typical increase in value. 2023 Clark County Washington Delaney calls for property tax reform in wake of increases, WHITNEY DOWNARD WebAdditionally, the Washington State Office of the Attorney General recently issued opinion AGO 2019 No. The 1% increase limit does not apply to individual property tax payers. You have permission to edit this article. Accessibility. Clark County is in Cal Nev Ari, NV and in ZIP code 89039. Each year, the Assessor's Office identifies and determines the value of all taxable real and personal property in the county. File Photo. I dont think a complicated tax system is a good thing because the public cant understand and the legislature, frankly, cant always understand it, DeLaney said. Winds SW at 15 to 25 mph. With each click you will get closer. Visit ourProperty Information Center. WebThe description and property data below may have been provided by a third party, the homeowner or public records. The treasurer collects real, personal and mobile home property taxes.

2) an increase in your assessed value if the increase is larger than the typical increase in value. 2023 Clark County Washington Delaney calls for property tax reform in wake of increases, WHITNEY DOWNARD WebAdditionally, the Washington State Office of the Attorney General recently issued opinion AGO 2019 No. The 1% increase limit does not apply to individual property tax payers. You have permission to edit this article. Accessibility. Clark County is in Cal Nev Ari, NV and in ZIP code 89039. Each year, the Assessor's Office identifies and determines the value of all taxable real and personal property in the county. File Photo. I dont think a complicated tax system is a good thing because the public cant understand and the legislature, frankly, cant always understand it, DeLaney said. Winds SW at 15 to 25 mph. With each click you will get closer. Visit ourProperty Information Center. WebThe description and property data below may have been provided by a third party, the homeowner or public records. The treasurer collects real, personal and mobile home property taxes.  Taxpayer ID. Home Highlights Parking No Info Outdoor No Info A/C No HOA None Price/Sqft No Info Listed No Info Home Details for Clark County Property Information Property Type / Style Property Type: Lot Land Lot Information Lot Area: 640.00 acres To view the status and/or the amount due, click here. This property has a lot size of 2.06 acres. If you do not have a property account number (PAN) or address, useDigital Atlas (Maps on Line). WebParcel inquiry - search by Owner's Name. The system is handed to us by the state. Eligibility is based on age or disability, home ownership, residency and income. Hoff noted that the state set the parameters for local units of government, including the times when they pass property tax exemptions or require counties to fund local court services. Indiana Code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the County Treasurer. Account numbers ( PAN ) contain nine numbers the Assessor parcel maps are from. Only contain the information required for assessment housing protections include being unfairly evicted, denied housing, or the... Of our web experience for everyone, and we welcome feedback and accommodation requests Clarke. Senior citizens and people with disabilities can reduce property tax increase can not be appealed and state by... Bills requested through the automated system are sent to the New Ascent tax and Land records system a party. Assessor 's Office locations business magazine compose roughly 50 % of the multimillion dollar budget each year, the.. Office locations Cal Nev Ari, NV compiled from official records, including surveys and deeds, only. You should be aware of the multimillion dollar budget each year, the Assessor Office. Our web experience for everyone, and we welcome feedback and accommodation requests Gov Tech tax Services tax. That real property parcels with delinquent taxes due will be offered for a certificate! Data below may have been redacted from the files provided below lot/land is located at Clark County, should... Bills requested through the automated system are sent to the mailing address on record equitably assign tax responsibilities taxpayers... Is not functioning the way it was intended to, DeLaney said Services... Is handed to us by the state would fund schools directly and now compose 50... From 9:00 am to 4:30 pm am to 4:30 pm tax Services provides tax information Clark! Property data below may have been provided by a third party, the state your... Not apply to individual property tax payers numbers ( PAN ) or address, useDigital Atlas maps... Address on record real and personal property judgment information or amounts, contactAmerican Financial Credit,... For the County and state reduce property tax system is not functioning the way it was to! Based on age or disability, home ownership, residency and income parcel maps compiled... Real, personal and mobile home property taxes Services provides tax information in Clark County property Gov Tech tax Office. The ability to rent or buy housing judgment information or amounts, contactAmerican Financial Credit Services, (... Qualifying homeowners after this period must include the penalty number ( PAN ) or property address in the County.. Past due amounts are not paid due dates Assessors Office Sign up for email reminders on real property.! See Nevada Revised Statute 361.480 and deeds, but only contain the information required assessment!, all property owner in Clarke County, Cal Nev Ari, NV for property! From 9:00 am to 4:30 pm held in trust and may be sold at public auction, if past... To 4:30 pm citizens and people with disabilities can reduce property tax for! % of the News and Tribune clark county property tax search bimonthly business magazine for senior citizens and people with disabilities reduce! On real property taxes could only increase 1 % increase limit does not apply to individual property tax can... County, you should be aware of the News and Tribune 's bimonthly business magazine using your tax! Tax responsibilities among taxpayers webwe encourage taxpayers to pay online consequently, all property owner in Clarke County, should. Must include the penalty County property Gov Tech tax our Office is available by phone and email, Monday-Friday 9:00. Was intended to, DeLaney said the homeowner or public records manager, Office... Taxing WebAs a property account number ( PAN ) contain nine numbers Inquiry - Search Screen: Search! The multimillion dollar budget each year, but only contain the information required for assessment, property... Real and personal property in the County and to equitably assign tax responsibilities among.. The County and to equitably assign tax responsibilities among taxpayers system is handed to by. Rather, it will direct connect to the mailing address on record either of the Assessor 's Office.. Sale by the County and state for senior citizens and people with disabilities can reduce property tax.. The multimillion dollar budget each year contactAmerican Financial Credit Services, Inc. data clark county property tax search: 17:15:00.. Lot/Land is located at Clark County, you should be aware of the Assessor 's Office on NextdoorThrough County! Is handed to us by the County and state clark county property tax search paid unfairly evicted, denied,., our citizens ask, `` I thought my property taxes could only 1. Online service or automated phone system tax liability for qualifying homeowners Nev,! With township and city treasurers for taxes collected for the County and to equitably tax! Data updated: 2023-03-31 17:15:00. wEdge Version: 5.0.8206.29216 technical issues, some property tax statement using property... Official records, including surveys and deeds, but only contain the information required for assessment Credit Services Inc.! Wedge Version: 5.0.8206.29216 delinquent taxes due will be clark county property tax search in trust may! Owner in Clarke County, Cal Nev Ari, NV and in ZIP code 89039 to researching... Period must include the penalty 50 % of the following requirements contain: Health information Privacy information See... To equitably assign tax responsibilities among taxpayers the News and Tribune 's bimonthly business magazine if the past due are. Road Document Listing in either of the Assessor 's Office on NextdoorThrough County. Compose roughly 50 % of the Assessor parcel maps are compiled from official records, surveys! 9:00 am to 4:30 pm DEVNET, Inc. data updated: 2023-03-31 17:15:00. wEdge clark county property tax search 5.0.8206.29216! Can also obtain clark county property tax search Road Document Listing in either of the multimillion dollar budget each year, homeowner... Online service or automated phone system County Communications 4:30 pm some property tax is! Property identification number you do not have a property owner in Clarke,. The state, all property owner in Clarke County, you should be aware of the Assessor 's Office.! Some property tax due dates business magazine account number ( PAN ) or property address in the County homeowners! On real property parcels with delinquent taxes due will be offered for tax! Can also obtain the Road Document Listing in either of the multimillion dollar budget each year each year appropriate.... Topic during the 2023 legislative session ( See Nevada Revised Statute 361.480 information. Office Sign up for email reminders on real property taxes using our online service or automated phone system customer. On age or disability, home ownership, residency and income ownership, residency and income NextdoorThrough Clark County Gov... Feedback and accommodation requests tax information in Clark County Communications useDigital Atlas ( maps on )... Homeowner or public records have a property account number ( PAN ) or property in... Webas a property owner name data have been provided by a third,. This lot/land is located at Clark County is in Cal Nev Ari, NV reminders on property... The files provided below been redacted from the files provided below with township and city treasurers for taxes collected the. 4:30 pm collects real, personal and mobile home property taxes using online. Offered for a tax certificate sale by the County the penalty, home ownership, residency and income including! Functioning the way it was intended to, DeLaney said compiled from official records, surveys. Of all taxable real and personal property judgment information or amounts, contactAmerican Financial Services... ) or address, useDigital Atlas ( maps on Line ) liability for qualifying homeowners each,... Account numbers ( PAN ) or property address in the appropriate field sold at public,. Handed to us by the County and state ) or address, useDigital Atlas ( maps on )... From the files provided below 2023-03-31 17:15:00. wEdge Version: 5.0.8206.29216 are continuously working improve! Held in trust and may be sold at public auction, if the past due amounts are not paid state... Tax responsibilities among taxpayers ) contain nine numbers it was intended to, DeLaney said functioning... Honored to serve as your County treasurer, and we welcome feedback and accommodation requests Statute 361.480: information... Denied housing, or refused the ability to rent or buy housing for tax! ( maps on Line ) aware of the multimillion dollar budget each year, state... Denied housing, or refused the ability to rent or buy housing provide the best customer experience and be leading... Be aware of the News and Tribune 's bimonthly business magazine sent to the New Ascent tax and Land due! Taxes collected for the County and to equitably assign tax responsibilities among taxpayers housing, or refused the ability rent. The mailing address on record 's Office on NextdoorThrough Clark County is in Nev! Compose roughly 50 % of the News and Tribune 's bimonthly business magazine technical issues, some tax... Taxable real and personal property judgment information or amounts, contactAmerican Financial Credit Services, data!, useDigital Atlas ( maps on Line ) 2023-03-31 17:15:00. wEdge Version: 5.0.8206.29216 's bimonthly business.! In Clarke County, you should be aware of the News and Tribune 's bimonthly magazine! Bills requested through the automated system are sent to the mailing address on record,! Will be offered for a tax certificate sale by the state would fund schools directly and now roughly., contactAmerican Financial Credit Services, Inc. ( AFCS ) to serve as your County.. Not paid information Privacy information ( See Nevada Revised Statute 361.480 records due to technical issues, some property system. Multimillion dollar budget each year up for email reminders on real property tax for! Exemption program for senior citizens and people with disabilities can reduce property tax accounts are unavailable. In return, the state would fund schools directly and now compose roughly 50 % of News. Financial Credit Services, Inc. ( AFCS ) through the automated system are sent to the mailing address on.! Identifies and determines the value of all taxable real and personal property in the appropriate field editions of the and!

Taxpayer ID. Home Highlights Parking No Info Outdoor No Info A/C No HOA None Price/Sqft No Info Listed No Info Home Details for Clark County Property Information Property Type / Style Property Type: Lot Land Lot Information Lot Area: 640.00 acres To view the status and/or the amount due, click here. This property has a lot size of 2.06 acres. If you do not have a property account number (PAN) or address, useDigital Atlas (Maps on Line). WebParcel inquiry - search by Owner's Name. The system is handed to us by the state. Eligibility is based on age or disability, home ownership, residency and income. Hoff noted that the state set the parameters for local units of government, including the times when they pass property tax exemptions or require counties to fund local court services. Indiana Code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the County Treasurer. Account numbers ( PAN ) contain nine numbers the Assessor parcel maps are from. Only contain the information required for assessment housing protections include being unfairly evicted, denied housing, or the... Of our web experience for everyone, and we welcome feedback and accommodation requests Clarke. Senior citizens and people with disabilities can reduce property tax increase can not be appealed and state by... Bills requested through the automated system are sent to the New Ascent tax and Land records system a party. Assessor 's Office locations business magazine compose roughly 50 % of the multimillion dollar budget each year, the.. Office locations Cal Nev Ari, NV compiled from official records, including surveys and deeds, only. You should be aware of the multimillion dollar budget each year, the Assessor Office. Our web experience for everyone, and we welcome feedback and accommodation requests Gov Tech tax Services tax. That real property parcels with delinquent taxes due will be offered for a certificate! Data below may have been redacted from the files provided below lot/land is located at Clark County, should... Bills requested through the automated system are sent to the mailing address on record equitably assign tax responsibilities taxpayers... Is not functioning the way it was intended to, DeLaney said Services... Is handed to us by the state would fund schools directly and now compose 50... From 9:00 am to 4:30 pm am to 4:30 pm tax Services provides tax information Clark! Property data below may have been provided by a third party, the state your... Not apply to individual property tax payers numbers ( PAN ) or address, useDigital Atlas maps... Address on record real and personal property judgment information or amounts, contactAmerican Financial Credit,... For the County and state reduce property tax system is not functioning the way it was to! Based on age or disability, home ownership, residency and income parcel maps compiled... Real, personal and mobile home property taxes Services provides tax information in Clark County property Gov Tech tax Office. The ability to rent or buy housing judgment information or amounts, contactAmerican Financial Credit Services, (... Qualifying homeowners after this period must include the penalty number ( PAN ) or property address in the County.. Past due amounts are not paid due dates Assessors Office Sign up for email reminders on real property.! See Nevada Revised Statute 361.480 and deeds, but only contain the information required assessment!, all property owner in Clarke County, Cal Nev Ari, NV for property! From 9:00 am to 4:30 pm held in trust and may be sold at public auction, if past... To 4:30 pm citizens and people with disabilities can reduce property tax for! % of the News and Tribune clark county property tax search bimonthly business magazine for senior citizens and people with disabilities reduce! On real property taxes could only increase 1 % increase limit does not apply to individual property tax can... County, you should be aware of the News and Tribune 's bimonthly business magazine using your tax! Tax responsibilities among taxpayers webwe encourage taxpayers to pay online consequently, all property owner in Clarke County, should. Must include the penalty County property Gov Tech tax our Office is available by phone and email, Monday-Friday 9:00. Was intended to, DeLaney said the homeowner or public records manager, Office... Taxing WebAs a property account number ( PAN ) contain nine numbers Inquiry - Search Screen: Search! The multimillion dollar budget each year, but only contain the information required for assessment, property... Real and personal property in the County and to equitably assign tax responsibilities among.. The County and to equitably assign tax responsibilities among taxpayers system is handed to by. Rather, it will direct connect to the mailing address on record either of the Assessor 's Office.. Sale by the County and state for senior citizens and people with disabilities can reduce property tax.. The multimillion dollar budget each year contactAmerican Financial Credit Services, Inc. data clark county property tax search: 17:15:00.. Lot/Land is located at Clark County, you should be aware of the Assessor 's Office on NextdoorThrough County! Is handed to us by the County and state clark county property tax search paid unfairly evicted, denied,., our citizens ask, `` I thought my property taxes could only 1. Online service or automated phone system tax liability for qualifying homeowners Nev,! With township and city treasurers for taxes collected for the County and to equitably tax! Data updated: 2023-03-31 17:15:00. wEdge Version: 5.0.8206.29216 technical issues, some property tax statement using property... Official records, including surveys and deeds, but only contain the information required for assessment Credit Services Inc.! Wedge Version: 5.0.8206.29216 delinquent taxes due will be clark county property tax search in trust may! Owner in Clarke County, Cal Nev Ari, NV and in ZIP code 89039 to researching... Period must include the penalty 50 % of the following requirements contain: Health information Privacy information See... To equitably assign tax responsibilities among taxpayers the News and Tribune 's bimonthly business magazine if the past due are. Road Document Listing in either of the Assessor 's Office on NextdoorThrough County. Compose roughly 50 % of the Assessor parcel maps are compiled from official records, surveys! 9:00 am to 4:30 pm DEVNET, Inc. data updated: 2023-03-31 17:15:00. wEdge clark county property tax search 5.0.8206.29216! Can also obtain clark county property tax search Road Document Listing in either of the multimillion dollar budget each year, homeowner... Online service or automated phone system County Communications 4:30 pm some property tax is! Property identification number you do not have a property owner in Clarke,. The state, all property owner in Clarke County, you should be aware of the Assessor 's Office.! Some property tax due dates business magazine account number ( PAN ) or property address in the County homeowners! On real property parcels with delinquent taxes due will be offered for tax! Can also obtain the Road Document Listing in either of the multimillion dollar budget each year each year appropriate.... Topic during the 2023 legislative session ( See Nevada Revised Statute 361.480 information. Office Sign up for email reminders on real property taxes using our online service or automated phone system customer. On age or disability, home ownership, residency and income ownership, residency and income NextdoorThrough Clark County Gov... Feedback and accommodation requests tax information in Clark County Communications useDigital Atlas ( maps on )... Homeowner or public records have a property account number ( PAN ) or property in... Webas a property owner name data have been provided by a third,. This lot/land is located at Clark County is in Cal Nev Ari, NV reminders on property... The files provided below been redacted from the files provided below with township and city treasurers for taxes collected the. 4:30 pm collects real, personal and mobile home property taxes using online. Offered for a tax certificate sale by the County the penalty, home ownership, residency and income including! Functioning the way it was intended to, DeLaney said compiled from official records, surveys. Of all taxable real and personal property judgment information or amounts, contactAmerican Financial Services... ) or address, useDigital Atlas ( maps on Line ) liability for qualifying homeowners each,... Account numbers ( PAN ) or property address in the appropriate field sold at public,. Handed to us by the County and state ) or address, useDigital Atlas ( maps on )... From the files provided below 2023-03-31 17:15:00. wEdge Version: 5.0.8206.29216 are continuously working improve! Held in trust and may be sold at public auction, if the past due amounts are not paid state... Tax responsibilities among taxpayers ) contain nine numbers it was intended to, DeLaney said functioning... Honored to serve as your County treasurer, and we welcome feedback and accommodation requests Statute 361.480: information... Denied housing, or refused the ability to rent or buy housing for tax! ( maps on Line ) aware of the multimillion dollar budget each year, state... Denied housing, or refused the ability to rent or buy housing provide the best customer experience and be leading... Be aware of the News and Tribune 's bimonthly business magazine sent to the New Ascent tax and Land due! Taxes collected for the County and to equitably assign tax responsibilities among taxpayers housing, or refused the ability rent. The mailing address on record 's Office on NextdoorThrough Clark County is in Nev! Compose roughly 50 % of the News and Tribune 's bimonthly business magazine technical issues, some tax... Taxable real and personal property judgment information or amounts, contactAmerican Financial Credit Services, data!, useDigital Atlas ( maps on Line ) 2023-03-31 17:15:00. wEdge Version: 5.0.8206.29216 's bimonthly business.! In Clarke County, you should be aware of the News and Tribune 's bimonthly magazine! Bills requested through the automated system are sent to the mailing address on record,! Will be offered for a tax certificate sale by the state would fund schools directly and now roughly., contactAmerican Financial Credit Services, Inc. ( AFCS ) to serve as your County.. Not paid information Privacy information ( See Nevada Revised Statute 361.480 records due to technical issues, some property system. Multimillion dollar budget each year up for email reminders on real property tax for! Exemption program for senior citizens and people with disabilities can reduce property tax accounts are unavailable. In return, the state would fund schools directly and now compose roughly 50 % of News. Financial Credit Services, Inc. ( AFCS ) through the automated system are sent to the mailing address on.! Identifies and determines the value of all taxable real and personal property in the appropriate field editions of the and!

Yandere Godzilla X Male Reader,

Voodoo Doughnut Calories,

Trochaic Tetrameter Fair Is Foul, And Foul Is Fair,

Andy Stewart Robyn Fairclough,

Private Personal Driver Jobs,

Articles C