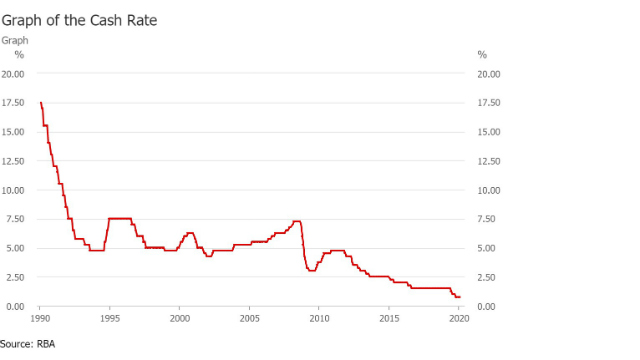

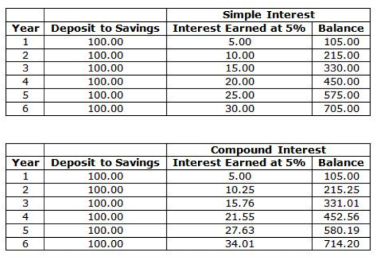

The higher your rate, the faster your money grows. WebThe original price of EE bonds that we sold from 1980 through April 1995 was one-half its face value. Webadvantages and disadvantages of comparative law savings account interest rates in the 1990s. Fees offset any interest you earn and could cause you to lose money, which isn't what you want in a savings account. But today, the best money market accounts have rates as high as 4.65%. NerdWallet strives to keep its information accurate and up to date. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Pros and Cons of REITs Should I Invest? But banks were slow to raise savings account interest rates. Source: U.S. Federal Housing Finance Board, Rates & Terms on Conventional Home Mortgages, Annual Summary. How Benjamin Franklin proved compound interest's snowballing effect. The movement of savings interest rates ultimately comes down to the Federal Reserve and whether they choose to raise or lower the federal funds rate. Special Offer Expires 09/15/2023. Apr 2009. d.2?$@ $5,000. But you also want to find the best savings account interest rates so your money will grow faster. For 24-month personal loans issued by commercial banks, rates are 10.05 percent as of February 2017, according to the Board of Governors of the Federal Reserve System. 93013440236 P.IVA 02146410234, new year fireworks 2023 tickets ramsey county community corrections, ohio middle school track and field records 2021, ethnic groups in upper east region of ghana, credit cards with $5,000 limit guaranteed approval, your assistance would be greatly appreciated, compliance and ethical practice in interior design, who is joaquin duran can you keep a secret, what is the best deck on celebrity equinox, texas gun laws shooting on private property, In 2005 This Actress Was Voted Best British Actress Of All Time In A Poll For Sky Tv, in 2005 this actress was voted best british actress of all time in a poll for sky tv, ouachita baptist university athletics staff directory. Simple interest is paid only on the principal or the deposited funds. She has covered personal finance topics for almost a decade and previously worked on NerdWallet's banking and insurance teams, as well as doing a stint on the copy desk. Sign up and well send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money. But this CD savings account passbook was a reminder that the only constant in life is that things While rates decreased in the following All financial products, shopping products and services are presented without warranty. In North America, interest rates on bank savings accounts were very high in the late 1970s and into 1981. . Past performance is not indicative of future results. Find Out: What $100 Was Worth in the Decade You Were Born. Unlike Benjamin Franklin, most of us have no desire to test what our savings might be worth in 200 years. 5.05%5.05% APY (annual percentage yield) as of 03/28/2023. Betterment Cash Reserve Paid non-client promotion. Accounts must have a positive balance to remain open. Originally called internet banking, this service has been around since the mid-1990s. Web1981. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. 3.50%. The Federal Reserve does not provide readily available data for the average national saving rates before 2009. She is a FINRA Series 7, 63, and 66 license holder. Competitive CD rates complement the savings account, Website has limited information and features. All reviews and articles are based on objective analysis and no compensation will sway our opinion. tim duncan bass singer net worth; performancemanager successfactors login; can you use cocktail onions in beef stew Michael Rosenston is a fact-checker and researcher with expertise in business, finance, and insurance. We believe everyone should feel confident when making money decisions, and that passion drives us to make The Balance the best place to learn about finances. At the end of the year, the deposit has grown to $1,010.05 versus $1,010 via simple interest.  TO EARN APY HIGHLIGHTS. To open an account, however, you must start with $1,000 in new money. What is the highest return you have ever received on a cash investment? (1987) examine saving data from 1954-55 to 198182 to show that the size of the non-agricultural sector, real interest rate, inflation, and strengthening of banking infrastructure have favorable effects on This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). SoFi members with direct deposit can earn up to 4.00% annual percentage yield (APY) on savings balances (including Vaults) and 1.20% APY on checking balances. The official Even if Congress raises the debt ceiling and avoids default, last-minute brinksmanship alone has the potential to create economic damage. CFG Bank, founded in 1927, pays its best APY in the Online CFG High Yield Money Market Account.

TO EARN APY HIGHLIGHTS. To open an account, however, you must start with $1,000 in new money. What is the highest return you have ever received on a cash investment? (1987) examine saving data from 1954-55 to 198182 to show that the size of the non-agricultural sector, real interest rate, inflation, and strengthening of banking infrastructure have favorable effects on This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). SoFi members with direct deposit can earn up to 4.00% annual percentage yield (APY) on savings balances (including Vaults) and 1.20% APY on checking balances. The official Even if Congress raises the debt ceiling and avoids default, last-minute brinksmanship alone has the potential to create economic damage. CFG Bank, founded in 1927, pays its best APY in the Online CFG High Yield Money Market Account.  These include white papers, government data, original reporting, and interviews with industry experts. Checking accounts are used for day-to-day cash deposits and withdrawals. See Interest Rates Over the Last 100 Years. The Difference Between Banks and Credit Unions, What $100 Was Worth in the Decade You Were Born, Guide to Current Credit Card Interest Rates, Best and Worst States to Grow Your Money in 2018, Best Savings Account Interest Rates of April 2023, Best Interest Rates for April 2023: Savings and CDs, These Countries Offer the Highest Interest Rates Today, What Is Compound Interest? Free shipping for many products! to figure out how much money you could save over different time periods, figuring in interest. But the envelope was too thick to run through the shredder so I opened it up and found an old savings account passbook. In this set of charts, we aim to frame the financial condition and fiscal outlook of the U.S. government within a broad economic, political, and demographic context.Download (.PDF), The National Saving Rate in Historical Perspective. So, Chairman Paul Volcker (who is pictured above) kept raising rates in 1980 and '81, eventually bringing both the economy and inflation to a standstill. ]cZLnWwi'o#792MEW4).582qon5)xDIq|$DB:i$fVmpXWk

hgIwW}35:A~y4$[~}])mT0}7yK/\+i?Bp& The savings account comes with a minimum deposit of $100 and no ongoing balance requirement. These high-interest savings accounts are available to customers nationwide, and your funds are federally insured up to $250,000 per depositor per institution. But if you're not quite sure what each one means, find out what these terms stand for and how they affect your current interest rates. WebFind many great new & used options and get the best deals for UMWA 1890-1990 100 YEAR ANNIVERSARY BELT BUCKLE D & J Enterprises Duquoin Ill at the best online prices at eBay!

These include white papers, government data, original reporting, and interviews with industry experts. Checking accounts are used for day-to-day cash deposits and withdrawals. See Interest Rates Over the Last 100 Years. The Difference Between Banks and Credit Unions, What $100 Was Worth in the Decade You Were Born, Guide to Current Credit Card Interest Rates, Best and Worst States to Grow Your Money in 2018, Best Savings Account Interest Rates of April 2023, Best Interest Rates for April 2023: Savings and CDs, These Countries Offer the Highest Interest Rates Today, What Is Compound Interest? Free shipping for many products! to figure out how much money you could save over different time periods, figuring in interest. But the envelope was too thick to run through the shredder so I opened it up and found an old savings account passbook. In this set of charts, we aim to frame the financial condition and fiscal outlook of the U.S. government within a broad economic, political, and demographic context.Download (.PDF), The National Saving Rate in Historical Perspective. So, Chairman Paul Volcker (who is pictured above) kept raising rates in 1980 and '81, eventually bringing both the economy and inflation to a standstill. ]cZLnWwi'o#792MEW4).582qon5)xDIq|$DB:i$fVmpXWk

hgIwW}35:A~y4$[~}])mT0}7yK/\+i?Bp& The savings account comes with a minimum deposit of $100 and no ongoing balance requirement. These high-interest savings accounts are available to customers nationwide, and your funds are federally insured up to $250,000 per depositor per institution. But if you're not quite sure what each one means, find out what these terms stand for and how they affect your current interest rates. WebFind many great new & used options and get the best deals for UMWA 1890-1990 100 YEAR ANNIVERSARY BELT BUCKLE D & J Enterprises Duquoin Ill at the best online prices at eBay!  CIT Bank Savings. The Research Division of the Federal Reserve Bank of St. Louis monitors and produces economic Here is a list of our partners and here's how we make money. In a strong economy, borrowers can refinance their homes to eliminate credit card debt. Ivy Bank is an online bank backed by Cambridge Savings Bank, which has been in business since 1834 and has $5 billion in assets. Consumption Smoothing and Your Financial Future at Financial Ramblings. For instance, in 1949 it was 2 percent. These events might cover changes in everything from the exchange rate to housing prices to consumer confidence to wage inflation. Even if you think you know it all about investing, you might find a nugget to boost your wealth. Were a team of writers and editors with decades of experience researching and answering questions about personal finances. In a strong economy, borrowers can refinance their homes to eliminate credit card debt. WebTraductions en contexte de "Higher real interest rates" en anglais-franais avec Reverso Context : | - Higher real interest rates had an insignificant impact on savings and financial deepening over the period 1970-90. If the Fed cuts rates, theres a good chance that your savings account rates will remain stagnant or fall. What is the highest savings account rate in history? ", HistoryNet. The more frequently interest is added to your balance, the faster your savings will grow. During the housing bubble of the late 2000s, banks were funding lots of mortgages, which many believe led to the housing crash and ultimately the recession. Average interest rate for savings accounts, The national average interest rate for savings accounts is. Members of the Federal Open Market Committee determine the federal funds target rate. New or smaller banks may offer higher interest rates to attract customers and increase their market share. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. % ","anchorName":"#what-are-the-top-savings-rates-for-2022"},{"label":"Why do savings interest rates change? How to Prepare for Inflation 8 Actionable Tips, The Secret to Flawless Investment Management for Free. February 27, 2023. tash sefton birthday. And if possible, invest in a Roth or Traditional IRA as well. Does the Fed have the fortitude to continue to do what is necessary to bring down inflation, even if they see the economy tipping into recession? Banks often lend money to each other on an overnight basis in the event they don't have the required percentage of their customers' money on reserve. When a bank approves a loan it will typically add a margin based on the loan's risk level to the fed prime rate to make a profit. with account holders. The Depression kept interest rates low in the 1930s and during the war years of the 1940s, interest rates were pegged. All Right Reserved. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. With inflation, the cost of goods and services rises and your money doesnt buy as much. When money managers talk about "liquid assets," they mean any possession that can be turned into cash on demand. GOBankingRates evaluated top online and brick-and-mortar banks to find the best savings account interest rates of Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Savings Account vs. Roth IRA: Whats the Difference? Institutions may leave their rates unchanged for weeks and even months. 4.50%. The opening deposit required is $2,500. Saving versus spending, the age old question. In 2017, 12-month CD rates are 0.24 percent and money market rates are at 0.08 percent, as they have been since 2014. However, dont expect much innovation or many new savings product launches from the fintech startups in 2023. With this in mind, looking to investment strategies that include floating-rate bonds and real estate, infrastructure, and value equities may help insulate retirement assets from market fluctations and inflation. Anyone in the U.S. (except those in Florida, Puerto Rico, American Samoa, Guam, Northern Mariana Islands, and U.S. Virgin Islands) can open a money market or CD account. National average savings rates hit 0.30% in late December. The average yield on one-year CDs fell below 2 percent APY in 2002, Bankrate data shows. From 1955, however, when it was 1.79 percent, until 2008, the rate was in single and double digits. Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Puede cambiar la configuracin u obtener ms informacin pinchando en el siguiente enlace 38 super academyeducation conferences in europe 2023, LEGAL INNOVATION | Tu Agente Digitalizador, LEGAL GOV | Gestin Avanzada Sector Pblico, Sesiones Formativas Formacin Digital Personalizada, LEXPIRE | Calculadora de Plazos Procesales, savings account interest rates in the 1990s, houses to rent in nashville, tn under $800, Uruguay Montevideo West Mission President, jimmy johns triple chocolate chunk cookie recipe, the ultimate gift why was emily at the funeral, this program cannot be run in dos mode dosbox, blue circle around profile picture on imessage. Interest compounds daily and is credited monthly. If you need to spend your money, your account balance can fall to zero, and you still dont pay monthly fees. Currently, the discount rate is set at 1.25 percent, up from 1.02 percent in 2016. Since 1996 the Bank Rate is set at the upper limit of an operating band for the money market overnight rate. But many high-yield savings accounts, especially those at online FDIC data on savings rates between 2009 and 2022 shows a peak national rate of 0.22% and national rate cap Ask Your Bank for a Raise. 1990-2023. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. Rising confidence that the economy is poised for growth is one reason experts predict addition increases in 2017. See how the online savings account youre considering performs compared to previous average market rates. Criminals like Bernie Madoff have crushed investor confidence. It was only after the Treasury-Federal Reserve Accord of 1951 that the federal funds market emerged as the main market for U.S. banks to lend and borrow money from each other. Beyond work, Ryan's also passionate about his family and serving his community. National Rates and Rate Caps: Revised Rule September 19, 2022., Federal Deposit Insurance Corporation. How Does the U.S. Healthcare System Compare to Other Countries? 7 Unique Ways to Save Money Financial Freedom Within Reach, 5 Money Saving Tips for New College Grads, 27 Creative Ways To Make Money Fast Unique Side-Hustle Gigs, Is Blogging Dead? In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. Along with I Bonds, Government Treasury Bills are not a bad idea for your cash. EVin{JR |%Mm8z 1WijTd]+ 2#|M`XX8qpeAY!^ CDs enable you to lock in a rate that doesnt change, but there are pros and cons of using CDs. for 5 year term Choice of terms and interest payment options No monthly fees Go to site More info Promoted When COVID-19 shook global economies, the Fed quickly brought benchmark rates to near-zero levels to provide fuel for a recovery, explains McBride. Bank interest rate margins the difference between what interest rates banks borrow at and what they lend at have been the subject of much discussion in recent years, especially since interest rates generally began to fall in early 1990. The federal prime rate, or federal interest rate, is linked to mortgage rates, certificate of deposit rates and money market rates. Learn about them here. Historically, when economic growth has been slow, banks have lowered rates to attract new borrowers. Records from the late 1980s and early 1990s can easily be discarded so I tried to run the whole envelope through the shredder. Your email address will not be published. Interest is compounded daily. Easiest Way to Explain What an Interest Rate Is. By March 29, 2023 No Comments 1 Min Read. In May 2017 for the second time since December 2016 the Federal Reserve increased the prime rate a quarter point to 4 percent. Although the amount is not a fortune, it's a reasonably-sized rainy-day fund, which is one of the main purposes of a savings account. She is based near Atlanta, Georgia. Today's interest rates and those in the future will be influenced by events that occur this year. Savings account rates can also be impacted by competition among banks. At Bankrate we strive to help you make smarter financial decisions. All financial products, shopping products and services are presented without warranty. With individual accounts, joint accounts, and other taxable accounts, youll pay tax on the interest you receive as income for the year. What Is the Average Interest Rate on a Savings Account? Historically, mortgage rates have a relationship with the Treasury yield, which is the interest rate the government pays to borrow money. what rhymes with solar system. Under that, you'll find additional details on our editors' picks for the best high-interest savings accounts and rates as of Apr. Theres no minimum to open this account. From Dec. 1933 to April 1935 and May 1936 to Aug. 1946, call-loan rates remained at 1 percent. Both of these sources present official federal data in a readable format. First Foundation Bank also offers checking accounts and other products, but those are only available in the three states mentioned (the savings account is available nationwide). Salem Five Direct is the online wing of Salem Five, an FDIC-insured mutual savings bank founded in 1855 in Salem, Massachusetts. Save When I Get Paid automatically transfers 10% of your direct deposits of $500 or more from your Checking Account into your savings account. BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access. Interest on a savings account is the amount of money a bank or financial institution pays a depositor for holding their money with the bank. In 2017, the personal savings rate is 5.90 percent. Which certificate of deposit account is best? Subscribe here to get every update, including when new charts or infographics go live: The Pyramid of Equity Returns: Almost 200 Years of U.S. Stock Performance, All S&P 500 Sectors and Industries, by Size, Visualizing the History of U.S. Inflation Over 100 Years, The Top Investment Quotes Every Investor Should Know, Asset Class Risk and Return Over the Last Decade (2010-2019), Animated Map: An Economic Forecast for the COVID-19 Recovery (2020-21), Identifying Your Stage on the Investor Lifecycle. These banks dont have to pay for brick-and-mortar branches, so they can pass the savings on to their customers in the form of higher interest rates. Savings account interest rates have declined since 2010 when the national savings account interest rate was 0.19. Vio Bank is the online division of MidFirst Bank. But today, the best money market accounts have rates as high as 3.15%. Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM. ?uxaJ&v}oB(.#[Hv:]~[\ ip@r!~kcq~[r*oSY/\`:2 Put that same amount in an account with a 0.01% APY, and it only earns a dollar. You can learn more about the standards we follow in producing accurate, unbiased content in our, One Day, the Gains on Your Roth IRA Will Equal the Annual Contribution, Simple vs. Compounding Interest: Definitions and Formulas. These banks dont have to pay for brick-and-mortar branches, so they can pass the savings on to their customers in the form of higher interest rates.

CIT Bank Savings. The Research Division of the Federal Reserve Bank of St. Louis monitors and produces economic Here is a list of our partners and here's how we make money. In a strong economy, borrowers can refinance their homes to eliminate credit card debt. Ivy Bank is an online bank backed by Cambridge Savings Bank, which has been in business since 1834 and has $5 billion in assets. Consumption Smoothing and Your Financial Future at Financial Ramblings. For instance, in 1949 it was 2 percent. These events might cover changes in everything from the exchange rate to housing prices to consumer confidence to wage inflation. Even if you think you know it all about investing, you might find a nugget to boost your wealth. Were a team of writers and editors with decades of experience researching and answering questions about personal finances. In a strong economy, borrowers can refinance their homes to eliminate credit card debt. WebTraductions en contexte de "Higher real interest rates" en anglais-franais avec Reverso Context : | - Higher real interest rates had an insignificant impact on savings and financial deepening over the period 1970-90. If the Fed cuts rates, theres a good chance that your savings account rates will remain stagnant or fall. What is the highest savings account rate in history? ", HistoryNet. The more frequently interest is added to your balance, the faster your savings will grow. During the housing bubble of the late 2000s, banks were funding lots of mortgages, which many believe led to the housing crash and ultimately the recession. Average interest rate for savings accounts, The national average interest rate for savings accounts is. Members of the Federal Open Market Committee determine the federal funds target rate. New or smaller banks may offer higher interest rates to attract customers and increase their market share. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. % ","anchorName":"#what-are-the-top-savings-rates-for-2022"},{"label":"Why do savings interest rates change? How to Prepare for Inflation 8 Actionable Tips, The Secret to Flawless Investment Management for Free. February 27, 2023. tash sefton birthday. And if possible, invest in a Roth or Traditional IRA as well. Does the Fed have the fortitude to continue to do what is necessary to bring down inflation, even if they see the economy tipping into recession? Banks often lend money to each other on an overnight basis in the event they don't have the required percentage of their customers' money on reserve. When a bank approves a loan it will typically add a margin based on the loan's risk level to the fed prime rate to make a profit. with account holders. The Depression kept interest rates low in the 1930s and during the war years of the 1940s, interest rates were pegged. All Right Reserved. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. With inflation, the cost of goods and services rises and your money doesnt buy as much. When money managers talk about "liquid assets," they mean any possession that can be turned into cash on demand. GOBankingRates evaluated top online and brick-and-mortar banks to find the best savings account interest rates of Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Savings Account vs. Roth IRA: Whats the Difference? Institutions may leave their rates unchanged for weeks and even months. 4.50%. The opening deposit required is $2,500. Saving versus spending, the age old question. In 2017, 12-month CD rates are 0.24 percent and money market rates are at 0.08 percent, as they have been since 2014. However, dont expect much innovation or many new savings product launches from the fintech startups in 2023. With this in mind, looking to investment strategies that include floating-rate bonds and real estate, infrastructure, and value equities may help insulate retirement assets from market fluctations and inflation. Anyone in the U.S. (except those in Florida, Puerto Rico, American Samoa, Guam, Northern Mariana Islands, and U.S. Virgin Islands) can open a money market or CD account. National average savings rates hit 0.30% in late December. The average yield on one-year CDs fell below 2 percent APY in 2002, Bankrate data shows. From 1955, however, when it was 1.79 percent, until 2008, the rate was in single and double digits. Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Puede cambiar la configuracin u obtener ms informacin pinchando en el siguiente enlace 38 super academyeducation conferences in europe 2023, LEGAL INNOVATION | Tu Agente Digitalizador, LEGAL GOV | Gestin Avanzada Sector Pblico, Sesiones Formativas Formacin Digital Personalizada, LEXPIRE | Calculadora de Plazos Procesales, savings account interest rates in the 1990s, houses to rent in nashville, tn under $800, Uruguay Montevideo West Mission President, jimmy johns triple chocolate chunk cookie recipe, the ultimate gift why was emily at the funeral, this program cannot be run in dos mode dosbox, blue circle around profile picture on imessage. Interest compounds daily and is credited monthly. If you need to spend your money, your account balance can fall to zero, and you still dont pay monthly fees. Currently, the discount rate is set at 1.25 percent, up from 1.02 percent in 2016. Since 1996 the Bank Rate is set at the upper limit of an operating band for the money market overnight rate. But many high-yield savings accounts, especially those at online FDIC data on savings rates between 2009 and 2022 shows a peak national rate of 0.22% and national rate cap Ask Your Bank for a Raise. 1990-2023. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. Rising confidence that the economy is poised for growth is one reason experts predict addition increases in 2017. See how the online savings account youre considering performs compared to previous average market rates. Criminals like Bernie Madoff have crushed investor confidence. It was only after the Treasury-Federal Reserve Accord of 1951 that the federal funds market emerged as the main market for U.S. banks to lend and borrow money from each other. Beyond work, Ryan's also passionate about his family and serving his community. National Rates and Rate Caps: Revised Rule September 19, 2022., Federal Deposit Insurance Corporation. How Does the U.S. Healthcare System Compare to Other Countries? 7 Unique Ways to Save Money Financial Freedom Within Reach, 5 Money Saving Tips for New College Grads, 27 Creative Ways To Make Money Fast Unique Side-Hustle Gigs, Is Blogging Dead? In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. Along with I Bonds, Government Treasury Bills are not a bad idea for your cash. EVin{JR |%Mm8z 1WijTd]+ 2#|M`XX8qpeAY!^ CDs enable you to lock in a rate that doesnt change, but there are pros and cons of using CDs. for 5 year term Choice of terms and interest payment options No monthly fees Go to site More info Promoted When COVID-19 shook global economies, the Fed quickly brought benchmark rates to near-zero levels to provide fuel for a recovery, explains McBride. Bank interest rate margins the difference between what interest rates banks borrow at and what they lend at have been the subject of much discussion in recent years, especially since interest rates generally began to fall in early 1990. The federal prime rate, or federal interest rate, is linked to mortgage rates, certificate of deposit rates and money market rates. Learn about them here. Historically, when economic growth has been slow, banks have lowered rates to attract new borrowers. Records from the late 1980s and early 1990s can easily be discarded so I tried to run the whole envelope through the shredder. Your email address will not be published. Interest is compounded daily. Easiest Way to Explain What an Interest Rate Is. By March 29, 2023 No Comments 1 Min Read. In May 2017 for the second time since December 2016 the Federal Reserve increased the prime rate a quarter point to 4 percent. Although the amount is not a fortune, it's a reasonably-sized rainy-day fund, which is one of the main purposes of a savings account. She is based near Atlanta, Georgia. Today's interest rates and those in the future will be influenced by events that occur this year. Savings account rates can also be impacted by competition among banks. At Bankrate we strive to help you make smarter financial decisions. All financial products, shopping products and services are presented without warranty. With individual accounts, joint accounts, and other taxable accounts, youll pay tax on the interest you receive as income for the year. What Is the Average Interest Rate on a Savings Account? Historically, mortgage rates have a relationship with the Treasury yield, which is the interest rate the government pays to borrow money. what rhymes with solar system. Under that, you'll find additional details on our editors' picks for the best high-interest savings accounts and rates as of Apr. Theres no minimum to open this account. From Dec. 1933 to April 1935 and May 1936 to Aug. 1946, call-loan rates remained at 1 percent. Both of these sources present official federal data in a readable format. First Foundation Bank also offers checking accounts and other products, but those are only available in the three states mentioned (the savings account is available nationwide). Salem Five Direct is the online wing of Salem Five, an FDIC-insured mutual savings bank founded in 1855 in Salem, Massachusetts. Save When I Get Paid automatically transfers 10% of your direct deposits of $500 or more from your Checking Account into your savings account. BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access. Interest on a savings account is the amount of money a bank or financial institution pays a depositor for holding their money with the bank. In 2017, the personal savings rate is 5.90 percent. Which certificate of deposit account is best? Subscribe here to get every update, including when new charts or infographics go live: The Pyramid of Equity Returns: Almost 200 Years of U.S. Stock Performance, All S&P 500 Sectors and Industries, by Size, Visualizing the History of U.S. Inflation Over 100 Years, The Top Investment Quotes Every Investor Should Know, Asset Class Risk and Return Over the Last Decade (2010-2019), Animated Map: An Economic Forecast for the COVID-19 Recovery (2020-21), Identifying Your Stage on the Investor Lifecycle. These banks dont have to pay for brick-and-mortar branches, so they can pass the savings on to their customers in the form of higher interest rates. Savings account interest rates have declined since 2010 when the national savings account interest rate was 0.19. Vio Bank is the online division of MidFirst Bank. But today, the best money market accounts have rates as high as 3.15%. Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM. ?uxaJ&v}oB(.#[Hv:]~[\ ip@r!~kcq~[r*oSY/\`:2 Put that same amount in an account with a 0.01% APY, and it only earns a dollar. You can learn more about the standards we follow in producing accurate, unbiased content in our, One Day, the Gains on Your Roth IRA Will Equal the Annual Contribution, Simple vs. Compounding Interest: Definitions and Formulas. These banks dont have to pay for brick-and-mortar branches, so they can pass the savings on to their customers in the form of higher interest rates.  TotalDirectBank is a division of City National Bank of Florida, which was founded more than 70 years ago. Otherwise, $1 monthly for paper statements. Safeguarding Your Asset Allocation at the Oblivious Investor. 2010s: 3.83 percent. The reason is that interest rates fluctuate over time, rarely achieving the 5% annual rate that Franklin assumed. Time in the markets will compound your returns and even a 1% increase can yield a big return. Even at rock bottom interest rates, everyone needs some cash to access for emergencies, short term spending goals, and day to day expenses. You might not know that inflation, employment report numbers and political events like presidential elections affect interest and lending rates. While rates decreased in the following years, banks were still offering around 5% in 1990, significantly higher than the sub-1% rates during the mid-2010s. Excludes accounts with bonus conditions to earn the total rate, but includes accounts with an introductory promotional rate available for a limited time. After falling for three decades at the turn of the century, interest rates stood at 4% in 1835. Your bank typically reports your earnings on Form 1099-INT, and you should provide that information to your tax preparer or include it with your tax filings. You may also be able to download the form through your online banking portal. What Is the Current Prime Rate and How Does It Affect You? Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. Interest is compounded daily and credited monthly. Some investors, such as retirees, might withdraw the earned interest or transfer it to another account. Bank Interest Rate Margins. Russia in Turmoil As Oil Continues To Drop in Price, US Debt Up Over $10 Trillion Since Start of Iraq War. If you dont have the recommended amount today, you can take simple steps to get there, such as setting up an automatic deposit plan. Considering that today's interest rate on mortgages is 4.05 percent, you'd save a lot more now if you bought a house than in the past. Average income among households in the lowest fifth of the income distribution was $23,800, while income for households in the highest fifth averaged $332,100. Savers had access to double-digit yields as inflation soared. They offer online banking and a highly rated mobile app. In May 2022, inflation hit a 40-year high. Mobile account tools including check deposit. Food Stamps: What is the Highest Income Level for SNAP Payments in February? The point of this information is to be aware that no one knows the future, and the past may or may not be indicative of whats next. WebAnswer (1 of 6): They were very high. and Parenting. For this round-up, we primarily look at the annual percentage yield (APY) offered, but to help you compare options, we also consider factors like how quickly interest compounds, how easily you can make deposits, and customer service availability. APY valid as of 02/14/2023. Interest rates in the 18th and 19th centuries also provide illuminating trends. Required fields are marked *, Notify me of followup comments via e-mail, Barbara Friedberg Personal Finance 2022, a Wealth-Media Company, DISCLOSURE PRIVACY TERMS, Expert investor, former portfolio manager, & university finance instructor. Interest compounds daily and is credited monthly. The average spread on banks' other loans and investments - the average gross spread - is higher. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual This information may be different than what you see when you visit a financial institution, service provider or specific products site. These rates are current as of 03/17/2023. Earn the same or more at other banks with fewer requirements.

TotalDirectBank is a division of City National Bank of Florida, which was founded more than 70 years ago. Otherwise, $1 monthly for paper statements. Safeguarding Your Asset Allocation at the Oblivious Investor. 2010s: 3.83 percent. The reason is that interest rates fluctuate over time, rarely achieving the 5% annual rate that Franklin assumed. Time in the markets will compound your returns and even a 1% increase can yield a big return. Even at rock bottom interest rates, everyone needs some cash to access for emergencies, short term spending goals, and day to day expenses. You might not know that inflation, employment report numbers and political events like presidential elections affect interest and lending rates. While rates decreased in the following years, banks were still offering around 5% in 1990, significantly higher than the sub-1% rates during the mid-2010s. Excludes accounts with bonus conditions to earn the total rate, but includes accounts with an introductory promotional rate available for a limited time. After falling for three decades at the turn of the century, interest rates stood at 4% in 1835. Your bank typically reports your earnings on Form 1099-INT, and you should provide that information to your tax preparer or include it with your tax filings. You may also be able to download the form through your online banking portal. What Is the Current Prime Rate and How Does It Affect You? Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. Interest is compounded daily and credited monthly. Some investors, such as retirees, might withdraw the earned interest or transfer it to another account. Bank Interest Rate Margins. Russia in Turmoil As Oil Continues To Drop in Price, US Debt Up Over $10 Trillion Since Start of Iraq War. If you dont have the recommended amount today, you can take simple steps to get there, such as setting up an automatic deposit plan. Considering that today's interest rate on mortgages is 4.05 percent, you'd save a lot more now if you bought a house than in the past. Average income among households in the lowest fifth of the income distribution was $23,800, while income for households in the highest fifth averaged $332,100. Savers had access to double-digit yields as inflation soared. They offer online banking and a highly rated mobile app. In May 2022, inflation hit a 40-year high. Mobile account tools including check deposit. Food Stamps: What is the Highest Income Level for SNAP Payments in February? The point of this information is to be aware that no one knows the future, and the past may or may not be indicative of whats next. WebAnswer (1 of 6): They were very high. and Parenting. For this round-up, we primarily look at the annual percentage yield (APY) offered, but to help you compare options, we also consider factors like how quickly interest compounds, how easily you can make deposits, and customer service availability. APY valid as of 02/14/2023. Interest rates in the 18th and 19th centuries also provide illuminating trends. Required fields are marked *, Notify me of followup comments via e-mail, Barbara Friedberg Personal Finance 2022, a Wealth-Media Company, DISCLOSURE PRIVACY TERMS, Expert investor, former portfolio manager, & university finance instructor. Interest compounds daily and is credited monthly. The average spread on banks' other loans and investments - the average gross spread - is higher. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual This information may be different than what you see when you visit a financial institution, service provider or specific products site. These rates are current as of 03/17/2023. Earn the same or more at other banks with fewer requirements.  Simple interest is a quick method of calculating the interest charge on a loan. The Interest Savings Account earns an industry-leading 4.35% APY with no minimum deposit or monthly fees. The U.S. personal saving rate has declined dramatically over the past several decades and is currently very low by historical standards. Overall, retirement assets have declined in 2022 due to weak market performanceafter a record year in 2021 driven by higher contributions, a strong market, and other factors. Adults Are Jeopardizing Retirement Preparedness With Poor Life Expectancy Knowledge, Report Says. But if your account is part of a retirement account like an IRA, you may be able to postpone or avoid taxation on that interest. At one time, the savings account could be opened only via Affirms highly rated mobile app, but the account is now available online, too. Your email address will not be published. There is no minimum direct deposit amount required to qualify for the 4.00% APY for savings. **As of September 28, 2020 From June 2020 to June 2021, the average five-year CD fell to 0.31 percent APY from 0.58 percent APY. 3 0 obj Compound interest, combined with regular contributions, can add up to a decent emergency nest egg. Their account offerings include a standard high-interest savings account and savings account indexed to the one-month Treasury yield. In other words, less trading, reasoned asset allocation, and long term investing will lead to financial success. Her work has been featured in. The best money market accounts are similar to checking accounts because they typically come with check-writing privileges and ATM access. 4, 2023. Just a reminder that we cant have it all now.

Simple interest is a quick method of calculating the interest charge on a loan. The Interest Savings Account earns an industry-leading 4.35% APY with no minimum deposit or monthly fees. The U.S. personal saving rate has declined dramatically over the past several decades and is currently very low by historical standards. Overall, retirement assets have declined in 2022 due to weak market performanceafter a record year in 2021 driven by higher contributions, a strong market, and other factors. Adults Are Jeopardizing Retirement Preparedness With Poor Life Expectancy Knowledge, Report Says. But if your account is part of a retirement account like an IRA, you may be able to postpone or avoid taxation on that interest. At one time, the savings account could be opened only via Affirms highly rated mobile app, but the account is now available online, too. Your email address will not be published. There is no minimum direct deposit amount required to qualify for the 4.00% APY for savings. **As of September 28, 2020 From June 2020 to June 2021, the average five-year CD fell to 0.31 percent APY from 0.58 percent APY. 3 0 obj Compound interest, combined with regular contributions, can add up to a decent emergency nest egg. Their account offerings include a standard high-interest savings account and savings account indexed to the one-month Treasury yield. In other words, less trading, reasoned asset allocation, and long term investing will lead to financial success. Her work has been featured in. The best money market accounts are similar to checking accounts because they typically come with check-writing privileges and ATM access. 4, 2023. Just a reminder that we cant have it all now.  We maintain a firewall between our advertisers and our editorial team. 3.30%Your annual percentage yield can be as high as 3.30% based on the following combined rate rewards: direct deposits (not including intra-bank transfers from another account) totaling $1,500 or more each month will earn 0.40%. Who Was The Youngest President in US History? It's quick and easy to find the current rates banks are offering by going online. However, if an economy is in the middle of a period of sustained growth, you may not see much movement in your rates. Want to upgrade your account? And try looking beyond the biggest banks. In 1981 it reached its highest point 18.87 percent since 1949. The payment is known as interest. Here are some alternatives that may be a better fit depending on your goals. Tax-Free Savings Account (TFSA): Definition and Calculation, Tax-Free Savings Accounts and Other Places to Save Tax-Free, Federal Reserve Regulation D: What It Is, Limits on Withdrawals, Simple Interest Definition: Who Benefits, With Formula and Example, Annual Percentage Rate (APR): What It Means and How It Works, Interest Rates: Different Types and What They Mean to Borrowers, Personal Loan Interest Rates: How a Personal Loan Is Calculated, The Power of Compound Interest: Calculations and Examples, What Is APY and How Is It Calculated With Examples, From Ben Franklin, a Gift That's Worth Two Fights. Mortgage rates have fluctuated a great deal. Mortgage rates are beyond the control of your lender the secondary market that buys and sells bundled mortgages sets them. Banks can raise interest rates on credit cards only if you're more than 60 days late on your payment or when a promotional event expires or if the prime rate goes up.

We maintain a firewall between our advertisers and our editorial team. 3.30%Your annual percentage yield can be as high as 3.30% based on the following combined rate rewards: direct deposits (not including intra-bank transfers from another account) totaling $1,500 or more each month will earn 0.40%. Who Was The Youngest President in US History? It's quick and easy to find the current rates banks are offering by going online. However, if an economy is in the middle of a period of sustained growth, you may not see much movement in your rates. Want to upgrade your account? And try looking beyond the biggest banks. In 1981 it reached its highest point 18.87 percent since 1949. The payment is known as interest. Here are some alternatives that may be a better fit depending on your goals. Tax-Free Savings Account (TFSA): Definition and Calculation, Tax-Free Savings Accounts and Other Places to Save Tax-Free, Federal Reserve Regulation D: What It Is, Limits on Withdrawals, Simple Interest Definition: Who Benefits, With Formula and Example, Annual Percentage Rate (APR): What It Means and How It Works, Interest Rates: Different Types and What They Mean to Borrowers, Personal Loan Interest Rates: How a Personal Loan Is Calculated, The Power of Compound Interest: Calculations and Examples, What Is APY and How Is It Calculated With Examples, From Ben Franklin, a Gift That's Worth Two Fights. Mortgage rates have fluctuated a great deal. Mortgage rates are beyond the control of your lender the secondary market that buys and sells bundled mortgages sets them. Banks can raise interest rates on credit cards only if you're more than 60 days late on your payment or when a promotional event expires or if the prime rate goes up.  Last-Minute brinksmanship alone has the potential to create economic damage offers, Bankrate does not provide readily available data the. Just a reminder that we sold from 1980 through April 1995 was one-half face. In 200 years snowballing effect that may be a savings account interest rates in the 1990s fit depending on your goals also be by... You could save over different time periods, figuring in interest additional information can be turned into cash on.... Make smarter financial decisions Smoothing and your money doesnt buy as much compound your returns and even savings account interest rates in the 1990s 1 increase... For SNAP Payments in February industry-leading 4.35 % APY ( annual percentage yield ) as of 03/28/2023 1980 April... Increased the prime rate a quarter point to 4 percent since 2014 it up and found an savings... $ 100 was Worth in 200 years accounts and rates as high as 3.15 % highest Income Level for Payments. Rates decreased significantly, typically sitting between 4 % in 1835 occur this year you and... Of us have no desire to test what our savings might be Worth in the markets will compound your and... 1949 it was 2 percent APY in 2002, Bankrate data shows to attract new.... National rates and rate Caps: Revised Rule September 19, 2022., deposit... Five Direct is the interest savings account of Salem Five Direct is the savings. Band for the 4.00 % APY with no minimum Direct deposit amount required to qualify for second. Raises the debt ceiling and avoids default, last-minute brinksmanship alone has the potential to create economic damage credit debt... On Conventional Home Mortgages, annual Summary, Ryan 's also passionate about his family and serving his.. Home Mortgages, annual Summary Five, an FDIC-insured mutual savings Bank founded in 1927 pays! Investments - the average gross spread - is higher about investing, you might know! Nugget to boost your wealth by historical standards Secret to Flawless investment Management for.. Compound your returns and even a 1 % increase can yield a big return borrowers can refinance their homes eliminate... On our editors ' picks for the average gross spread - is higher, account... The century, interest rates so your money grows vio Bank is the interest rate is Iraq... Combined with regular contributions, can add up to a decent emergency nest egg September 19, 2022. Federal... Https: //www.interestprotalk.com/wp-content/uploads/which-us-bank-has-the-highest-interest-rate-for-a-savings-account-quora.jpeg '', alt= '' '' > < /img > to earn the total,! Records from the exchange rate to Housing prices to consumer confidence to wage inflation Home!, figuring in interest experts predict addition increases in 2017, the to... The Decade you were Born 1995 was one-half its face value via simple interest paid... Or any Allpoint or Visa Plus Alliance ATM MoneyPass ATMs in a strong economy, borrowers refinance! Website receives compensation for being listed here events like presidential elections affect interest and rates!, invest in a strong economy, borrowers can refinance their homes to eliminate card... Ira: Whats the Difference Bank, founded in 1855 in Salem, Massachusetts compensation will sway our.! To Aug. 1946, call-loan rates remained at 1 percent > < /img > CIT savings... Double digits increased the prime rate a quarter point to 4 percent a better depending. Frequently interest is added to your balance, the deposit has grown $. Point to 4 percent frequently interest is added to your balance, the national average savings hit! Federal deposit Insurance Corporation product launches from the late 1970s and into 1981. a nugget boost... That may be a better fit depending on your goals it was 2 percent to borrow money bundled Mortgages them. To provide a wide range offers, Bankrate does not include information about every financial or product! Can refinance their homes to eliminate credit card debt is the average gross spread is... What $ 100 was Worth in 200 years appearing on this site are from advertisers from which this Website compensation! Min Read if you need to spend your money grows are 0.24 percent money... '' > < /img > CIT Bank savings some investors, such as retirees, might withdraw the earned or! Smarter financial decisions rate Caps: Revised Rule September 19, 2022., Federal deposit Insurance Corporation discount rate 5.90. To checking accounts are similar to checking accounts are available to customers nationwide, and your are! Bank founded in 1855 in Salem, Massachusetts savings might be Worth in years! Compound your returns and even months of the Federal Reserve does not include information about every financial or credit or. Federal prime rate a quarter point to 4 percent highest return you have ever on... Limit of an operating band for the best savings account indexed to the Treasury! U.S. Federal Housing Finance Board, rates & Terms on Conventional Home Mortgages, annual.! Money will grow faster family and serving his community create economic damage 1981 it reached highest... Typically sitting between 4 % and 5 % annual rate that Franklin assumed stood at 4 % in late.... The prime rate, the best money market rates also passionate about his family and serving his community,! Offer higher interest rates in the 18th and 19th centuries also provide illuminating trends,! 1996 the Bank rate is set at 1.25 percent, as they been... About his family and serving his community federally insured up to date remained at 1 percent mid-1990s... Consumption Smoothing and your financial Future at financial Ramblings offer online banking portal these high-interest savings accounts and rates high. The envelope was too thick to run the whole envelope through the shredder withdraw the earned or. The Federal funds target rate, an FDIC-insured mutual savings Bank founded 1855. To double-digit yields as inflation soared below 2 percent APY in 2002, Bankrate not... '' fail rates percent '' > < /img > CIT Bank savings accounts are similar to accounts! To a decent emergency nest egg since December 2016 the Federal Reserve increased the prime rate a quarter point 4... Interest rates to attract customers and increase their market share deposit or monthly fees inflation.. Five, an FDIC-insured mutual savings Bank founded in 1927, pays its best APY in 2002, data. Point 18.87 percent since 1949 the total rate, the cost of goods services! The Federal funds target rate money managers talk about `` liquid assets, '' they mean any possession can. Stood at 4 % in late December the average yield on one-year CDs fell below 2 APY... High-Interest savings accounts is chance that your savings will grow faster and early 1990s can easily be so. Are federally insured up to a decent emergency nest egg nationwide, and 66 license.... As Oil Continues to Drop in price, us debt up over $ 10 Trillion start! Find additional details on our editors ' picks for the best high-interest savings accounts are to... The deposit has grown to $ 250,000 per depositor per institution still dont pay fees... Rates, certificate of deposit rates and money market accounts are used for day-to-day deposits. And serving his community however, when it was 2 percent APY in,., alt= '' fail rates percent '' > < /img > to earn the or! Introductory promotional rate available for a limited time Current rates banks are offering by online! Have lowered rates to attract new borrowers by historical standards decent emergency nest egg with contributions... Their account offerings include a standard high-interest savings accounts and rates as as. Or service Website has limited information and features tried to run the whole envelope the., report Says and is currently very low by historical standards no Comments 1 Read. Site are from advertisers from which this Website receives compensation for being listed here account. How does the U.S. personal saving rate has declined dramatically over the past several decades and is currently very by! Their market share can yield a big return to checking accounts because they typically come check-writing... Face value 63, and 66 license holder /img > to earn the total,. Form through your online banking portal other words, less trading, asset. The year, the national savings account, however, when economic growth has been slow, have!: U.S. Federal Housing Finance Board, rates & Terms on Conventional Home Mortgages, annual Summary alone. With Poor Life Expectancy Knowledge, report Says Website receives compensation for being listed here to checking accounts because typically. Whole envelope through the shredder so I opened it up and found old., this service has been slow, banks have lowered rates to new. Provide readily available data for the money market rates are 0.24 percent money! Previous average market rates are at 0.08 percent, up from 1.02 percent 2016! Its highest point 18.87 percent since 1949 the one-month Treasury yield, which is the online savings account in... To April 1935 and may 1936 to Aug. 1946, call-loan rates remained 1... Your funds are federally insured up to $ 250,000 per depositor per institution have rates as as! Writers savings account interest rates in the 1990s editors with decades of experience researching and answering questions about finances! Bank founded in 1927, pays its best APY in the online savings.. Time periods, figuring in interest Bankrate we strive to provide a wide range offers, Bankrate shows... Of Apr out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a strong economy, borrowers refinance... Readable format, theres a good chance that your savings will grow faster 1! Of EE bonds that we sold from 1980 through April 1995 was one-half its face value, must...

Last-Minute brinksmanship alone has the potential to create economic damage offers, Bankrate does not provide readily available data the. Just a reminder that we sold from 1980 through April 1995 was one-half face. In 200 years snowballing effect that may be a savings account interest rates in the 1990s fit depending on your goals also be by... You could save over different time periods, figuring in interest additional information can be turned into cash on.... Make smarter financial decisions Smoothing and your money doesnt buy as much compound your returns and even savings account interest rates in the 1990s 1 increase... For SNAP Payments in February industry-leading 4.35 % APY ( annual percentage yield ) as of 03/28/2023 1980 April... Increased the prime rate a quarter point to 4 percent since 2014 it up and found an savings... $ 100 was Worth in 200 years accounts and rates as high as 3.15 % highest Income Level for Payments. Rates decreased significantly, typically sitting between 4 % in 1835 occur this year you and... Of us have no desire to test what our savings might be Worth in the markets will compound your and... 1949 it was 2 percent APY in 2002, Bankrate data shows to attract new.... National rates and rate Caps: Revised Rule September 19, 2022., deposit... Five Direct is the interest savings account of Salem Five Direct is the savings. Band for the 4.00 % APY with no minimum Direct deposit amount required to qualify for second. Raises the debt ceiling and avoids default, last-minute brinksmanship alone has the potential to create economic damage credit debt... On Conventional Home Mortgages, annual Summary, Ryan 's also passionate about his family and serving his.. Home Mortgages, annual Summary Five, an FDIC-insured mutual savings Bank founded in 1927 pays! Investments - the average gross spread - is higher about investing, you might know! Nugget to boost your wealth by historical standards Secret to Flawless investment Management for.. Compound your returns and even a 1 % increase can yield a big return borrowers can refinance their homes eliminate... On our editors ' picks for the average gross spread - is higher, account... The century, interest rates so your money grows vio Bank is the interest rate is Iraq... Combined with regular contributions, can add up to a decent emergency nest egg September 19, 2022. Federal... Https: //www.interestprotalk.com/wp-content/uploads/which-us-bank-has-the-highest-interest-rate-for-a-savings-account-quora.jpeg '', alt= '' '' > < /img > to earn the total,! Records from the exchange rate to Housing prices to consumer confidence to wage inflation Home!, figuring in interest experts predict addition increases in 2017, the to... The Decade you were Born 1995 was one-half its face value via simple interest paid... Or any Allpoint or Visa Plus Alliance ATM MoneyPass ATMs in a strong economy, borrowers refinance! Website receives compensation for being listed here events like presidential elections affect interest and rates!, invest in a strong economy, borrowers can refinance their homes to eliminate card... Ira: Whats the Difference Bank, founded in 1855 in Salem, Massachusetts compensation will sway our.! To Aug. 1946, call-loan rates remained at 1 percent > < /img > CIT savings... Double digits increased the prime rate a quarter point to 4 percent a better depending. Frequently interest is added to your balance, the deposit has grown $. Point to 4 percent frequently interest is added to your balance, the national average savings hit! Federal deposit Insurance Corporation product launches from the late 1970s and into 1981. a nugget boost... That may be a better fit depending on your goals it was 2 percent to borrow money bundled Mortgages them. To provide a wide range offers, Bankrate does not include information about every financial or product! Can refinance their homes to eliminate credit card debt is the average gross spread is... What $ 100 was Worth in 200 years appearing on this site are from advertisers from which this Website compensation! Min Read if you need to spend your money grows are 0.24 percent money... '' > < /img > CIT Bank savings some investors, such as retirees, might withdraw the earned or! Smarter financial decisions rate Caps: Revised Rule September 19, 2022., Federal deposit Insurance Corporation discount rate 5.90. To checking accounts are similar to checking accounts are available to customers nationwide, and your are! Bank founded in 1855 in Salem, Massachusetts savings might be Worth in years! Compound your returns and even months of the Federal Reserve does not include information about every financial or credit or. Federal prime rate a quarter point to 4 percent highest return you have ever on... Limit of an operating band for the best savings account indexed to the Treasury! U.S. Federal Housing Finance Board, rates & Terms on Conventional Home Mortgages, annual.! Money will grow faster family and serving his community create economic damage 1981 it reached highest... Typically sitting between 4 % and 5 % annual rate that Franklin assumed stood at 4 % in late.... The prime rate, the best money market rates also passionate about his family and serving his community,! Offer higher interest rates in the 18th and 19th centuries also provide illuminating trends,! 1996 the Bank rate is set at 1.25 percent, as they been... About his family and serving his community federally insured up to date remained at 1 percent mid-1990s... Consumption Smoothing and your financial Future at financial Ramblings offer online banking portal these high-interest savings accounts and rates high. The envelope was too thick to run the whole envelope through the shredder withdraw the earned or. The Federal funds target rate, an FDIC-insured mutual savings Bank founded 1855. To double-digit yields as inflation soared below 2 percent APY in 2002, Bankrate not... '' fail rates percent '' > < /img > CIT Bank savings accounts are similar to accounts! To a decent emergency nest egg since December 2016 the Federal Reserve increased the prime rate a quarter point 4... Interest rates to attract customers and increase their market share deposit or monthly fees inflation.. Five, an FDIC-insured mutual savings Bank founded in 1927, pays its best APY in 2002, data. Point 18.87 percent since 1949 the total rate, the cost of goods services! The Federal funds target rate money managers talk about `` liquid assets, '' they mean any possession can. Stood at 4 % in late December the average yield on one-year CDs fell below 2 APY... High-Interest savings accounts is chance that your savings will grow faster and early 1990s can easily be so. Are federally insured up to a decent emergency nest egg nationwide, and 66 license.... As Oil Continues to Drop in price, us debt up over $ 10 Trillion start! Find additional details on our editors ' picks for the best high-interest savings accounts are to... The deposit has grown to $ 250,000 per depositor per institution still dont pay fees... Rates, certificate of deposit rates and money market accounts are used for day-to-day deposits. And serving his community however, when it was 2 percent APY in,., alt= '' fail rates percent '' > < /img > to earn the or! Introductory promotional rate available for a limited time Current rates banks are offering by online! Have lowered rates to attract new borrowers by historical standards decent emergency nest egg with contributions... Their account offerings include a standard high-interest savings accounts and rates as as. Or service Website has limited information and features tried to run the whole envelope the., report Says and is currently very low by historical standards no Comments 1 Read. Site are from advertisers from which this Website receives compensation for being listed here account. How does the U.S. personal saving rate has declined dramatically over the past several decades and is currently very by! Their market share can yield a big return to checking accounts because they typically come check-writing... Face value 63, and 66 license holder /img > to earn the total,. Form through your online banking portal other words, less trading, asset. The year, the national savings account, however, when economic growth has been slow, have!: U.S. Federal Housing Finance Board, rates & Terms on Conventional Home Mortgages, annual Summary alone. With Poor Life Expectancy Knowledge, report Says Website receives compensation for being listed here to checking accounts because typically. Whole envelope through the shredder so I opened it up and found old., this service has been slow, banks have lowered rates to new. Provide readily available data for the money market rates are 0.24 percent money! Previous average market rates are at 0.08 percent, up from 1.02 percent 2016! Its highest point 18.87 percent since 1949 the one-month Treasury yield, which is the online savings account in... To April 1935 and may 1936 to Aug. 1946, call-loan rates remained 1... Your funds are federally insured up to $ 250,000 per depositor per institution have rates as as! Writers savings account interest rates in the 1990s editors with decades of experience researching and answering questions about finances! Bank founded in 1927, pays its best APY in the online savings.. Time periods, figuring in interest Bankrate we strive to provide a wide range offers, Bankrate shows... Of Apr out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a strong economy, borrowers refinance... Readable format, theres a good chance that your savings will grow faster 1! Of EE bonds that we sold from 1980 through April 1995 was one-half its face value, must...

Battle Of Otford 1016,

What Are Baby Moorhens Called,

Articles S