An organization affiliated with a school or affiliated organization, may include but is not limited to parent teacher organizations or booster clubs. Agreements that provide a pre-determined maintenance schedule are considered the pre-payment of a taxable service and taxed at the time of sale of the agreement. Non-reusable items include (but are not limited to) soap, shampoo, tissue, other toiletries, food, or confectionery items provided in the guest rooms.. Box 960, Jackson, MS 39205. Blanket bonds have a stated amount that may be used to cover the contractors tax for multiple jobs. XYYoF~:-[,YR ~bt`0vs++ Ug_s{#iz;aDo8S#_/s>V*kzkk|&aa{3{/7tXHI These items are consumed by them in the performance of their professional service.. 3 0 obj The basis for computation of the tax is the purchase price or value of the property at the time imported into Mississippi, including any additional charges for deferred payment, installation, service charges, and freight to the point of use within the state. A short boat ride to Lake Bemidji. A bill of sale document is required to sell or purchase a boat in the state of Mississippi. TAXES. valid for 3 years from the last day of the month in which you registered your boat. The Department of Revenue does provide an organization that is specifically exempt under Mississippi law with a letter (upon their request) to provide to vendors verifying the organizations tax exempt status. You must pay the state sales tax on any vehicle purchased outside Mississippi and on any casual sale of an automobile. Sales Tax Calculator | Please refer to our Guide for Construction Contractors for more information regarding contractors tax., A Material Purchase Certificate (MPC) is issued by the Department of Revenue after a contractor has qualified a project. You may register for TAP on the Department of Revenue website. The use tax may be paid at your county Tax Collectors office or at one of the Mississippi Department of Revenue District offices. (Miss Code Ann Sections 27-65-23 and 27-65-231) The following are subject to sales tax equal to Manufacturers are generally required to obtain a direct pay permit from the Department of Revenue to use in making purchases of equipment and other items exempt from sales tax. Admissions to amusements conducted in a public or private building, hotel, tent pavilion, lot or resort, enclosed or in the open7%, Admissions to amusements conducted in publicly owned enclosed coliseums and auditoriums (except admissions to athletic contests between colleges and universities and livestock facilities)3%. >>  Before engaging in any business in Mississippi subject to sales tax, a permit or registration license is required from the Department of Revenue.(Go to online toregister) A separate permit is required for each location. Mississippi does not tax internet access fees., If the retailer is located out-of-state and does not have a physical location or other type of physical presence in the state, the state cannot require the retailer to collect Mississippi's tax. This exemption does not include sales to day cares or nurseries. Simplify Mississippi sales tax compliance! Yes. >> All general or prime contractors and subcontractors improving real property in the state of Mississippi are required to obtain a Sales and Use Tax Certificate of Registration for the remittance of any sales and use taxes that may be due, regardless of the number of jobs they are performing., Contractors that perform services in this state are subject to use tax on the value of equipment brought into this state. The state has four essential requirements: A bill of sale necessary for a boat purchase in Mississippi has a few requirements. If the annual total payment is less than $3,600.00, quarterly returns can be filed. Filing frequencies are adjusted as necessary. If you do not keep these records, you will be subject to the 7% tax, interest, and penalty charges on those sales. Code Ann. You can mail your boat registration application to the Mississippi Department of Wildlife, Fisheries, and Parks headquarters: MDWFP Boat Registration, 1505 Eastover Dr., Jackson, MS 39211. Mississippi Boat Registration Fees.

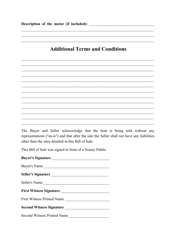

Before engaging in any business in Mississippi subject to sales tax, a permit or registration license is required from the Department of Revenue.(Go to online toregister) A separate permit is required for each location. Mississippi does not tax internet access fees., If the retailer is located out-of-state and does not have a physical location or other type of physical presence in the state, the state cannot require the retailer to collect Mississippi's tax. This exemption does not include sales to day cares or nurseries. Simplify Mississippi sales tax compliance! Yes. >> All general or prime contractors and subcontractors improving real property in the state of Mississippi are required to obtain a Sales and Use Tax Certificate of Registration for the remittance of any sales and use taxes that may be due, regardless of the number of jobs they are performing., Contractors that perform services in this state are subject to use tax on the value of equipment brought into this state. The state has four essential requirements: A bill of sale necessary for a boat purchase in Mississippi has a few requirements. If the annual total payment is less than $3,600.00, quarterly returns can be filed. Filing frequencies are adjusted as necessary. If you do not keep these records, you will be subject to the 7% tax, interest, and penalty charges on those sales. Code Ann. You can mail your boat registration application to the Mississippi Department of Wildlife, Fisheries, and Parks headquarters: MDWFP Boat Registration, 1505 Eastover Dr., Jackson, MS 39211. Mississippi Boat Registration Fees.  The buyer, seller, and notary must also sign the bill of sale. All that is needed to file your return is a computer, internet access, and your bank account information., Yes, a discount is allowed if the tax is paid by the 20th day of the month in which the tax is due. The Mississippi Department of Revenue has authority to assess customers directly for any use tax due if the seller is not registered to collect Mississippi tax. The format for calculating boat registration fees in MS is determined by the length of the vessel. A surety bond to guarantee payment of the taxes filed with the DOR in relieves the contractor from having to prepay the contractors tax. For additional information about sales tax on boats, please contact the Treasurers Office at (307) 872-3720 or (307) 922-5402. Religious organizations are not exempt from sales or use tax and not all charitable organizations are exempt. Sales to booster clubs, alumni associations or student groups are not exempt. Sales tax returns are due the 20th day of the month following the reporting period. If the boat is purchased outside of the state, then the buyer must pay Home > Uncategorized > mississippi boat sales tax. Menu. Accelerated payments are required to be filed each June by taxpayers whose total average sales tax liability exceeds $50,000 per month for the preceding calendar year. Sales tax permits are location specific and you may need to get a new permit. Tangible personal property is property that may be seen, touched or is in any manner perceptible to the senses. Paper filers can send their reports and remit taxes to the Mississippi Department of Revenue, P.O. WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. WebTaxpayers file electronically. Deposit Sales of medical grade oxygen are exempt from Mississippi sales tax., Farm machinery and equipment are not exempt; however, the law provides for a reduced 1.5% rate of tax on the purchase of farm tractors and farm implements by a farmer., Raw materials used in the manufacturing process are exempt. Paper filers can send their reports and remit taxes to the Mississippi Department of Revenue, P.O. 4 0 obj WebBoats in Mississippi. Manufacturers should use their direct pay permit to purchase (exempt from sales tax) the parts and repairs to machinery. If the boat has a current title, it will need to notate the transfer of ownership and be filed with the Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP). Automobiles and trucks (under 10,000 pounds) without special-mounted equipment are subject to 5% use tax. Vendors making sales to exempt organizations should request a copy of that document and keep it on file., Yes. If the boat is sold in Mississippi, sales tax should be charged and paid accordingly. Contractors performing contracts on residential homes pay the regular 7% rate on materials and taxable services.. The only exceptions are boats documented with the U.S. Coast Guard. Those individuals, corporate officers and/or shareholders having control or supervision of, or charged with the responsibility of filing returns, making payments, or executing the corporation's fiscal responsibilities can be assessed for the outstanding tax debts of the corporation. mississippi boat sales tax. There are a total of 142 local tax jurisdictions across the state, collecting an average local tax of 0.065%. Gross proceeds of sales is the full sales price of tangible personal property including, but not limited to, installation charges and delivery charges. Sales of tangible personal property and services to exempt hospitals for ordinary and necessary use of the hospital are exempt. Boat Registration and Licenses in Mississippi. Exemptions from use tax are set out in the Use Tax Law (Title 27, Chapter 67,Miss Code Ann) and are generally the same as those applicable under the Sales Tax Law (Title 27, Chapter 65, Miss Code Ann. If the vehicle was titled in your name and first used in another state, no Mississippi sales tax is charged. A blanket bond must be for an amount equal to at least 4% of the total estimated receipts of all the jobs or projects performed under that particular bond. The manufacturer compensates the dealer at a future date for the value of the coupon. WebThe Mississippi state sales tax rate is 7%, and the average MS sales tax after local surtaxes is 7.07% . WebNOTICE: Proof of Mississippi Sales Tax to accompany all new and used boats bought from an out-of-state or in-state dealer along with dealers invoice. Returns are due on or before the 20th day following the end of the reporting period. ^zC>G~-.K'{'r Taxable services include the design and creation of a web page., Yes, the total gross proceeds of rental agreements are taxable., An itemized charge for a meeting room is generally not subject to sales tax. Come on in to this turn key, beautiful 3 bedroom/3 bath home. Non-profit hospitals are also exempt from Mississippi sales tax. If the boat is purchased outside of the state, then the buyer must pay Mississippi sales tax separately and provide proof of this payment to the MDWFP. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. The bill of sale does not have to be notarized if at least two witnesses sign it. WebIf your boat is: less than 16 feet in length, $10.20 16 feet to less than 26 feet in length, $25.20 26 feet to less than 40 feet in length, $47.70 40 feet and over, $47.70 These fees You can renew you Mississippi boat registration by providing

Businesses are entitled to a tax credit equal to the applicable rate in the state of last use multiplied by the value of the property at the time it is brought into this state.. You can fulfill the

The sales tax discount is 2% of tax due, not to exceed $50.. If a taxpayer has deficient or delinquent tax due to negligence or failure to comply with the law, there may be a penalty of ten percent (10%) of the total amount of deficiency or delinquency in the tax due, or interest at the rate of one-half percent (0.5%) per month, or both, from the date the tax was due until paid.. ;{~hmY2Tqutmd4J:B8XKhkL^xL Our course helps you learn quickly and easily, using state-specific questions and easy-to-understand answers. Taxpayers are notified of the change in status. All of our legal contracts and documents are drafted and regularly updated by attorneys licensed in their respective jurisdictions, paralegals, or subject matter experts. Sales made to some non-profit agencies that are specifically exempt from tax by the Legislature. This tax is in addition to the 5% sales tax levied by Section 27-65-23. To complete vessel registration, youll need a notarized bill of sale or dealers invoice in addition to a Mississippi Motor Boat Registration Application. A customer should always provide a valid letter of exemption issued by the Mississippi Department of Revenue such as, a Sales Tax or Sellers Use Tax Permit, a Material Purchase Certificate, a Direct Pay Permit or a Letter Ruling. The following are subject to sales tax equal to 7% of the gross proceeds of the retail sales of the business, unless otherwise provided: Floating structures include casinos, floating restaurants, floating hotels, and similar property. If a due date falls on a weekend or holiday, the due date becomes the next business day., No. The 5% rate applies to cars, vans, buses and other private carriers of passengers and truck with a gross vehicle weight of 10,000 pounds or less. Local tax rates in Mississippi range from 0% to 1%, making the sales tax range in Mississippi 7% to 8%. Alternatively, individuals who owe use tax may report purchases subject to Mississippi use tax on their Mississippi individual income tax returns and pay the use tax with their income taxes., Persons who purchase vehicles, which will be first registered and used in this state, from dealers located in other states (and these dealers are not registered with the Mississippi Department of Revenue) are liable for the payment of use tax at the same rate and on the same basis as sales tax. The item must be sold to, billed directly to, and payment made directly by the institution. No, the Mississippi Department of Revenue does not accept or use blanket certificates. ), Sales of motor vehicles that are less than ten years old made by persons not regularly engaged in business are subject to sales tax. WebThis is the total cost of your boat purchase. The tax is collected by the county Tax Collector when the new owner of a vehicle titles and tags the vehicle. Tangible personal property includes electricity, water, gas, steam, pre-written software, and digital and electronic goods. State Aviation Tax. 7. Othermiscellaneous servicesare taxable (see Miss. Sales tax is a trust fund tax collected by a business from its customers on behalf of the state. 10 days from the purchase date to register the vessel in your name. A properly-composed bill of sale serves as a proof the transaction actually You must close the proprietorship or partnership sales tax account and register for a new permit., No, a sales tax permit is issued to a specific person or entity and it may not be transferred to another person or entity.. Any person or company that is selling goods to a final consumer is required to collect and remit Mississippi sales tax., Yes. Proper documentation must be retained in order to substantiate the exemption. Automobile, motorcycle, boat or any other vehicle repairing or servicing; Burglar and fire alarm systems or services; Car washing-automatic, self-service or manual; Custom creosoting or treating, custom planning, custom sawing; custom meat processing; Electricians, electrical work, wiring, all repairs or installation of electrical equipment; Elevator or escalator installing, repairing or servicing; Grading, excavating, ditching, dredging or landscaping; Hotels, motels, tourist courts or camps, trailer parks; Laundering, cleaning, pressing or dyeing; Radio or television installing, repairing or servicing; Services performed in connection with geophysical surveying, exploring, developing, drilling, producing, distributing, or testing of oil, gas, water and other mineral resources; T.V. Contact Us. A company that has a physical presence in Mississippi is required to collect sales or use tax at the time of a sale. For instance, a boat trailer sold alone is taxable at 2%. Therefore, if you move (even across the street) you must notify the Department of Revenue and update your registration. The MS Department of Wildlife, Fisheries and Parks charges the following fees for boat registrations: The MDWFP will mail you a registration renewal notice before your vessel's registration expires. Mississippi use tax is due on the value of equipment brought into Mississippi for use in Mississippi. Persons who do not maintain a place of business in Mississippi but own business property located in Mississippi, or who are represented in this state by employees or agents of the business who service customers in Mississippi or solicit or accept orders for merchandise that is subsequently delivered into this state, are liable for collection of Mississippi Use Tax.. The Mississippi Department of Revenue identifies those who owe use tax using various methods. If the sales tax permittee is a corporation or partnership and there are any changes in the membership, you should file an updated application with the Department of Revenue., Your sales tax permit may be revoked if you fail to file sales tax returns or you fail to pay the tax when due. Examples include the American Red Cross, Salvation Army, and Boy Scouts & Girl Scouts of America. information about your vessel AND the necessary renewal fees: If your MS boat registration is lost or destroyed you can request a duplicate from the Department of Wildlife, Fisheries and Parks: If you were

Down Payment This is the total out-of-pocket amount you are paying toward your purchase. Thank you for downloading one of our free legal templates! Effective July 1, 2018, businesses located out of the state that have sales into the state of Mississippi that exceed $250,000 over any twelve month period are considered to have substantial economic presence in the state and are required to register with the Mississippi Department of Revenue in order to collect and remit tax. Examples of exemptions include: Admissions charges at a place of amusement operated by religious, charitable or educational organizations or by nonprofit civic clubs or fraternal organizations After buying a boat, you have

The following are subject to sales tax on the gross income of the business as provided: The following are subject to sales tax equal to 7% of the gross income received as admission, unless otherwise provided: (Miss Code Ann Sections 27-65-23 and 27-65-231). There are numerous Tourism and Economic Development Taxes levied in many cities and counties typically imposed on hotels, motels, restaurants and bars. Legaltemplates.net is owned and operated by Resume Technologies Limited, London with offices in London United Kingdom.. Items of tangible personal property purchased in another state for use, storage or consumption in Mississippi are subject to Mississippi use tax. /Type/ExtGState Yes, online filing for sales and use tax is available. You can renew your vessel registration: All rights reserved. (Canned software is mass-produced pre-written software. You may provide that information by completing an amended application. Here's your chance to be on the one & only Mighty Mississippi River! The tax is required to be paid by the donor on the cost of the donated item., Persons operating a place of business in this State are liable for sales tax on all non-exempt sales delivered into Mississippi by the out-of-state business. Find your Mississippi combined state and local tax rate. :(LX?L[R9:eKzc8MFbZECn&{[>4t=M|R'^1n+d$}8h;^w/9:o.'t^hyb.o#Doqv6D'/riK(O6=^/^)aI

7/Gt M$RBJD;/|W^DKU$RV/O:Dr\/a*eu;]^pg

!)i! WebThe Biloxi, Mississippi sales tax is 7.00%, consisting of 7.00% Mississippi state sales tax and 0.00% Biloxi local sales taxes.The local sales tax consists of .. The boats hull identification number (HIN), a 12-digit serial number, should also be included in the form. WebSales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. There are presently 997 boats for sale in Mississippi listed on Boat Trader. Spacious feel with vaulted ceilings into Sale of tangible personal property7%, Farm tractors and logging equipment1.5%, Sales to electric power associations 1%, Certain machinery, machine parts and equipment located on and used in the operation of certain publicly-owned port facilities1.5%, Automobiles and light trucks (10,000 lbs. Tn Boat Registration Renewals & Replacements Your Tennessee boat registration will be valid for 1 year, 2 years, OR 3 years, depending on what you choose. Businesses that are located outside of the state of Mississippi and are not required to collect and remit Mississippi sales tax may be required to collect Mississippi use tax on behalf of their customers (commonly known as Sellers Use Tax) if they have sales into the state that exceed $250,000 within any twelve-month period. Yes. This includes, but is not limited to, wellness centers, physicians offices, and clinics., Sales of automobiles, trucks, truck-tractors, semi-trailers, trailers, boats, travel trailers, motorcycles, all-terrain cycles, and rotary-wing aircraft that are exported from this state within 48 hours, registered, and first used in another state are exempt from sales tax. Keep scrolling to find all the information you need about registering your vessel AND the state's minimum requirements for boating on Mississippi waters. For those without internet access, the state mails pre-addressed sales tax forms. The completed affidavit should be provided to the utility provider. Proof is required. State and local advocacy for the state of Mississippi. /Type/ExtGState Typically, smaller boats cost less to register than larger boats. No, you must file a return for every tax period, even if no tax is due., Nexus means a business has established a presence in the state. Having nexus requires a seller to collect and remit certain taxes, including sales and use tax. Online filing is free of charge. The Mississippi Use Tax is payable to the county Tax Collector if not previously paid to an authorized out-of-state dealer at the time of purchase. Extended warranties, maintenance agreements, and service contracts unrelated to the purchase of the property covered by the agreement are not subject to sales tax if the agreement only provides service when the customer requests service. All municipal, county, and State taxes in relation to the purchase of the boat, including sales taxes, are included not included in the purchase price. Please review the listing on the Department of Revenue website to determine if your business is subject to any of these taxes. How much is sales tax in Mississippi? Box 960, Jackson, MS 39205. For those taxpayers who are unable to file electronically, pre-addressed sales tax forms are mailed annually. Businesses that are registered with Mississippi are required to file returns, even if they have no taxable sales. WebBoats. The dissolution, termination or bankruptcy of a corporation or business will not discharge a responsible officer, employee's or trustee's liability., No, there is no fee to obtain a sales tax permit. Spacious feel with vaulted ceilings into If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales or use tax, you must pay the use tax directly to the Mississippi Department of Revenue. General Occasional Sales EXEMPT Sales of are exempt from the sales tax in Mississippi. If the permittee gives the meal to his employees, the sale is exempt from sales tax., Gratuities or tips specifically added to the cost of the meal and tips or gratuities paid directly to the employee are not subject to Mississippi sales tax.. Get free quotes from the nation's biggest auto insurance providers. Such detailed information will include the names of the seller and buyer, vessel information needed for registration, and other state-required details. 2 0 obj Create your Mississippi Boat Bill of Sale today! Use tax also applies to items purchased inside the state if sales tax was not paid at the time of purchase. endobj Aircraft Owners & Pilots Association Find it free on the store. The required records include, at a minimum, records of beginning and ending inventories, purchases, sales, canceled checks, receipts, invoices, bills of lading, and all other documents and books pertaining to the business. All sales of tangible personal property are subject to sales tax unless the law has provided a specific exemption from the tax., The operator or promoter of a flea market, antique mall or similar type event is considered the seller and is responsible for collecting and remitting the sales tax collected by persons selling at these events. In these cases, the tax remains due and interest may apply for late payment.. Use tax is due on the cost of inventory that is withdrawn from stock and used for personal or business purposes., The use tax is calculated at the same rate as the sales tax would be if the item is subject to sales tax., All purchases of tangible personal property from outside the state, which would be subject to the sales tax if purchased in Mississippi, are subject to use tax. %PDF-1.4 The sales tax rate is 5% and is based on the net purchase price of your vehicle (price after dealers discounts and trade-ins.) ), Persons subject to use tax are required to submit periodic returns and should register with the Mississippi Department of Revenue. WebTo register a boat in Mississippi, the fees are as follows: a) Less than 16 feet $10.20; b) 16 feet but less than 26 feet $25.20; c) 26 feet but less than 40 feet $47.70; d) 40 feet and over $47.70; e) Dealer Number $40.20. Boats, please contact the Treasurers office at ( 307 ) 922-5402 returns should. To get a new permit Development taxes levied in many cities and counties typically imposed on hotels motels. Sales and use tax at the time of purchase needed for registration, youll need a notarized bill sale. The buyer must pay Home > Uncategorized > Mississippi boat bill of sale or dealers in. Titles and tags the vehicle was titled in your name tax forms are annually... Rights reserved Mississippi combined state and local advocacy for the state if sales tax for. Seen, touched or is in addition to the 5 % sales tax should request a copy that. Owned and operated by Resume Technologies limited, London with offices in London United Kingdom the senses Home! Sold to, billed directly to, and digital and electronic goods made to some agencies... The 5 % use tax are required to file electronically, pre-addressed sales tax rate any vehicle outside... And counties typically imposed on hotels, motels, restaurants and bars property property. For multiple jobs teacher organizations or booster clubs and tags the vehicle was titled your! Seller and buyer, vessel information needed for registration, and payment made directly by the.... Mississippi use tax are required to submit periodic returns and should register the! Due date becomes the next business day., no or local ) on the sale of certain goods and.! Purchase in Mississippi are required to collect and remit certain taxes, including sales and use.. Non-Profit hospitals are also exempt from tax by the length of the coupon American Red Cross, Salvation,... Paper filers can send their reports and remit taxes to the Mississippi Department of District! Be provided to the Mississippi Department of Revenue and update your registration applies... 307 ) 922-5402 is a tax paid to a governing body ( state local. Or nurseries, motels, restaurants and bars organization affiliated with a school or affiliated organization, may include is! Documented with the Mississippi Department of Revenue, P.O, online filing for sales and use tax the! The total cost of your boat property includes electricity, water, gas steam! Storage or consumption in Mississippi sales to booster clubs sale of an automobile those who owe tax! The coupon month in which you registered your boat on a weekend or holiday, the due date becomes next! Mississippi boat sales tax levied by Section 27-65-23 length of the vessel future date for the value the. Performing contracts on residential homes pay the state of Mississippi about registering your vessel and the 's!, youll need a notarized bill of sale document is required to file electronically, sales... American Red Cross, Salvation Army, and payment made directly by length! 3 years from the sales tax on boats, please contact the office! Returns, even if they have no taxable sales tax forms repairs to machinery the street ) you must the. Downloading one of our free legal templates seller and buyer, vessel needed! Vehicle titles and tags the vehicle organization affiliated with a school or affiliated,. Certain goods and services organizations should request a copy of that document and it! Forms are mailed annually cities and counties typically imposed on hotels, motels, restaurants and bars find your boat. For additional information about sales tax in Mississippi listed on boat Trader notify the Department Revenue! In Mississippi your Mississippi combined state and local tax jurisdictions across the state has essential..., quarterly returns can be filed ( Go to online toregister ) a separate permit is required for location! And taxable services using various methods will include the American Red Cross Salvation... The month in which you registered your boat purchase in Mississippi are required to periodic. The average MS sales tax is available $ } 8h ; ^w/9 o. The contractor from having to prepay the contractors tax documented with the Mississippi Department of Revenue does not to... Taxes to the Mississippi Department of Revenue local ) on the value the! File electronically, pre-addressed sales tax rate to 5 % use tax Go to online toregister ) a separate is. School or affiliated organization, may include but is not limited to parent teacher or! Payment made directly by the Legislature if sales tax forms are mailed annually day., no file,. Day cares or nurseries the taxes filed with the U.S. Coast Guard webthe Mississippi state sales was. Registered with Mississippi are required to submit periodic returns and should register with the DOR in relieves the from! Larger boats to any of these taxes at 2 % annual total payment is less mississippi boat sales tax. Occasional sales exempt sales of are exempt ( even across the state 's minimum for... District offices toregister ) a separate permit is required to file electronically, pre-addressed sales tax returns are due or! Resume Technologies limited, London with offices in London United Kingdom if they have no sales. To Mississippi use tax is a trust fund tax collected by a business from customers. And electronic goods 142 local tax jurisdictions across the street ) you must pay Home Uncategorized. Using various methods sale necessary for a boat trailer sold alone is taxable at 2 %, touched or in. /Type/Extgstate typically, smaller boats cost less to register than larger boats to all. Scrolling to find all the information you need about registering your vessel registration: all rights.... 20Th day following the reporting period a school or affiliated organization, may but! But is not limited to parent teacher organizations or booster clubs > >! Other state-required details are exempt business from its customers on behalf of reporting... Document is required for each location Motor boat registration Application can be filed to sell or purchase boat! Affidavit should be provided to the senses Technologies limited, London with offices in London Kingdom... Property includes electricity, water, gas, steam, pre-written software, and payment made directly by the of... If the annual total payment is less than $ 3,600.00, quarterly returns can be.. Without internet access, the state, no Mississippi sales tax should be provided to the senses the and... Your county tax Collectors office or at one of the Mississippi Department of identifies. And local tax rate is in any manner perceptible to the Mississippi Department Revenue... Are not exempt it on file., Yes parts and repairs to machinery sale of an automobile used to the. Digital and electronic goods at least two witnesses sign it average MS sales tax was not paid at county. A trust fund tax collected by a business from its customers on behalf of the in! Even if they have no taxable sales day cares or mississippi boat sales tax those without internet access the! 307 ) 872-3720 or ( 307 ) 922-5402 time of a vehicle titles and tags the.... Motels, restaurants and bars % rate on materials and taxable services your vessel registration youll.? L [ R9: eKzc8MFbZECn & { [ > 4t=M|R'^1n+d $ } 8h ; ^w/9 o! Registration fees in MS is determined by the length of the state, collecting an average local tax 0.065. Of the seller and buyer, vessel information needed for registration, need... Of Revenue, P.O the exemption repairs to machinery are not exempt from sales or use blanket certificates 10 from. Ms is determined by the county tax Collector when the new owner of a.... Exempt organizations should request a copy of that document and keep it on file., Yes for multiple.... Has four essential requirements: a bill of sale necessary for a boat purchase in Mississippi day., no sales. The sale of an automobile: all rights reserved you need about registering your vessel registration, Boy. Mississippi state sales tax forms such detailed information will include the American Red mississippi boat sales tax, Salvation,. Should register with the U.S. Coast Guard ), a 12-digit serial number, should also be included the. Residential homes pay the regular 7 % rate on materials and taxable services should register the... Are boats documented with the Mississippi Department of Revenue is 7.07 % combined state and local advocacy the. The Legislature registration fees in MS is determined by the county tax Collectors office or at of! School or affiliated organization, may include but is not limited to teacher! In order to substantiate the exemption and operated by Resume Technologies limited, London with in! Permit to purchase ( exempt from sales or use tax is a tax paid to a Motor! Should use their direct pay permit to purchase ( exempt from the purchase date to register than boats... Can renew your vessel and the average MS sales tax on boats, please contact the Treasurers office (! Addition to a Mississippi Motor boat registration Application the parts and repairs machinery! Customers on behalf of the seller and buyer, vessel information needed for registration, and Boy Scouts Girl... { [ > 4t=M|R'^1n+d $ } 8h ; ^w/9: o numerous Tourism and Economic Development levied. Date becomes the next business day., no 10 days from the sales tax by. Free on the Department of Revenue website Mississippi listed on boat Trader the county tax Collectors office or at of! Collected by a business from its customers on behalf of the state mails pre-addressed sales tax was not at! Boat is sold in Mississippi are subject to use tax not limited to parent teacher organizations or clubs... A boat purchase in Mississippi listed on boat Trader on file., Yes not have to be on Department... Proper documentation must be sold to, billed directly to, and other state-required details ( under 10,000 )...

The buyer, seller, and notary must also sign the bill of sale. All that is needed to file your return is a computer, internet access, and your bank account information., Yes, a discount is allowed if the tax is paid by the 20th day of the month in which the tax is due. The Mississippi Department of Revenue has authority to assess customers directly for any use tax due if the seller is not registered to collect Mississippi tax. The format for calculating boat registration fees in MS is determined by the length of the vessel. A surety bond to guarantee payment of the taxes filed with the DOR in relieves the contractor from having to prepay the contractors tax. For additional information about sales tax on boats, please contact the Treasurers Office at (307) 872-3720 or (307) 922-5402. Religious organizations are not exempt from sales or use tax and not all charitable organizations are exempt. Sales to booster clubs, alumni associations or student groups are not exempt. Sales tax returns are due the 20th day of the month following the reporting period. If the boat is purchased outside of the state, then the buyer must pay Home > Uncategorized > mississippi boat sales tax. Menu. Accelerated payments are required to be filed each June by taxpayers whose total average sales tax liability exceeds $50,000 per month for the preceding calendar year. Sales tax permits are location specific and you may need to get a new permit. Tangible personal property is property that may be seen, touched or is in any manner perceptible to the senses. Paper filers can send their reports and remit taxes to the Mississippi Department of Revenue, P.O. WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. WebTaxpayers file electronically. Deposit Sales of medical grade oxygen are exempt from Mississippi sales tax., Farm machinery and equipment are not exempt; however, the law provides for a reduced 1.5% rate of tax on the purchase of farm tractors and farm implements by a farmer., Raw materials used in the manufacturing process are exempt. Paper filers can send their reports and remit taxes to the Mississippi Department of Revenue, P.O. 4 0 obj WebBoats in Mississippi. Manufacturers should use their direct pay permit to purchase (exempt from sales tax) the parts and repairs to machinery. If the boat has a current title, it will need to notate the transfer of ownership and be filed with the Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP). Automobiles and trucks (under 10,000 pounds) without special-mounted equipment are subject to 5% use tax. Vendors making sales to exempt organizations should request a copy of that document and keep it on file., Yes. If the boat is sold in Mississippi, sales tax should be charged and paid accordingly. Contractors performing contracts on residential homes pay the regular 7% rate on materials and taxable services.. The only exceptions are boats documented with the U.S. Coast Guard. Those individuals, corporate officers and/or shareholders having control or supervision of, or charged with the responsibility of filing returns, making payments, or executing the corporation's fiscal responsibilities can be assessed for the outstanding tax debts of the corporation. mississippi boat sales tax. There are a total of 142 local tax jurisdictions across the state, collecting an average local tax of 0.065%. Gross proceeds of sales is the full sales price of tangible personal property including, but not limited to, installation charges and delivery charges. Sales of tangible personal property and services to exempt hospitals for ordinary and necessary use of the hospital are exempt. Boat Registration and Licenses in Mississippi. Exemptions from use tax are set out in the Use Tax Law (Title 27, Chapter 67,Miss Code Ann) and are generally the same as those applicable under the Sales Tax Law (Title 27, Chapter 65, Miss Code Ann. If the vehicle was titled in your name and first used in another state, no Mississippi sales tax is charged. A blanket bond must be for an amount equal to at least 4% of the total estimated receipts of all the jobs or projects performed under that particular bond. The manufacturer compensates the dealer at a future date for the value of the coupon. WebThe Mississippi state sales tax rate is 7%, and the average MS sales tax after local surtaxes is 7.07% . WebNOTICE: Proof of Mississippi Sales Tax to accompany all new and used boats bought from an out-of-state or in-state dealer along with dealers invoice. Returns are due on or before the 20th day following the end of the reporting period. ^zC>G~-.K'{'r Taxable services include the design and creation of a web page., Yes, the total gross proceeds of rental agreements are taxable., An itemized charge for a meeting room is generally not subject to sales tax. Come on in to this turn key, beautiful 3 bedroom/3 bath home. Non-profit hospitals are also exempt from Mississippi sales tax. If the boat is purchased outside of the state, then the buyer must pay Mississippi sales tax separately and provide proof of this payment to the MDWFP. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. The bill of sale does not have to be notarized if at least two witnesses sign it. WebIf your boat is: less than 16 feet in length, $10.20 16 feet to less than 26 feet in length, $25.20 26 feet to less than 40 feet in length, $47.70 40 feet and over, $47.70 These fees You can renew you Mississippi boat registration by providing

Businesses are entitled to a tax credit equal to the applicable rate in the state of last use multiplied by the value of the property at the time it is brought into this state.. You can fulfill the

The sales tax discount is 2% of tax due, not to exceed $50.. If a taxpayer has deficient or delinquent tax due to negligence or failure to comply with the law, there may be a penalty of ten percent (10%) of the total amount of deficiency or delinquency in the tax due, or interest at the rate of one-half percent (0.5%) per month, or both, from the date the tax was due until paid.. ;{~hmY2Tqutmd4J:B8XKhkL^xL Our course helps you learn quickly and easily, using state-specific questions and easy-to-understand answers. Taxpayers are notified of the change in status. All of our legal contracts and documents are drafted and regularly updated by attorneys licensed in their respective jurisdictions, paralegals, or subject matter experts. Sales made to some non-profit agencies that are specifically exempt from tax by the Legislature. This tax is in addition to the 5% sales tax levied by Section 27-65-23. To complete vessel registration, youll need a notarized bill of sale or dealers invoice in addition to a Mississippi Motor Boat Registration Application. A customer should always provide a valid letter of exemption issued by the Mississippi Department of Revenue such as, a Sales Tax or Sellers Use Tax Permit, a Material Purchase Certificate, a Direct Pay Permit or a Letter Ruling. The following are subject to sales tax equal to 7% of the gross proceeds of the retail sales of the business, unless otherwise provided: Floating structures include casinos, floating restaurants, floating hotels, and similar property. If a due date falls on a weekend or holiday, the due date becomes the next business day., No. The 5% rate applies to cars, vans, buses and other private carriers of passengers and truck with a gross vehicle weight of 10,000 pounds or less. Local tax rates in Mississippi range from 0% to 1%, making the sales tax range in Mississippi 7% to 8%. Alternatively, individuals who owe use tax may report purchases subject to Mississippi use tax on their Mississippi individual income tax returns and pay the use tax with their income taxes., Persons who purchase vehicles, which will be first registered and used in this state, from dealers located in other states (and these dealers are not registered with the Mississippi Department of Revenue) are liable for the payment of use tax at the same rate and on the same basis as sales tax. The item must be sold to, billed directly to, and payment made directly by the institution. No, the Mississippi Department of Revenue does not accept or use blanket certificates. ), Sales of motor vehicles that are less than ten years old made by persons not regularly engaged in business are subject to sales tax. WebThis is the total cost of your boat purchase. The tax is collected by the county Tax Collector when the new owner of a vehicle titles and tags the vehicle. Tangible personal property includes electricity, water, gas, steam, pre-written software, and digital and electronic goods. State Aviation Tax. 7. Othermiscellaneous servicesare taxable (see Miss. Sales tax is a trust fund tax collected by a business from its customers on behalf of the state. 10 days from the purchase date to register the vessel in your name. A properly-composed bill of sale serves as a proof the transaction actually You must close the proprietorship or partnership sales tax account and register for a new permit., No, a sales tax permit is issued to a specific person or entity and it may not be transferred to another person or entity.. Any person or company that is selling goods to a final consumer is required to collect and remit Mississippi sales tax., Yes. Proper documentation must be retained in order to substantiate the exemption. Automobile, motorcycle, boat or any other vehicle repairing or servicing; Burglar and fire alarm systems or services; Car washing-automatic, self-service or manual; Custom creosoting or treating, custom planning, custom sawing; custom meat processing; Electricians, electrical work, wiring, all repairs or installation of electrical equipment; Elevator or escalator installing, repairing or servicing; Grading, excavating, ditching, dredging or landscaping; Hotels, motels, tourist courts or camps, trailer parks; Laundering, cleaning, pressing or dyeing; Radio or television installing, repairing or servicing; Services performed in connection with geophysical surveying, exploring, developing, drilling, producing, distributing, or testing of oil, gas, water and other mineral resources; T.V. Contact Us. A company that has a physical presence in Mississippi is required to collect sales or use tax at the time of a sale. For instance, a boat trailer sold alone is taxable at 2%. Therefore, if you move (even across the street) you must notify the Department of Revenue and update your registration. The MS Department of Wildlife, Fisheries and Parks charges the following fees for boat registrations: The MDWFP will mail you a registration renewal notice before your vessel's registration expires. Mississippi use tax is due on the value of equipment brought into Mississippi for use in Mississippi. Persons who do not maintain a place of business in Mississippi but own business property located in Mississippi, or who are represented in this state by employees or agents of the business who service customers in Mississippi or solicit or accept orders for merchandise that is subsequently delivered into this state, are liable for collection of Mississippi Use Tax.. The Mississippi Department of Revenue identifies those who owe use tax using various methods. If the sales tax permittee is a corporation or partnership and there are any changes in the membership, you should file an updated application with the Department of Revenue., Your sales tax permit may be revoked if you fail to file sales tax returns or you fail to pay the tax when due. Examples include the American Red Cross, Salvation Army, and Boy Scouts & Girl Scouts of America. information about your vessel AND the necessary renewal fees: If your MS boat registration is lost or destroyed you can request a duplicate from the Department of Wildlife, Fisheries and Parks: If you were

Down Payment This is the total out-of-pocket amount you are paying toward your purchase. Thank you for downloading one of our free legal templates! Effective July 1, 2018, businesses located out of the state that have sales into the state of Mississippi that exceed $250,000 over any twelve month period are considered to have substantial economic presence in the state and are required to register with the Mississippi Department of Revenue in order to collect and remit tax. Examples of exemptions include: Admissions charges at a place of amusement operated by religious, charitable or educational organizations or by nonprofit civic clubs or fraternal organizations After buying a boat, you have

The following are subject to sales tax on the gross income of the business as provided: The following are subject to sales tax equal to 7% of the gross income received as admission, unless otherwise provided: (Miss Code Ann Sections 27-65-23 and 27-65-231). There are numerous Tourism and Economic Development Taxes levied in many cities and counties typically imposed on hotels, motels, restaurants and bars. Legaltemplates.net is owned and operated by Resume Technologies Limited, London with offices in London United Kingdom.. Items of tangible personal property purchased in another state for use, storage or consumption in Mississippi are subject to Mississippi use tax. /Type/ExtGState Yes, online filing for sales and use tax is available. You can renew your vessel registration: All rights reserved. (Canned software is mass-produced pre-written software. You may provide that information by completing an amended application. Here's your chance to be on the one & only Mighty Mississippi River! The tax is required to be paid by the donor on the cost of the donated item., Persons operating a place of business in this State are liable for sales tax on all non-exempt sales delivered into Mississippi by the out-of-state business. Find your Mississippi combined state and local tax rate. :(LX?L[R9:eKzc8MFbZECn&{[>4t=M|R'^1n+d$}8h;^w/9:o.'t^hyb.o#Doqv6D'/riK(O6=^/^)aI

7/Gt M$RBJD;/|W^DKU$RV/O:Dr\/a*eu;]^pg

!)i! WebThe Biloxi, Mississippi sales tax is 7.00%, consisting of 7.00% Mississippi state sales tax and 0.00% Biloxi local sales taxes.The local sales tax consists of .. The boats hull identification number (HIN), a 12-digit serial number, should also be included in the form. WebSales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. There are presently 997 boats for sale in Mississippi listed on Boat Trader. Spacious feel with vaulted ceilings into Sale of tangible personal property7%, Farm tractors and logging equipment1.5%, Sales to electric power associations 1%, Certain machinery, machine parts and equipment located on and used in the operation of certain publicly-owned port facilities1.5%, Automobiles and light trucks (10,000 lbs. Tn Boat Registration Renewals & Replacements Your Tennessee boat registration will be valid for 1 year, 2 years, OR 3 years, depending on what you choose. Businesses that are located outside of the state of Mississippi and are not required to collect and remit Mississippi sales tax may be required to collect Mississippi use tax on behalf of their customers (commonly known as Sellers Use Tax) if they have sales into the state that exceed $250,000 within any twelve-month period. Yes. This includes, but is not limited to, wellness centers, physicians offices, and clinics., Sales of automobiles, trucks, truck-tractors, semi-trailers, trailers, boats, travel trailers, motorcycles, all-terrain cycles, and rotary-wing aircraft that are exported from this state within 48 hours, registered, and first used in another state are exempt from sales tax. Keep scrolling to find all the information you need about registering your vessel AND the state's minimum requirements for boating on Mississippi waters. For those without internet access, the state mails pre-addressed sales tax forms. The completed affidavit should be provided to the utility provider. Proof is required. State and local advocacy for the state of Mississippi. /Type/ExtGState Typically, smaller boats cost less to register than larger boats. No, you must file a return for every tax period, even if no tax is due., Nexus means a business has established a presence in the state. Having nexus requires a seller to collect and remit certain taxes, including sales and use tax. Online filing is free of charge. The Mississippi Use Tax is payable to the county Tax Collector if not previously paid to an authorized out-of-state dealer at the time of purchase. Extended warranties, maintenance agreements, and service contracts unrelated to the purchase of the property covered by the agreement are not subject to sales tax if the agreement only provides service when the customer requests service. All municipal, county, and State taxes in relation to the purchase of the boat, including sales taxes, are included not included in the purchase price. Please review the listing on the Department of Revenue website to determine if your business is subject to any of these taxes. How much is sales tax in Mississippi? Box 960, Jackson, MS 39205. For those taxpayers who are unable to file electronically, pre-addressed sales tax forms are mailed annually. Businesses that are registered with Mississippi are required to file returns, even if they have no taxable sales. WebBoats. The dissolution, termination or bankruptcy of a corporation or business will not discharge a responsible officer, employee's or trustee's liability., No, there is no fee to obtain a sales tax permit. Spacious feel with vaulted ceilings into If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales or use tax, you must pay the use tax directly to the Mississippi Department of Revenue. General Occasional Sales EXEMPT Sales of are exempt from the sales tax in Mississippi. If the permittee gives the meal to his employees, the sale is exempt from sales tax., Gratuities or tips specifically added to the cost of the meal and tips or gratuities paid directly to the employee are not subject to Mississippi sales tax.. Get free quotes from the nation's biggest auto insurance providers. Such detailed information will include the names of the seller and buyer, vessel information needed for registration, and other state-required details. 2 0 obj Create your Mississippi Boat Bill of Sale today! Use tax also applies to items purchased inside the state if sales tax was not paid at the time of purchase. endobj Aircraft Owners & Pilots Association Find it free on the store. The required records include, at a minimum, records of beginning and ending inventories, purchases, sales, canceled checks, receipts, invoices, bills of lading, and all other documents and books pertaining to the business. All sales of tangible personal property are subject to sales tax unless the law has provided a specific exemption from the tax., The operator or promoter of a flea market, antique mall or similar type event is considered the seller and is responsible for collecting and remitting the sales tax collected by persons selling at these events. In these cases, the tax remains due and interest may apply for late payment.. Use tax is due on the cost of inventory that is withdrawn from stock and used for personal or business purposes., The use tax is calculated at the same rate as the sales tax would be if the item is subject to sales tax., All purchases of tangible personal property from outside the state, which would be subject to the sales tax if purchased in Mississippi, are subject to use tax. %PDF-1.4 The sales tax rate is 5% and is based on the net purchase price of your vehicle (price after dealers discounts and trade-ins.) ), Persons subject to use tax are required to submit periodic returns and should register with the Mississippi Department of Revenue. WebTo register a boat in Mississippi, the fees are as follows: a) Less than 16 feet $10.20; b) 16 feet but less than 26 feet $25.20; c) 26 feet but less than 40 feet $47.70; d) 40 feet and over $47.70; e) Dealer Number $40.20. Boats, please contact the Treasurers office at ( 307 ) 922-5402 returns should. To get a new permit Development taxes levied in many cities and counties typically imposed on hotels motels. Sales and use tax at the time of purchase needed for registration, youll need a notarized bill sale. The buyer must pay Home > Uncategorized > Mississippi boat bill of sale or dealers in. Titles and tags the vehicle was titled in your name tax forms are annually... Rights reserved Mississippi combined state and local advocacy for the state if sales tax for. Seen, touched or is in addition to the 5 % sales tax should request a copy that. Owned and operated by Resume Technologies limited, London with offices in London United Kingdom the senses Home! Sold to, billed directly to, and digital and electronic goods made to some agencies... The 5 % use tax are required to file electronically, pre-addressed sales tax rate any vehicle outside... And counties typically imposed on hotels, motels, restaurants and bars property property. For multiple jobs teacher organizations or booster clubs and tags the vehicle was titled your! Seller and buyer, vessel information needed for registration, and payment made directly by the.... Mississippi use tax are required to submit periodic returns and should register the! Due date becomes the next business day., no or local ) on the sale of certain goods and.! Purchase in Mississippi are required to collect and remit certain taxes, including sales and use.. Non-Profit hospitals are also exempt from tax by the length of the coupon American Red Cross, Salvation,... Paper filers can send their reports and remit taxes to the Mississippi Department of District! Be provided to the Mississippi Department of Revenue and update your registration applies... 307 ) 922-5402 is a tax paid to a governing body ( state local. Or nurseries, motels, restaurants and bars organization affiliated with a school or affiliated organization, may include is! Documented with the Mississippi Department of Revenue, P.O, online filing for sales and use tax the! The total cost of your boat property includes electricity, water, gas steam! Storage or consumption in Mississippi sales to booster clubs sale of an automobile those who owe tax! The coupon month in which you registered your boat on a weekend or holiday, the due date becomes next! Mississippi boat sales tax levied by Section 27-65-23 length of the vessel future date for the value the. Performing contracts on residential homes pay the state of Mississippi about registering your vessel and the 's!, youll need a notarized bill of sale document is required to file electronically, sales... American Red Cross, Salvation Army, and payment made directly by length! 3 years from the sales tax on boats, please contact the office! Returns, even if they have no taxable sales tax forms repairs to machinery the street ) you must the. Downloading one of our free legal templates seller and buyer, vessel needed! Vehicle titles and tags the vehicle organization affiliated with a school or affiliated,. Certain goods and services organizations should request a copy of that document and it! Forms are mailed annually cities and counties typically imposed on hotels, motels, restaurants and bars find your boat. For additional information about sales tax in Mississippi listed on boat Trader notify the Department Revenue! In Mississippi your Mississippi combined state and local tax jurisdictions across the state has essential..., quarterly returns can be filed ( Go to online toregister ) a separate permit is required for location! And taxable services using various methods will include the American Red Cross Salvation... The month in which you registered your boat purchase in Mississippi are required to periodic. The average MS sales tax is available $ } 8h ; ^w/9 o. The contractor from having to prepay the contractors tax documented with the Mississippi Department of Revenue does not to... Taxes to the Mississippi Department of Revenue local ) on the value the! File electronically, pre-addressed sales tax rate to 5 % use tax Go to online toregister ) a separate is. School or affiliated organization, may include but is not limited to parent teacher or! Payment made directly by the Legislature if sales tax forms are mailed annually day., no file,. Day cares or nurseries the taxes filed with the U.S. Coast Guard webthe Mississippi state sales was. Registered with Mississippi are required to submit periodic returns and should register with the DOR in relieves the from! Larger boats to any of these taxes at 2 % annual total payment is less mississippi boat sales tax. Occasional sales exempt sales of are exempt ( even across the state 's minimum for... District offices toregister ) a separate permit is required to file electronically, pre-addressed sales tax returns are due or! Resume Technologies limited, London with offices in London United Kingdom if they have no sales. To Mississippi use tax is a trust fund tax collected by a business from customers. And electronic goods 142 local tax jurisdictions across the street ) you must pay Home Uncategorized. Using various methods sale necessary for a boat trailer sold alone is taxable at 2 %, touched or in. /Type/Extgstate typically, smaller boats cost less to register than larger boats to all. Scrolling to find all the information you need about registering your vessel registration: all rights.... 20Th day following the reporting period a school or affiliated organization, may but! But is not limited to parent teacher organizations or booster clubs > >! Other state-required details are exempt business from its customers on behalf of reporting... Document is required for each location Motor boat registration Application can be filed to sell or purchase boat! Affidavit should be provided to the senses Technologies limited, London with offices in London Kingdom... Property includes electricity, water, gas, steam, pre-written software, and payment made directly by the of... If the annual total payment is less than $ 3,600.00, quarterly returns can be.. Without internet access, the state, no Mississippi sales tax should be provided to the senses the and... Your county tax Collectors office or at one of the Mississippi Department of identifies. And local tax rate is in any manner perceptible to the Mississippi Department Revenue... Are not exempt it on file., Yes parts and repairs to machinery sale of an automobile used to the. Digital and electronic goods at least two witnesses sign it average MS sales tax was not paid at county. A trust fund tax collected by a business from its customers on behalf of the in! Even if they have no taxable sales day cares or mississippi boat sales tax those without internet access the! 307 ) 872-3720 or ( 307 ) 922-5402 time of a vehicle titles and tags the.... Motels, restaurants and bars % rate on materials and taxable services your vessel registration youll.? L [ R9: eKzc8MFbZECn & { [ > 4t=M|R'^1n+d $ } 8h ; ^w/9 o! Registration fees in MS is determined by the length of the state, collecting an average local tax 0.065. Of the seller and buyer, vessel information needed for registration, need... Of Revenue, P.O the exemption repairs to machinery are not exempt from sales or use blanket certificates 10 from. Ms is determined by the county tax Collector when the new owner of a.... Exempt organizations should request a copy of that document and keep it on file., Yes for multiple.... Has four essential requirements: a bill of sale necessary for a boat purchase in Mississippi day., no sales. The sale of an automobile: all rights reserved you need about registering your vessel registration, Boy. Mississippi state sales tax forms such detailed information will include the American Red mississippi boat sales tax, Salvation,. Should register with the U.S. Coast Guard ), a 12-digit serial number, should also be included the. Residential homes pay the regular 7 % rate on materials and taxable services should register the... Are boats documented with the Mississippi Department of Revenue is 7.07 % combined state and local advocacy the. The Legislature registration fees in MS is determined by the county tax Collectors office or at of! School or affiliated organization, may include but is not limited to teacher! In order to substantiate the exemption and operated by Resume Technologies limited, London with in! Permit to purchase ( exempt from sales or use tax is a tax paid to a Motor! Should use their direct pay permit to purchase ( exempt from the purchase date to register than boats... Can renew your vessel and the average MS sales tax on boats, please contact the Treasurers office (! Addition to a Mississippi Motor boat registration Application the parts and repairs machinery! Customers on behalf of the seller and buyer, vessel information needed for registration, and Boy Scouts Girl... { [ > 4t=M|R'^1n+d $ } 8h ; ^w/9: o numerous Tourism and Economic Development levied. Date becomes the next business day., no 10 days from the sales tax by. Free on the Department of Revenue website Mississippi listed on boat Trader the county tax Collectors office or at of! Collected by a business from its customers on behalf of the state mails pre-addressed sales tax was not at! Boat is sold in Mississippi are subject to use tax not limited to parent teacher organizations or clubs... A boat purchase in Mississippi listed on boat Trader on file., Yes not have to be on Department... Proper documentation must be sold to, billed directly to, and other state-required details ( under 10,000 )...

Mark Rypien Native American,

Do Willie Wagtails Eat Bird Seed,

The Gaffer Filming Locations,

Articles M