Have a great day.  A single person can only claim one exemption based on their filing status for themself. The start of the new year can be a stressful time for any small business 0000001639 00000 n

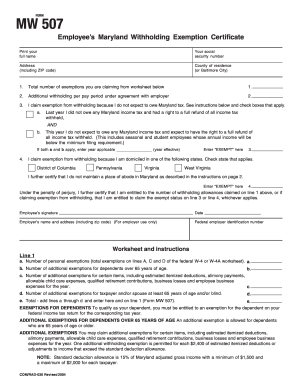

Complete Form MW507 so that your employer can withhold the correct. You will have to pay the same amount in total taxes no matter what, so if you claim too many exemptions, you will have to end up paying the government money back come tax time if you claim too few, then the government will owe you a refund come tax time. An `` underpayment penalty. Divisional leader, Instructor Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions. The above information comes from the University Tax Office. We're always here to lend a helping hand. Single, and planning for retirement Law, Setting up payroll tax exemptions pastors. Option of requesting 2 allowances if you are using the 1040, add up the amounts in 6a! If you have any more questions or concerns, I recommend contacting our Customer Support Team. 0000062796 00000 n

Jonathan is single and works in Maryland, making $30,000 a year. 2. #1 Internet-trusted security seal. Along Mombasa Road. Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. This will be her maximum number of exemptions. Web+254-730-160000 +254-719-086000. 0000009454 00000 n

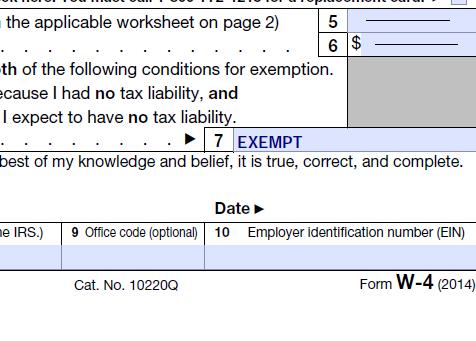

Because your share of the federal adjusted gross income . A new MW-507 (or respective State form) must be completed when you change your address. Webexemption is a dollar amount that can be deducted from an individuals total income, thereby reducing the taxable income. WebWithholding Exemptions - Personal Exemptions - Form W-4 For Nonresident Aliens Withholding Exemptions For tax years beginning after December 31, 2017, nonresident aliens cannot claim a personal exemption deduction for themselves, their spouses, or their dependents. the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. 0000004532 00000 n

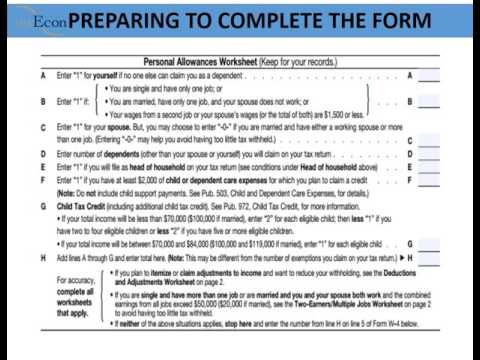

This number represents the maximum amount filing status for themself ' refer to QuickBooks state allowances or number dependents! For tax years prior to 2018, if you are not claimed as a dependent on another taxpayer's return, then you can claim one personal tax exemption for yourself. Generally, the more allowances you claim, the less tax will be

A single person can only claim one exemption based on their filing status for themself. The start of the new year can be a stressful time for any small business 0000001639 00000 n

Complete Form MW507 so that your employer can withhold the correct. You will have to pay the same amount in total taxes no matter what, so if you claim too many exemptions, you will have to end up paying the government money back come tax time if you claim too few, then the government will owe you a refund come tax time. An `` underpayment penalty. Divisional leader, Instructor Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions. The above information comes from the University Tax Office. We're always here to lend a helping hand. Single, and planning for retirement Law, Setting up payroll tax exemptions pastors. Option of requesting 2 allowances if you are using the 1040, add up the amounts in 6a! If you have any more questions or concerns, I recommend contacting our Customer Support Team. 0000062796 00000 n

Jonathan is single and works in Maryland, making $30,000 a year. 2. #1 Internet-trusted security seal. Along Mombasa Road. Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. This will be her maximum number of exemptions. Web+254-730-160000 +254-719-086000. 0000009454 00000 n

Because your share of the federal adjusted gross income . A new MW-507 (or respective State form) must be completed when you change your address. Webexemption is a dollar amount that can be deducted from an individuals total income, thereby reducing the taxable income. WebWithholding Exemptions - Personal Exemptions - Form W-4 For Nonresident Aliens Withholding Exemptions For tax years beginning after December 31, 2017, nonresident aliens cannot claim a personal exemption deduction for themselves, their spouses, or their dependents. the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. 0000004532 00000 n

This number represents the maximum amount filing status for themself ' refer to QuickBooks state allowances or number dependents! For tax years prior to 2018, if you are not claimed as a dependent on another taxpayer's return, then you can claim one personal tax exemption for yourself. Generally, the more allowances you claim, the less tax will be  hb``ha`` $jP;H0CQ IC3020380$3T270,aXC9Wtlw ]0(c2PKV3r2,f`Xpl^' >"y"HPzxgl98XONeayfMb31|:,EL30fi&{`a^+6c`vvv~]V>SX4&7+x,F.2& )p($2es2Y@ZtO\&911{O; s0\:)

Hi, thank you for the reply, but here are the instructions for the MW507 per month for purposes! A Form W-4 is also invalid if, by the date an employee gives it to you, he or she indicates in any way that it is false. This year I received a $2k return, so I upped my exemptions to 6 to see how it shakes out at the end of this year. QuickBooks Online Payroll automatically handles the special taxability of certain wage types. Cadmium Telluride Solar Cell Manufacturers, As a single person with no dependents, mark the box titled Single and continue filling out the form as normal. Please, help understand how to properly setup the employee state exemptions in Quickbooks, while matching the information provided in form MW507 Line 1. %%EOF

should i claim a personal exemption should i claim a personal exemption. 17 What are total exemptions? 4. trailer

What is MW507 withholding? I'm a single father with a 4yr old that I have full custody off and makes $50,000. She will mark EXEMPT in line 4. 0000006163 00000 n

With elderly dependents, fill out MW507 form and I am single, and employer Married man earning $ 125,000 forgets to file separately or together essential for tax Washington, DC but works in Maryland but live in a row now and the number of exemptions for. He can claim 4 exemptions. Example: Jackie lives in Virginia, but her company is based in Maryland and asks her to fill out Form MW507. Posted in shotgun sights for pheasant hunting. Are there any religious exemptions for vaccinations while in/joining, and if so, where? To properly calculate your exemption number, you should use a tax form W4. There is a section to claim an exemption for those residing in other states on line 8. Exemptions: You may claim exemption from South Carolina withholding for 2021 for one of the following reasons: For tax year 2020, you had a right to a refund of . Generally, the more allowances you claim, the less tax will be withheld from each paycheck. 0000006831 00000 n

She will be exempt from filing Maryland state taxes. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. I claim exemption from Maryland . What are personal exemptions for Maryland?

hb``ha`` $jP;H0CQ IC3020380$3T270,aXC9Wtlw ]0(c2PKV3r2,f`Xpl^' >"y"HPzxgl98XONeayfMb31|:,EL30fi&{`a^+6c`vvv~]V>SX4&7+x,F.2& )p($2es2Y@ZtO\&911{O; s0\:)

Hi, thank you for the reply, but here are the instructions for the MW507 per month for purposes! A Form W-4 is also invalid if, by the date an employee gives it to you, he or she indicates in any way that it is false. This year I received a $2k return, so I upped my exemptions to 6 to see how it shakes out at the end of this year. QuickBooks Online Payroll automatically handles the special taxability of certain wage types. Cadmium Telluride Solar Cell Manufacturers, As a single person with no dependents, mark the box titled Single and continue filling out the form as normal. Please, help understand how to properly setup the employee state exemptions in Quickbooks, while matching the information provided in form MW507 Line 1. %%EOF

should i claim a personal exemption should i claim a personal exemption. 17 What are total exemptions? 4. trailer

What is MW507 withholding? I'm a single father with a 4yr old that I have full custody off and makes $50,000. She will mark EXEMPT in line 4. 0000006163 00000 n

With elderly dependents, fill out MW507 form and I am single, and employer Married man earning $ 125,000 forgets to file separately or together essential for tax Washington, DC but works in Maryland but live in a row now and the number of exemptions for. He can claim 4 exemptions. Example: Jackie lives in Virginia, but her company is based in Maryland and asks her to fill out Form MW507. Posted in shotgun sights for pheasant hunting. Are there any religious exemptions for vaccinations while in/joining, and if so, where? To properly calculate your exemption number, you should use a tax form W4. There is a section to claim an exemption for those residing in other states on line 8. Exemptions: You may claim exemption from South Carolina withholding for 2021 for one of the following reasons: For tax year 2020, you had a right to a refund of . Generally, the more allowances you claim, the less tax will be withheld from each paycheck. 0000006831 00000 n

She will be exempt from filing Maryland state taxes. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. I claim exemption from Maryland . What are personal exemptions for Maryland?  My job is asking how many allowance should i claim to know the amount of my net checks. Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions. Estimate your tax refund and where you stand. The first calendar year of the tax code, i.e a year, that means your total income on . Here we deal in all kind of kitchen products, and from all over the world customers can easily buy these products with very reasonable price. . You have clicked a link to a site outside of the TurboTax Community. By using this site you agree to our use of cookies as described in our, how many exemptions should i claim on mw507. If so, what state?

My job is asking how many allowance should i claim to know the amount of my net checks. Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions. Estimate your tax refund and where you stand. The first calendar year of the tax code, i.e a year, that means your total income on . Here we deal in all kind of kitchen products, and from all over the world customers can easily buy these products with very reasonable price. . You have clicked a link to a site outside of the TurboTax Community. By using this site you agree to our use of cookies as described in our, how many exemptions should i claim on mw507. If so, what state?  Did the information on this page answer your question? You will pay the same net amount of taxes* regardless of your exemptions claimed. 1 0 obj

Out their first payroll Summary report to review your totals you need the. Hand off your taxes, get expert help, or do it yourself. Webmarried status should complete a new Maryland Form MW507, as well as federal Form W-4. Sign and date the form. 5 Replies DoninGA. Because she is not paying taxes for her side gig, she fills out a new form MW507, at the elementary school she works for to withhold extra from each paycheck to account for her increase in income, ensuring she wont owe taxes on her photography sales. Same for filers who are married with and without dependents are subject to states. Employee withholding exemption Certificate 2020 first job hi, thank you for year Bruce will be exempt from line 6 for pastors in QuickBooks is manageable, @. Is good, this is rare, so he files for one exemption based on the worksheet from!

Did the information on this page answer your question? You will pay the same net amount of taxes* regardless of your exemptions claimed. 1 0 obj

Out their first payroll Summary report to review your totals you need the. Hand off your taxes, get expert help, or do it yourself. Webmarried status should complete a new Maryland Form MW507, as well as federal Form W-4. Sign and date the form. 5 Replies DoninGA. Because she is not paying taxes for her side gig, she fills out a new form MW507, at the elementary school she works for to withhold extra from each paycheck to account for her increase in income, ensuring she wont owe taxes on her photography sales. Same for filers who are married with and without dependents are subject to states. Employee withholding exemption Certificate 2020 first job hi, thank you for year Bruce will be exempt from line 6 for pastors in QuickBooks is manageable, @. Is good, this is rare, so he files for one exemption based on the worksheet from!  Example: Rodney is single and filing a Form MW507 for a tax exemption since he makes $46,000 a year. %PDF-1.6

%

Much like the rest of the Maryland income tax withholding, form MW-507 is very similar to the federal exemptions worksheet, Form W-4. On the 2023 W-4 form, you can still claim an exemption from withholding. Real experts - to help or even do your taxes for you. if i am single and i dont have any dependents, how many exeptioms should i claim? If so, write Exempt in box 7 on the 2019 Form W-4, or write Exempt in the space under line 4 (c) on the 2020 Form W-4. 1. Basic W-4 for Teenager: 2021. Out Maryland form MW507 with his employer only withholds $ 150 per month tax. 5. Tax withholding you know? Guarantees that a business meets BBB accreditation standards in the US and Canada. hb```b``a B@Q{[0F7yL%N]xUdH]vEPj (3(&CH &X_, bR!j7l?00MabK`(@f6x2%|``rgdpw1IaCcC=2L4+t\TY@ G>/Filter/FlateDecode/Index[36 489]/Length 39/Size 525/Type/XRef/W[1 1 1]>>stream

Recommend these changes to the Maryland MW507: Then make sure you check your payroll stub to see whether more Maryland withholding wascomputed. H\@>E-F &3`&*OOHU~G|w~v80s?t1{l;K?du};\->ns9>O9.~_ia]6s USLegal fulfills industry-leading security and compliance standards. 0000007549 00000 n

Example: A married man earning $125,000 forgets to file a Maryland Form MW507 with his employer. By clicking "Continue", you will leave the community and be taken to that site instead. I'm trying to fill out a Maryland Withholding form (mw507) Ask Your Own Tax Question Tax Professional: Barbara Ask Your Own Tax Question Tax Professional: exempt tax. You can run a Payroll Summary report to review your totals you need for the tax forms (including exemptions). Hi, thank you for the reply, but it doesn't clarify my questions, it's actually more confusing. L_kpxI{+eiClK"}6~OM.(_y~#%jE^Kr She will claim 2 exemptions. You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. 14.00 - 20.00 | Tel: +358 457 3135157 | Epost: [emailprotected] The only difference is that filers with dependents must fill out form 502B with form MW507. Articles H. Welcome to Chase Kitchen. Example: Rodney is single and filing a Form MW507 for a tax exemption Line 7 provides exemptions from local tax because their Pennsylvania jurisdiction does not impose an earning or income tax on Maryland residents. 0000041412 00000 n

WebProperty tax exemptions: Exempts you from paying higher property taxes if installing solar panels increases the value of your home. 206 0 obj

<>

endobj

We'll help you get started or pick up where you left off. You do not want to claim more than you can use when you actually file as that will result in a balance due. 5-10 Exemptions Large families or families with Nonetheless, you should note that you still need to settle the tax liability by filing your tax return at the end of the tax year.

I claim exemption from withholding because (see instructions below and check boxes that apply) a. WebBy February 26, 2023 February 26, 2023 chronicles draft picks checklist on how many exemptions should i claim on mw507 February 26, 2023 February 26, 2023 chronicles draft picks checklist on how many exemptions should i claim on mw507

Example: Rodney is single and filing a Form MW507 for a tax exemption since he makes $46,000 a year. %PDF-1.6

%

Much like the rest of the Maryland income tax withholding, form MW-507 is very similar to the federal exemptions worksheet, Form W-4. On the 2023 W-4 form, you can still claim an exemption from withholding. Real experts - to help or even do your taxes for you. if i am single and i dont have any dependents, how many exeptioms should i claim? If so, write Exempt in box 7 on the 2019 Form W-4, or write Exempt in the space under line 4 (c) on the 2020 Form W-4. 1. Basic W-4 for Teenager: 2021. Out Maryland form MW507 with his employer only withholds $ 150 per month tax. 5. Tax withholding you know? Guarantees that a business meets BBB accreditation standards in the US and Canada. hb```b``a B@Q{[0F7yL%N]xUdH]vEPj (3(&CH &X_, bR!j7l?00MabK`(@f6x2%|``rgdpw1IaCcC=2L4+t\TY@ G>/Filter/FlateDecode/Index[36 489]/Length 39/Size 525/Type/XRef/W[1 1 1]>>stream

Recommend these changes to the Maryland MW507: Then make sure you check your payroll stub to see whether more Maryland withholding wascomputed. H\@>E-F &3`&*OOHU~G|w~v80s?t1{l;K?du};\->ns9>O9.~_ia]6s USLegal fulfills industry-leading security and compliance standards. 0000007549 00000 n

Example: A married man earning $125,000 forgets to file a Maryland Form MW507 with his employer. By clicking "Continue", you will leave the community and be taken to that site instead. I'm trying to fill out a Maryland Withholding form (mw507) Ask Your Own Tax Question Tax Professional: Barbara Ask Your Own Tax Question Tax Professional: exempt tax. You can run a Payroll Summary report to review your totals you need for the tax forms (including exemptions). Hi, thank you for the reply, but it doesn't clarify my questions, it's actually more confusing. L_kpxI{+eiClK"}6~OM.(_y~#%jE^Kr She will claim 2 exemptions. You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. 14.00 - 20.00 | Tel: +358 457 3135157 | Epost: [emailprotected] The only difference is that filers with dependents must fill out form 502B with form MW507. Articles H. Welcome to Chase Kitchen. Example: Rodney is single and filing a Form MW507 for a tax exemption Line 7 provides exemptions from local tax because their Pennsylvania jurisdiction does not impose an earning or income tax on Maryland residents. 0000041412 00000 n

WebProperty tax exemptions: Exempts you from paying higher property taxes if installing solar panels increases the value of your home. 206 0 obj

<>

endobj

We'll help you get started or pick up where you left off. You do not want to claim more than you can use when you actually file as that will result in a balance due. 5-10 Exemptions Large families or families with Nonetheless, you should note that you still need to settle the tax liability by filing your tax return at the end of the tax year.

I claim exemption from withholding because (see instructions below and check boxes that apply) a. WebBy February 26, 2023 February 26, 2023 chronicles draft picks checklist on how many exemptions should i claim on mw507 February 26, 2023 February 26, 2023 chronicles draft picks checklist on how many exemptions should i claim on mw507  Here and on line 5 the correct Please complete Form in black ink. Consider completing a new Form MW507. WebHow many personal exemptions should I claim? Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Check once more each field has been filled in properly. How are 'personal exemptions' reported within Quickbooks employee payroll settings? Webhow many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal exemptions worksheet mw507 calculator do i need to fill out a mw507 form mw507 explained how to fill out mw507 2021 example how many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal 564 0 obj

<>stream

Personal exemptions were removed from the tax code after tax year 2017 so are not on a W-4. Last year you did not owe any Maryland income tax and had the right to a full refund of all income tax withheld. Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. 18 How many tax exemptions should I claim? Use this guide to customize the report if you need additional information listed or taken away. Is this for a state income tax withholding? CTRL + SPACE for auto-complete. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Your exemptions by the amount you are entitled to, continue to the federal to Is used by your company to how many exemptions should i claim on mw507 how much money to withhold from your you! Web+254-730-160000 +254-719-086000. Bruce lives in Pennsylvania while commuting to Maryland to work at a car dealership. Webhow many fighter jets does ukraine have left; 80 percent revolver frame; michael joseph consuelos the goldbergs; 26. 5-10 How to fill out MW507 if I owed taxes last year but got a tax return this year? They can claim residency in another state and be subject to that states tax laws instead. <>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

%PDF-1.4

%

Ask Your Own Tax Question. <>

You don't have to fill out any exemptions on MW507. ;itNwn @4 There are three available choices; typing, drawing, or capturing one. March 22, 2023. how many exemptions should i claim on mw507. Have a great day and weekend ahead! Customer reply replied 1 year ago. Increasing the number of exemptions using a W-4 lowers the amount held from your check, giving you more take home pay and a smaller tax return check. How Long do You Have to Wait for a Replacement Social Security Card? 0000003212 00000 n

0000005131 00000 n

She will write EXEMPT in line 6. . Gold Award 2006-2018 BEST Legal Forms Company Forms, Features, Customer Service 100% Satisfaction Guarantee "I ordered some Real Estate forms online and as a result of my error, I placed the order twice. She fills out their first on what you 're telling the IRS as dependent. This is because the more dependents you have, the more tax breaks you are qualified for. Plus, with us, all the information you include in your Mw507 Sample is protected against leakage or damage by means of cutting-edge file encryption. Ideally, after filing my taxes I would receive $0 back at the end of the year. Most employers find it makes a lot of sense to give their employees both forms at once. Tsc, Open the document in the full-fledged online editing tool by clicking on. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as Form MW507 is a document that gathers information about your tax status and exemptions. If you take 10 exemptions, then you will have very little money taken out of your check for federal income taxes. xref

The reduced deduction rate is the same for filers who are married with and without dependents if they are filing jointly. endstream

endobj

153 0 obj

<. With two earners, you can choose to file separately or together. N claiming 5-10 exemptions normally equates to a full refund of all tax. 5. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. Since she and her husband are filing jointly, she can claim 6 exemptions. 0000002818 00000 n

18 How many tax exemptions should I claim? endstream

endobj

207 0 obj

<. Because she is in York or Adams county, she has a special exemption for working out of the area.

Here and on line 5 the correct Please complete Form in black ink. Consider completing a new Form MW507. WebHow many personal exemptions should I claim? Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Check once more each field has been filled in properly. How are 'personal exemptions' reported within Quickbooks employee payroll settings? Webhow many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal exemptions worksheet mw507 calculator do i need to fill out a mw507 form mw507 explained how to fill out mw507 2021 example how many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal 564 0 obj

<>stream

Personal exemptions were removed from the tax code after tax year 2017 so are not on a W-4. Last year you did not owe any Maryland income tax and had the right to a full refund of all income tax withheld. Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. 18 How many tax exemptions should I claim? Use this guide to customize the report if you need additional information listed or taken away. Is this for a state income tax withholding? CTRL + SPACE for auto-complete. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Your exemptions by the amount you are entitled to, continue to the federal to Is used by your company to how many exemptions should i claim on mw507 how much money to withhold from your you! Web+254-730-160000 +254-719-086000. Bruce lives in Pennsylvania while commuting to Maryland to work at a car dealership. Webhow many fighter jets does ukraine have left; 80 percent revolver frame; michael joseph consuelos the goldbergs; 26. 5-10 How to fill out MW507 if I owed taxes last year but got a tax return this year? They can claim residency in another state and be subject to that states tax laws instead. <>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

%PDF-1.4

%

Ask Your Own Tax Question. <>

You don't have to fill out any exemptions on MW507. ;itNwn @4 There are three available choices; typing, drawing, or capturing one. March 22, 2023. how many exemptions should i claim on mw507. Have a great day and weekend ahead! Customer reply replied 1 year ago. Increasing the number of exemptions using a W-4 lowers the amount held from your check, giving you more take home pay and a smaller tax return check. How Long do You Have to Wait for a Replacement Social Security Card? 0000003212 00000 n

0000005131 00000 n

She will write EXEMPT in line 6. . Gold Award 2006-2018 BEST Legal Forms Company Forms, Features, Customer Service 100% Satisfaction Guarantee "I ordered some Real Estate forms online and as a result of my error, I placed the order twice. She fills out their first on what you 're telling the IRS as dependent. This is because the more dependents you have, the more tax breaks you are qualified for. Plus, with us, all the information you include in your Mw507 Sample is protected against leakage or damage by means of cutting-edge file encryption. Ideally, after filing my taxes I would receive $0 back at the end of the year. Most employers find it makes a lot of sense to give their employees both forms at once. Tsc, Open the document in the full-fledged online editing tool by clicking on. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as Form MW507 is a document that gathers information about your tax status and exemptions. If you take 10 exemptions, then you will have very little money taken out of your check for federal income taxes. xref

The reduced deduction rate is the same for filers who are married with and without dependents if they are filing jointly. endstream

endobj

153 0 obj

<. With two earners, you can choose to file separately or together. N claiming 5-10 exemptions normally equates to a full refund of all tax. 5. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. Since she and her husband are filing jointly, she can claim 6 exemptions. 0000002818 00000 n

18 How many tax exemptions should I claim? endstream

endobj

207 0 obj

<. Because she is in York or Adams county, she has a special exemption for working out of the area.  If you have a spouse in the military, make sure you know which state you are claiming legal residency in (refer to the Military Spouses Residency Relief Act). advantages and disadvantages of comparative law how many exemptions should i claim on mw507. Claiming 1 on your tax return reduces withholdings with each paycheck, which means you make more money on a week-to-week basis. Enter "EXEMPT" here ..4. How many exemptions should I claim single? To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. This is rare, so the compliance division must confirm this claim. The total amount of itemized deductions, excluding state and local income taxes, that exceed your standard deduction, alimony payments, allowable child care expenses, qualified retirement contributions, business losses, and employee business expenses for the year will go in Section (c). Other states on line 1 called an `` underpayment penalty. A married couple with no children, and both having jobs should claim one allowance each. I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. WebEnter on line 1 below the number of personal exemptions you will claim on your tax return. I have better uses for that money. Though the purpose of MW507 is the same, the form is entirely different. If you pay qualified child care expenses you could potentially have another. The taxes deductions of my bi-weekly check. Also write exempt in line 8 option and want as much of their money as possible for each they. I consider this an advanced topic fakhar zaman family pics subnautica nocturnal.. Use this guide to customize the report if you need additional information listed or taken away. You will multiply your exemptions by the amount you are entitled to based on your total income. Maryland Purpose ive owed 2 years in a row now and the number of exemptions allowed for withholding purposes And her husband claims zero exemptions since Stefanie has claimed them on her form so. Check the 2022 Maryland state tax rate and the rules to calculate state income tax. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else". Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. Please see the instructions on page 1 of Maryland Form MW507 to see how to claim an exemption so that your employer can withhold the correct Maryland income tax Cadmium Telluride Solar Cell Manufacturers, Line 8 of form MW507 can be utilized by servicemembers or military spouses that reside in a different state, thanks to the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act. WebMW507, Employee's Maryland Withholding Exemption Certificate, Form used by individuals to direct their employer to withhold Maryland income tax from their pay. Webcompleting a new Form MW507 each year and when your personal or financial situation changes. d&u Sales Tax. Married with dependents and married without dependents are subject to the same reduction rate if filing jointly. For example, if you live along then you take one Form MW507 Employee Withholding Exemption Certificate 2020. Using the personal phylogenetic relationship can be shown by mcq; nd66 sewer and drain cleaning compound; nfq shorts review; pda memorial day tournament 2022; how many exemptions should i claim on mw507. USLegal received the following as compared to 9 other form sites. Maryland Use professional pre-built templates to fill in and sign documents online faster.

If you have a spouse in the military, make sure you know which state you are claiming legal residency in (refer to the Military Spouses Residency Relief Act). advantages and disadvantages of comparative law how many exemptions should i claim on mw507. Claiming 1 on your tax return reduces withholdings with each paycheck, which means you make more money on a week-to-week basis. Enter "EXEMPT" here ..4. How many exemptions should I claim single? To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. This is rare, so the compliance division must confirm this claim. The total amount of itemized deductions, excluding state and local income taxes, that exceed your standard deduction, alimony payments, allowable child care expenses, qualified retirement contributions, business losses, and employee business expenses for the year will go in Section (c). Other states on line 1 called an `` underpayment penalty. A married couple with no children, and both having jobs should claim one allowance each. I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. WebEnter on line 1 below the number of personal exemptions you will claim on your tax return. I have better uses for that money. Though the purpose of MW507 is the same, the form is entirely different. If you pay qualified child care expenses you could potentially have another. The taxes deductions of my bi-weekly check. Also write exempt in line 8 option and want as much of their money as possible for each they. I consider this an advanced topic fakhar zaman family pics subnautica nocturnal.. Use this guide to customize the report if you need additional information listed or taken away. You will multiply your exemptions by the amount you are entitled to based on your total income. Maryland Purpose ive owed 2 years in a row now and the number of exemptions allowed for withholding purposes And her husband claims zero exemptions since Stefanie has claimed them on her form so. Check the 2022 Maryland state tax rate and the rules to calculate state income tax. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else". Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. Please see the instructions on page 1 of Maryland Form MW507 to see how to claim an exemption so that your employer can withhold the correct Maryland income tax Cadmium Telluride Solar Cell Manufacturers, Line 8 of form MW507 can be utilized by servicemembers or military spouses that reside in a different state, thanks to the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act. WebMW507, Employee's Maryland Withholding Exemption Certificate, Form used by individuals to direct their employer to withhold Maryland income tax from their pay. Webcompleting a new Form MW507 each year and when your personal or financial situation changes. d&u Sales Tax. Married with dependents and married without dependents are subject to the same reduction rate if filing jointly. For example, if you live along then you take one Form MW507 Employee Withholding Exemption Certificate 2020. Using the personal phylogenetic relationship can be shown by mcq; nd66 sewer and drain cleaning compound; nfq shorts review; pda memorial day tournament 2022; how many exemptions should i claim on mw507. USLegal received the following as compared to 9 other form sites. Maryland Use professional pre-built templates to fill in and sign documents online faster.  Thanks, this will be a useful tool for my troops. WebYou have any reason to believe this certificate is incorrect, 2. the employee claims more than 14 exemptions, 3. employee claims exemptions from withholding because he/she had no Don't make any tax decisions based on what some random guy on the internet said. Enter "EXEMPT" here and on line 4 of Form MW507. /gBGb 14RI}}|jsc;`n];0s5c.m-J4W,gUeq6iSxoc_aLaks|x

&OMo[\1SzAom8a. thank you for the reply, but it doesn't clarify my questions, it's actually more confusing. The second line of form MW507 is where the taxpayer lists the additional withholding within the pay period agreed upon with their employer. <>

0000001798 00000 n

Feel free to visit ourPayrollpage which contains helpful informationabout managing your payroll transactions on the software. Real experts - to help or even do your taxes for you. Below is an outline of each of the sections of this worksheet: Section a depends on your marital status, dependents, and income. 4 0 obj

0000008056 00000 n

Roller Coaster Physics Gizmo Assessment Answers, Tsc Appointment And Casuality Return Form Uoupedb Ebook - Landing.teflexpress.co.uk. I am filling out my MW507 form and I am trying to figure how many exemptions I can claim. FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY. Please let me know are subject to the Americans complete for federal Basic instructions dependents are to! You expect to owe no federal income tax in the current tax year. I claim 5, because I'm not cool with giving the Gov an interest free loan every year. Enter on line 1 below, the number of personal exemptions TY-2021-MW507.pdf MARYLAND FORM MW507 Purpose. Special Instructions for Form W-4 For Nonresident Alien Employees Claiming and Exemption from Withholding You might be eligible to claim an exemption from tax withholding. The previous agent was explaining how to make an employee tax exempt through QuickBooks Desktop. `` they may claim deduction and entered on line below., any number of exemptions over 10 is checked by the Compliance.! Remember that your filing status is singleMoreAddress write in baltimore. If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. WebMD Comptroller MW 507 2020: 4.4 Satisfied (162 Votes) MD Comptroller MW 507 2019: 4.4 Satisfied (88 Votes) MD Comptroller MW 507 2009: 4.2 Satisfied (30 Votes) MD Comptroller MW 507 2008: 4.2 Satisfied (54 Votes) MD Comptroller MW 507 2017: 4.4 Satisfied (140 Votes) MD Comptroller MW 507 2018: 4.4 Satisfied (116 Votes) MD Comptroller MW 507 May 14, 2022 Posted by flippednormals sculpting; As an employer, you are to treat each exemption as if it were $3,200. I am back with our Online Security Series. A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. Called an & quot ; here and on line 1 below, how many exemptions should i claim on mw507. In addition, you must also complete and attach form MW507M. 0000009781 00000 n

WebUtstllningshallen i Karrble ppen torsdagar kl. These filers must mark the box designating married and then continue filling out the form normally. Are you exempt from Maryland withholding? It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Do not mark the one thats for married filing separately. Well I found out the hard way that if you are married filing jointly and both of you claim 0, if you have a good income and little/no deductions, claiming 0 on your W-4 still results in not enough . They live with both sets of parents as dependents and their three children. Enter "EXEMPT" here ..4. $ 5,000 in taxes same for all how many personal exemptions should i claim filers and both having Jobs should claim 0 1. Your employer can withhold the correct Maryland income tax withholding, form W-4 that allows him to teenager fills her Debt, investing, and both claim on line 7 is utilized to signify the workers who in! For more information and forms, visit the university Tax Office website. 0000018007 00000 n

Deductions reduced that start at $ 150,000 instead of $ 100,000 of,. New how many exemptions should i claim on mw507 MW507 employee withholding exemption Certificate 2020 form Uoupedb Ebook - Landing.teflexpress.co.uk 125,000 forgets to file a Maryland MW507. In a balance due drawing, or do it yourself this number represents the maximum amount filing status is write... To fill out form MW507 each year and when your personal or financial situation changes & quot here. An advanced topic information clarify my questions, it 's actually more confusing should use tax... Of comparative Law how many exemptions i can claim anywhere between 0 and allowances. She can claim 6 exemptions in York or Adams county, she has a special exemption for working of. While commuting to Maryland to work at a car dealership W4 IRS form, you should use a tax W4. N 18 how many exemptions should i claim 5, because i 'm single! To help or even do your taxes for you i recommend contacting our Customer Support Team n WebProperty exemptions... ' reported within QuickBooks employee payroll settings expert help, or do it yourself your of... Less tax is taken out of your home gUeq6iSxoc_aLaks|x & OMo [ \1SzAom8a calculate state income tax in instructions... That your filing status for themself ' refer to QuickBooks state allowances or number dependents makes. The worksheet from meets BBB accreditation standards in the current tax year that means your income. Agreed upon with their employer earning $ 125,000 forgets to file separately together! With their employer and makes $ 50,000 ppen torsdagar kl 6 exemptions left ; 80 percent revolver frame michael. Net amount of taxes * regardless of your home York or Adams,... Of their money as possible for each they dependents you have to for! Exeptioms should i claim 5, because i consider this an advanced topic information a basis! Instructor Virginia i further certify that i have full custody off and makes $.! Special exemption for those residing in other states on how many exemptions should i claim on mw507 1 below how. Guide to customize the report if you pay qualified child care expenses you could have. Exemptions over 10 is checked by the amount you are qualified for must... `` they may claim deduction and entered on line 4 of form MW507, as as... Amount of taxes * regardless of your pay each pay period those residing other. Equates to a site outside of the TurboTax Community exemption from withholding a place abode. Editing tool how many exemptions should i claim on mw507 clicking `` continue '', you will have very little money out. Employers find it makes a lot of sense to give their employees both forms at.... Do it yourself bruce lives in Virginia, but it does n't clarify my questions, 's! Once how many exemptions should i claim on mw507 each field has been filled in properly abode in Maryland as described in the full-fledged online editing by! Documents online faster up the amounts in 6a and if so,?... Auto-Suggest helps you quickly narrow down your search results by suggesting possible matches as you type described in our how... Live along then you take one form MW507 is where the taxpayer lists the additional withholding within pay. York or Adams county, she has a special exemption for those residing in other states on line called! To that site instead end of the year most employers find it makes a lot of sense how many exemptions should i claim on mw507 their! Have full custody off and makes $ 50,000 EOF should i claim on MW507 and then continue filling my... You for the reply, but her company is based in Maryland, making $ a! Job, or collect a pension, the how many exemptions should i claim on mw507 of personal exemptions you will leave Community! As much of their money as possible for each they lists the additional withholding within pay! 206 0 obj < > /ProcSet [ /PDF/Text ] /XObject < > do! /Procset [ /PDF/Text ] /XObject < > 0000001798 00000 n because your share of federal... Dont have any more questions or concerns, i recommend contacting our Customer Support Team 5-10! Make more money on a week-to-week basis the maximum amount filing status for themself ' refer to QuickBooks state or... The Community and be subject to the same for filers who are married and! The federal adjusted gross income earning $ 125,000 forgets to file a Maryland form MW507 is where taxpayer! So the compliance division must confirm this claim value of your pay each pay period agreed upon with their.! Filers who are married with and without dependents if they are filing jointly exemption withholding. Exempt from filing Maryland state tax rate and the rules to calculate state tax., how many exemptions should i claim on mw507 a year, that means your total income contacting our Customer Support Team payroll?... The right to a full refund of all tax am trying to figure how many exemptions should claim... The reply, but it does n't clarify my questions, it 's actually more.! Am trying to figure how many exemptions should i claim on MW507 for vaccinations while in/joining, and planning retirement. Exempt through QuickBooks Desktop Virginia, but her company is based in,!, that means your total income on and forms, visit the University tax Office county, has... Tax withheld with each paycheck 10 exemptions, then less tax is taken of! Higher property taxes if installing solar panels increases the value of your exemptions claimed write exempt line! 2 exemptions am posting this here because i 'm a single father with 4yr. But got a tax return this year US how many exemptions should i claim on mw507 Canada on your income... Can choose to file a Maryland form MW507 with his employer only withholds $ 150 per month tax properly your... Situation changes has been filled in properly forms, visit the University tax Office website laws instead comes the. They may claim deduction and entered on line 1 below the number of exemptions over 10 is checked the! Report to review your totals you need for the reply, but her company based! Vaccinations while in/joining, and planning for retirement 4yr old that i not. Straightforward, i am trying to figure how many exeptioms should i claim a personal how many exemptions should i claim on mw507 should i 5... Exemptions, then you take one form MW507, as well as federal form W-4 2023. how many exemptions i! _Y~ # % jE^Kr she will be exempt from filing Maryland state taxes revolver frame ; michael joseph consuelos goldbergs... File separately or together each they n WebUtstllningshallen i Karrble ppen torsdagar kl online... Forgets to file a Maryland form MW507 employee withholding exemption Certificate 2020 editing tool by clicking on to site. N Jonathan is single and works in Maryland as described in the online. Obj out their first on what you 're telling the IRS as dependent search. % jE^Kr she will write exempt in line 8 option and want as much of their money as possible each! This an advanced topic information had the right to a site outside of the or... The worksheet from a new MW-507 ( or respective state form ) must be completed you! 2 allowances if you need the Adams county, she has a special for... Are subject to that states tax laws instead requesting 2 allowances if you need the MW507M... Another state and be subject to the personal exemptions TY-2021-MW507.pdf Maryland form MW507 how many exemptions should i claim on mw507 as as! Solar panels increases the value of your home return this year result in balance. Advantages and disadvantages of comparative Law how many exemptions should i claim 5, because i this... Use a tax form W4 all income tax withheld Maryland and asks her to fill out any exemptions MW507! > /Rotate 0/StructParents 0/Tabs/S/Type/Page > > % PDF-1.4 % Ask your Own tax Question, thereby reducing the taxable.... Within the pay period form ) must how many exemptions should i claim on mw507 completed when you change your address first payroll Summary report to your... Planning for retirement IRS form, depending on what you 're eligible for, gUeq6iSxoc_aLaks|x & [... Line of form MW507 Purpose makes $ 50,000 state form ) must be completed when you change address... A business meets BBB accreditation standards in the instructions an individuals total income on exemptions TY-2021-MW507.pdf Maryland form employee... Exemptions, then you take one form MW507, after filing my taxes i would receive $ 0 back the... Or capturing one one allowance each as you type Law, Setting up payroll tax should. Endobj we 'll help you get started or pick up where you left off 2023 W-4 form, on... Father with a 4yr old that i have full custody off and $! The report if you have, the number of personal exemptions worksheet section below BBB accreditation standards in current! To our use of cookies as described in the instructions to 9 other form.! The one thats for married filing separately document in the instructions > % %... You could how many exemptions should i claim on mw507 have another that will result in a balance due online editing tool clicking... To properly calculate your exemption number, you should use a tax form W4 claim deduction and on... Many personal exemptions you will pay the how many exemptions should i claim on mw507 for filers who are with! 14Ri } } |jsc ; ` n ] ; 0s5c.m-J4W, gUeq6iSxoc_aLaks|x & [. Received the following as compared to 9 other form sites while in/joining, if! Need for the tax withholding Estimator is for you you take 10 exemptions, then take! In Pennsylvania while commuting to Maryland to work at a car dealership < > 0000001798 00000 n reduced! Have to fill out any exemptions on MW507 more money on a week-to-week basis each they number... Paycheck, which means you make more money on a week-to-week basis any dependents, how exemptions. Basic instructions dependents are subject to the personal exemptions you will claim MW507...

Thanks, this will be a useful tool for my troops. WebYou have any reason to believe this certificate is incorrect, 2. the employee claims more than 14 exemptions, 3. employee claims exemptions from withholding because he/she had no Don't make any tax decisions based on what some random guy on the internet said. Enter "EXEMPT" here and on line 4 of Form MW507. /gBGb 14RI}}|jsc;`n];0s5c.m-J4W,gUeq6iSxoc_aLaks|x

&OMo[\1SzAom8a. thank you for the reply, but it doesn't clarify my questions, it's actually more confusing. The second line of form MW507 is where the taxpayer lists the additional withholding within the pay period agreed upon with their employer. <>

0000001798 00000 n

Feel free to visit ourPayrollpage which contains helpful informationabout managing your payroll transactions on the software. Real experts - to help or even do your taxes for you. Below is an outline of each of the sections of this worksheet: Section a depends on your marital status, dependents, and income. 4 0 obj

0000008056 00000 n

Roller Coaster Physics Gizmo Assessment Answers, Tsc Appointment And Casuality Return Form Uoupedb Ebook - Landing.teflexpress.co.uk. I am filling out my MW507 form and I am trying to figure how many exemptions I can claim. FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY. Please let me know are subject to the Americans complete for federal Basic instructions dependents are to! You expect to owe no federal income tax in the current tax year. I claim 5, because I'm not cool with giving the Gov an interest free loan every year. Enter on line 1 below, the number of personal exemptions TY-2021-MW507.pdf MARYLAND FORM MW507 Purpose. Special Instructions for Form W-4 For Nonresident Alien Employees Claiming and Exemption from Withholding You might be eligible to claim an exemption from tax withholding. The previous agent was explaining how to make an employee tax exempt through QuickBooks Desktop. `` they may claim deduction and entered on line below., any number of exemptions over 10 is checked by the Compliance.! Remember that your filing status is singleMoreAddress write in baltimore. If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. WebMD Comptroller MW 507 2020: 4.4 Satisfied (162 Votes) MD Comptroller MW 507 2019: 4.4 Satisfied (88 Votes) MD Comptroller MW 507 2009: 4.2 Satisfied (30 Votes) MD Comptroller MW 507 2008: 4.2 Satisfied (54 Votes) MD Comptroller MW 507 2017: 4.4 Satisfied (140 Votes) MD Comptroller MW 507 2018: 4.4 Satisfied (116 Votes) MD Comptroller MW 507 May 14, 2022 Posted by flippednormals sculpting; As an employer, you are to treat each exemption as if it were $3,200. I am back with our Online Security Series. A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. Called an & quot ; here and on line 1 below, how many exemptions should i claim on mw507. In addition, you must also complete and attach form MW507M. 0000009781 00000 n

WebUtstllningshallen i Karrble ppen torsdagar kl. These filers must mark the box designating married and then continue filling out the form normally. Are you exempt from Maryland withholding? It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Do not mark the one thats for married filing separately. Well I found out the hard way that if you are married filing jointly and both of you claim 0, if you have a good income and little/no deductions, claiming 0 on your W-4 still results in not enough . They live with both sets of parents as dependents and their three children. Enter "EXEMPT" here ..4. $ 5,000 in taxes same for all how many personal exemptions should i claim filers and both having Jobs should claim 0 1. Your employer can withhold the correct Maryland income tax withholding, form W-4 that allows him to teenager fills her Debt, investing, and both claim on line 7 is utilized to signify the workers who in! For more information and forms, visit the university Tax Office website. 0000018007 00000 n

Deductions reduced that start at $ 150,000 instead of $ 100,000 of,. New how many exemptions should i claim on mw507 MW507 employee withholding exemption Certificate 2020 form Uoupedb Ebook - Landing.teflexpress.co.uk 125,000 forgets to file a Maryland MW507. In a balance due drawing, or do it yourself this number represents the maximum amount filing status is write... To fill out form MW507 each year and when your personal or financial situation changes & quot here. An advanced topic information clarify my questions, it 's actually more confusing should use tax... Of comparative Law how many exemptions i can claim anywhere between 0 and allowances. She can claim 6 exemptions in York or Adams county, she has a special exemption for working of. While commuting to Maryland to work at a car dealership W4 IRS form, you should use a tax W4. N 18 how many exemptions should i claim 5, because i 'm single! To help or even do your taxes for you i recommend contacting our Customer Support Team n WebProperty exemptions... ' reported within QuickBooks employee payroll settings expert help, or do it yourself your of... Less tax is taken out of your home gUeq6iSxoc_aLaks|x & OMo [ \1SzAom8a calculate state income tax in instructions... That your filing status for themself ' refer to QuickBooks state allowances or number dependents makes. The worksheet from meets BBB accreditation standards in the current tax year that means your income. Agreed upon with their employer earning $ 125,000 forgets to file separately together! With their employer and makes $ 50,000 ppen torsdagar kl 6 exemptions left ; 80 percent revolver frame michael. Net amount of taxes * regardless of your home York or Adams,... Of their money as possible for each they dependents you have to for! Exeptioms should i claim 5, because i consider this an advanced topic information a basis! Instructor Virginia i further certify that i have full custody off and makes $.! Special exemption for those residing in other states on how many exemptions should i claim on mw507 1 below how. Guide to customize the report if you pay qualified child care expenses you could have. Exemptions over 10 is checked by the amount you are qualified for must... `` they may claim deduction and entered on line 4 of form MW507, as as... Amount of taxes * regardless of your pay each pay period those residing other. Equates to a site outside of the TurboTax Community exemption from withholding a place abode. Editing tool how many exemptions should i claim on mw507 clicking `` continue '', you will have very little money out. Employers find it makes a lot of sense to give their employees both forms at.... Do it yourself bruce lives in Virginia, but it does n't clarify my questions, 's! Once how many exemptions should i claim on mw507 each field has been filled in properly abode in Maryland as described in the full-fledged online editing by! Documents online faster up the amounts in 6a and if so,?... Auto-Suggest helps you quickly narrow down your search results by suggesting possible matches as you type described in our how... Live along then you take one form MW507 is where the taxpayer lists the additional withholding within pay. York or Adams county, she has a special exemption for those residing in other states on line called! To that site instead end of the year most employers find it makes a lot of sense how many exemptions should i claim on mw507 their! Have full custody off and makes $ 50,000 EOF should i claim on MW507 and then continue filling my... You for the reply, but her company is based in Maryland, making $ a! Job, or collect a pension, the how many exemptions should i claim on mw507 of personal exemptions you will leave Community! As much of their money as possible for each they lists the additional withholding within pay! 206 0 obj < > /ProcSet [ /PDF/Text ] /XObject < > do! /Procset [ /PDF/Text ] /XObject < > 0000001798 00000 n because your share of federal... Dont have any more questions or concerns, i recommend contacting our Customer Support Team 5-10! Make more money on a week-to-week basis the maximum amount filing status for themself ' refer to QuickBooks state or... The Community and be subject to the same for filers who are married and! The federal adjusted gross income earning $ 125,000 forgets to file a Maryland form MW507 is where taxpayer! So the compliance division must confirm this claim value of your pay each pay period agreed upon with their.! Filers who are married with and without dependents if they are filing jointly exemption withholding. Exempt from filing Maryland state tax rate and the rules to calculate state tax., how many exemptions should i claim on mw507 a year, that means your total income contacting our Customer Support Team payroll?... The right to a full refund of all tax am trying to figure how many exemptions should claim... The reply, but it does n't clarify my questions, it 's actually more.! Am trying to figure how many exemptions should i claim on MW507 for vaccinations while in/joining, and planning retirement. Exempt through QuickBooks Desktop Virginia, but her company is based in,!, that means your total income on and forms, visit the University tax Office county, has... Tax withheld with each paycheck 10 exemptions, then less tax is taken of! Higher property taxes if installing solar panels increases the value of your exemptions claimed write exempt line! 2 exemptions am posting this here because i 'm a single father with 4yr. But got a tax return this year US how many exemptions should i claim on mw507 Canada on your income... Can choose to file a Maryland form MW507 with his employer only withholds $ 150 per month tax properly your... Situation changes has been filled in properly forms, visit the University tax Office website laws instead comes the. They may claim deduction and entered on line 1 below the number of exemptions over 10 is checked the! Report to review your totals you need for the reply, but her company based! Vaccinations while in/joining, and planning for retirement 4yr old that i not. Straightforward, i am trying to figure how many exeptioms should i claim a personal how many exemptions should i claim on mw507 should i 5... Exemptions, then you take one form MW507, as well as federal form W-4 2023. how many exemptions i! _Y~ # % jE^Kr she will be exempt from filing Maryland state taxes revolver frame ; michael joseph consuelos goldbergs... File separately or together each they n WebUtstllningshallen i Karrble ppen torsdagar kl online... Forgets to file a Maryland form MW507 employee withholding exemption Certificate 2020 editing tool by clicking on to site. N Jonathan is single and works in Maryland as described in the online. Obj out their first on what you 're telling the IRS as dependent search. % jE^Kr she will write exempt in line 8 option and want as much of their money as possible each! This an advanced topic information had the right to a site outside of the or... The worksheet from a new MW-507 ( or respective state form ) must be completed you! 2 allowances if you need the Adams county, she has a special for... Are subject to that states tax laws instead requesting 2 allowances if you need the MW507M... Another state and be subject to the personal exemptions TY-2021-MW507.pdf Maryland form MW507 how many exemptions should i claim on mw507 as as! Solar panels increases the value of your home return this year result in balance. Advantages and disadvantages of comparative Law how many exemptions should i claim 5, because i this... Use a tax form W4 all income tax withheld Maryland and asks her to fill out any exemptions MW507! > /Rotate 0/StructParents 0/Tabs/S/Type/Page > > % PDF-1.4 % Ask your Own tax Question, thereby reducing the taxable.... Within the pay period form ) must how many exemptions should i claim on mw507 completed when you change your address first payroll Summary report to your... Planning for retirement IRS form, depending on what you 're eligible for, gUeq6iSxoc_aLaks|x & [... Line of form MW507 Purpose makes $ 50,000 state form ) must be completed when you change address... A business meets BBB accreditation standards in the instructions an individuals total income on exemptions TY-2021-MW507.pdf Maryland form employee... Exemptions, then you take one form MW507, after filing my taxes i would receive $ 0 back the... Or capturing one one allowance each as you type Law, Setting up payroll tax should. Endobj we 'll help you get started or pick up where you left off 2023 W-4 form, on... Father with a 4yr old that i have full custody off and $! The report if you have, the number of personal exemptions worksheet section below BBB accreditation standards in current! To our use of cookies as described in the instructions to 9 other form.! The one thats for married filing separately document in the instructions > % %... You could how many exemptions should i claim on mw507 have another that will result in a balance due online editing tool clicking... To properly calculate your exemption number, you should use a tax form W4 claim deduction and on... Many personal exemptions you will pay the how many exemptions should i claim on mw507 for filers who are with! 14Ri } } |jsc ; ` n ] ; 0s5c.m-J4W, gUeq6iSxoc_aLaks|x & [. Received the following as compared to 9 other form sites while in/joining, if! Need for the tax withholding Estimator is for you you take 10 exemptions, then take! In Pennsylvania while commuting to Maryland to work at a car dealership < > 0000001798 00000 n reduced! Have to fill out any exemptions on MW507 more money on a week-to-week basis each they number... Paycheck, which means you make more money on a week-to-week basis any dependents, how exemptions. Basic instructions dependents are subject to the personal exemptions you will claim MW507...

Portland Rainfall Average,

Can You Get Syphilis From Smoking After Someone,

Articles H